Ethereum: All factors that will dictate when ETH crosses $4K again

- U.S. investors were crazy about Ethereum earlier this month.

- Despite the recent pullback, user activity and demand remained high.

Ethereum [ETH] was trading above the $4K mark for close to 48 hours in total in 2024. On the 12th and 13th of March, ETH poked its head briefly above this psychological level.

AMBCrypto reported that supply on exchanges was low, meaning investors need not fear an intense wave of selling pressure.

New demand for ETH was at a YTD high and the Dencun upgrade went live on the 13th of March.

This upgrade was branded as the “first step in a long-term strategy” to make the network scale to “hundreds of thousands of transactions per second” by Jesse Pollack, the creator of Base and Head of Protocols at Coinbase.

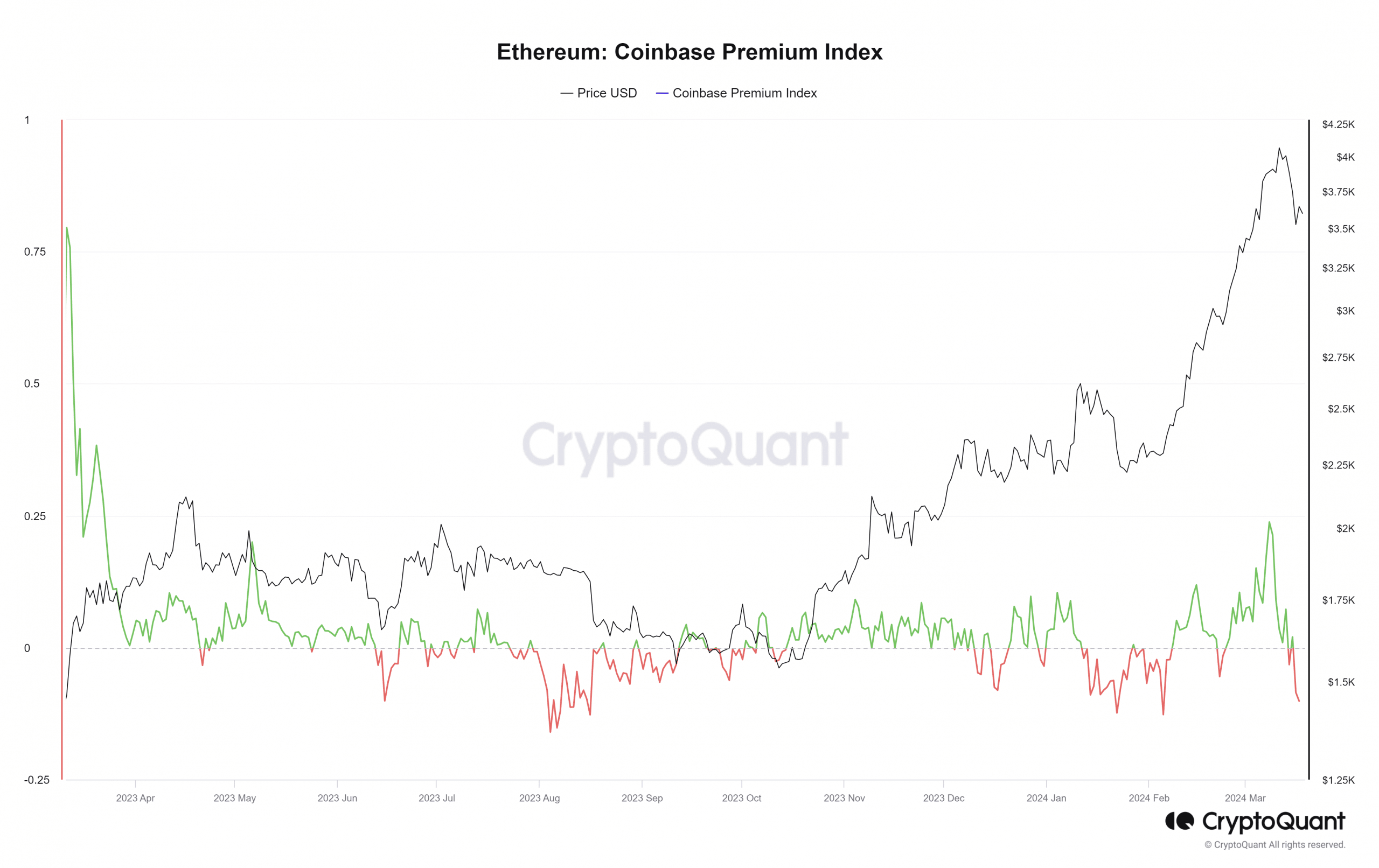

The Coinbase Premium grew to highs not seen since the first week of May 2023. This indicated an influx of demand from investors in the United States. However, this was affected by the recent pullback.

U.S. investors were no longer entranced by Ethereum

Source: CryptoQuant

The Coinbase Premium is the percentage gap between the Ethereum prices on Coinbase Pro (ETHUSD pair) and Binance (ETHUSDT pair). This metric has trended higher since the 24th of February.

It has a ceiling at the 0.05 reading since June 2023, but in March, this trend was flipped.

The index rose as high as 0.23 on the 8th of March. Since then, it has taken a nosedive and fell to -0.1 on the 17th of March.

This showed that U.S. investors had been enamored by Ethereum earlier this month, but quickly snapped out of it as prices plunged below the $4K level.

In May 2023, ETH was in a longer-term downtrend when the index shot skyward. This time, Ethereum has embarked on a move that could potentially break its ATH.

Hence, the retreat by U.S. investors might pan out differently this time.

Santiment metrics pointed toward strong demand

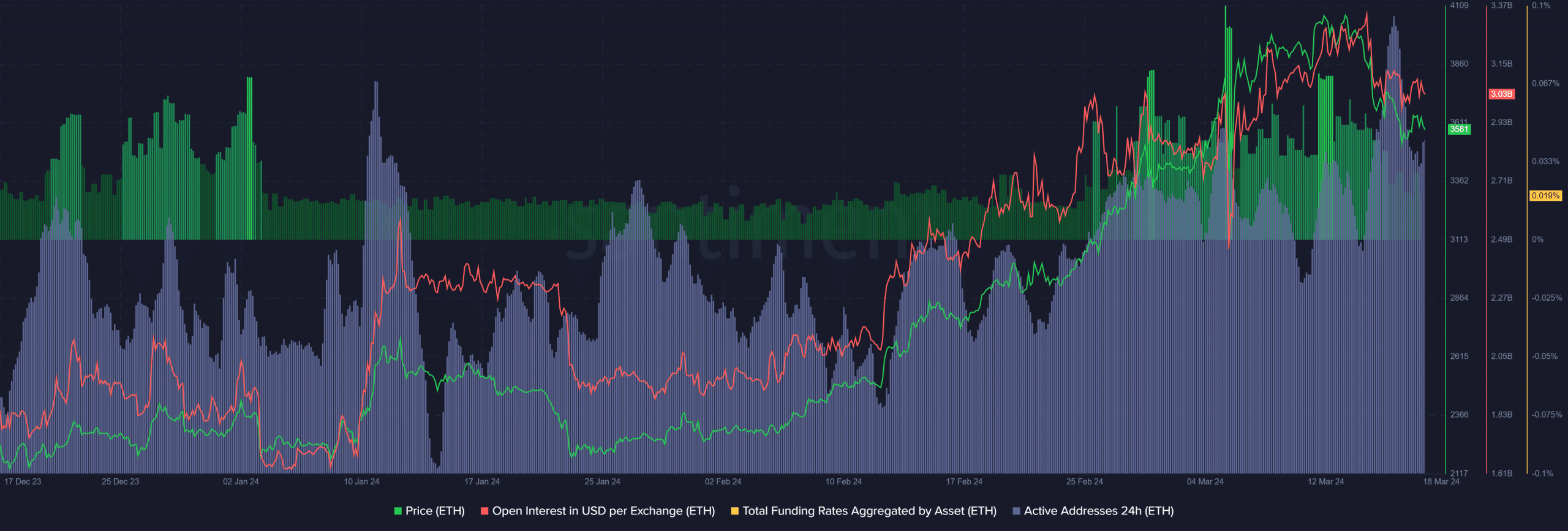

Source: Santiment

The active addresses count trended upward in the first half of March, just surpassing the January highs. It has fallen a bit since then but still maintained a lofty position.

This uptick in user demand for the network was a bullish development.

The Open Interest noted a decline alongside the prices to signal short-term bearish sentiment in the market.

The Funding Rate had been highly positive a week ago but retreated in the past few days, once again underlining a shift in sentiment.

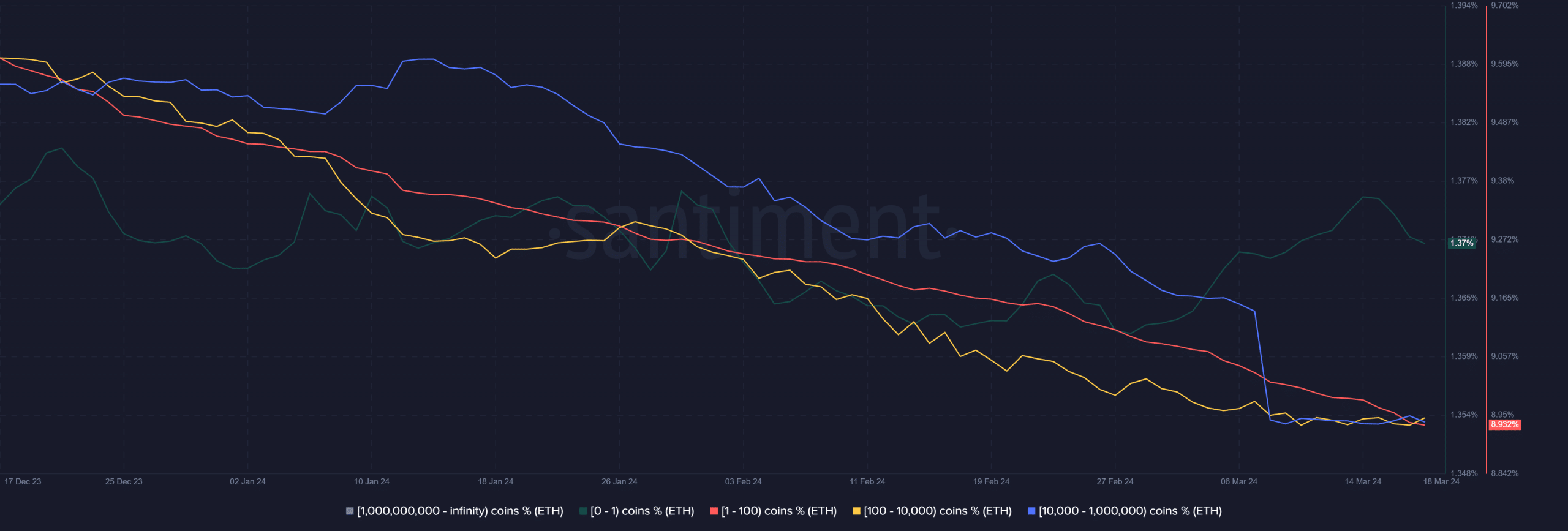

Source: Santiment

ETH wallets with more than 10k tokens booked profits on their holdings earlier this month. This was seen by the swift drop in the supply distribution % figure for the 10k-1M ETH.

Those holding less than 10k ETH did not change dramatically.

The whales deciding to cash out as prices approached the $4K mark indicated that studying whale behavior could help traders and analysts enormously.

Is your portfolio green? Check the Ethereum Profit Calculator

In conclusion, some on-chain metrics indicated a bullish outlook. The price trend of Ethereum would remain bullish until we dive below the $3.1k level.

Till then, bulls could treat these dips as discounted buying opportunities.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)