Will Ethereum Classic repeat recent history and recover from $18 level soon

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The structure was bearish but a significant bounce in prices was a possibility.

- Short sellers can wait for a revisit to a significant zone before looking to sell ETC.

Ethereum Classic saw a large rally from $15 on 3 January and reached $23.9 on 14 January. The rally of Bitcoin was on 8 January, after it burst out past the $17k resistance. Bitcoin’s rally was slower and a bit later than ETC’s.

Read Ethereum Classic’s [ETC] Price Prediction 2023-24

Just like the gains were delayed, it seemed that the losses and shift in trend were apparent in Ethereum Classic earlier than for Bitcoin. While BTC rested at $22.3k, ETC fell beneath its six-week range.

At the time of writing, the next move on the ETC chart was unclear, but a bounce toward $19.5 might not be surprising.

The support from November was tested yet again

The implication made above was not that ETC leads BTC, but rather an observation that ETC happened to move before Bitcoin did. This might or might not repeat itself. Taking the charts of Ethereum Classic, we see that the bulls will not find much to be enthused about.

The price made a series of lower highs and lower lows since 24 February, which meant the trend was bearish. The RSI stood at 28 to show oversold conditions on the 4-hour chart, but this did not indicate a reversal.

However, the CMF climbed above +0.05 to show significant capital inflow into the market.

Thrice in the three months of November, December, and January, a test of the $18 level of support saw a notable bullish reaction.

Could March be the fourth such instance? It remained to be seen. In either case, shorting Ethereum Classic around the $18 mark was not feasible in terms of risk-to-reward.

Is your portfolio green? Check the Ethereum Classic Profit Calculator

In November and December, the $19-$19.5 area was a place where ETC consolidated on lower timeframes before a move above or beneath either of these levels.

This marked it as an area of importance. A revisit to this region could offer selling opportunities, with invalidation above the recent lower high at $19.84.

To the south, the large fair value gap (white) from $16-$17.5 would likely be filled should the bears drive prices beneath $18.

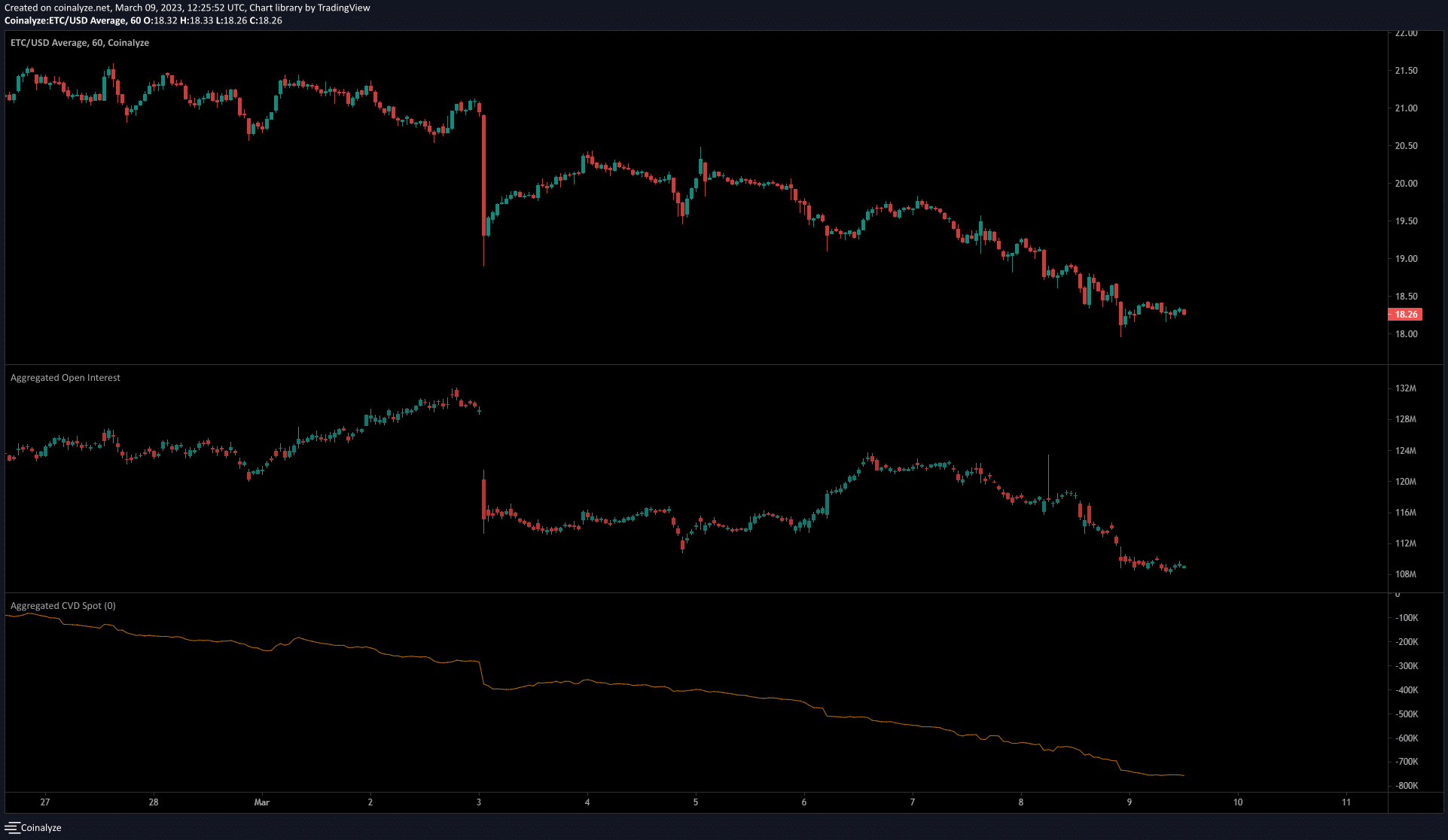

The dwindling Open Interest highlighted further losses were likely

Source: Coinalyze

The 1-hour chart on Coinalyze showed the spot CVD to be in a steady downtrend. This signaled relentless selling pressure over the past two weeks. The OI was also falling over the past few days alongside the price. This showed bearish momentum remained in the market.

It also highlighted the possibility that Ethereum Classic could soon drop below the $18 level.