Will Ethereum [ETH] bulls continue dominating the market next week

![Will Ethereum [ETH] bulls continue dominating the market next week](https://ambcrypto.com/wp-content/uploads/2023/03/kanchanara-vu13QDlTQyU-unsplash-e1679144517337.jpg)

- ETH bulls push past the $1800 and eye the $2,000 level in less than 4 weeks to the Shanghai upgrade.

- Low leverage underpins the current rally, lowering the risk of an extended downside.

ETH bulls have finally summed up enough momentum to push out of its 6-month low range. Meanwhile, the Ethereum network just confirmed the official launch date for the Shanghai uptate which will happen in three weeks.

Will 4 four weeks be enough time for ETH to push above the $2,000 resistance?

Is your portfolio green? Check out the Ethereum Profit Calculator

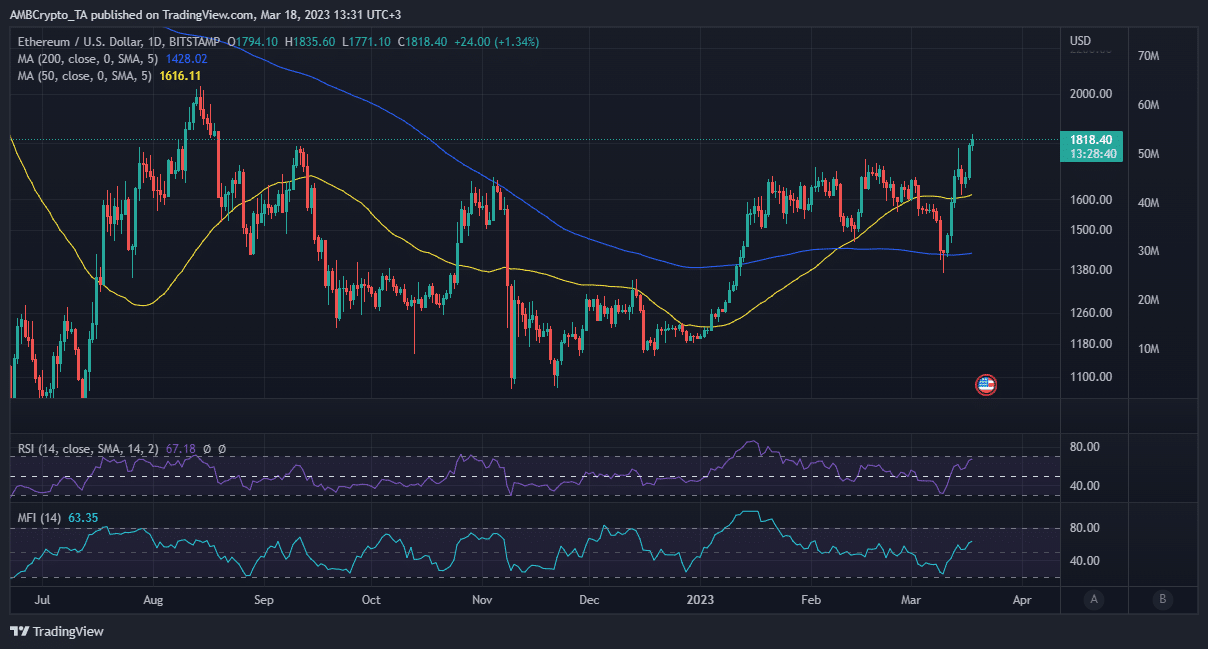

Just a week ago, ETH seemed like it was falling off a cliff. Fast forward to the present and it is now up by roughly 32% from last week’s lows.

It owes this surge to the banking contagion that occurred last week. As a result, investors became more fearful of a widespread banking collapse, thus the FUD favored cryptocurrencies.

ETH attempts to exit the bottom range

To recap, ETH’s upside was enough to push beyond the previous 6-month resistance level at the $1700 price range. Its realized price also soared to a 3-month high according to the latest Glassnode data.

? #Ethereum $ETH Realized Price just reached a 3-month high of $1,384.12

View metric:https://t.co/9xWb0WuEGn pic.twitter.com/FfPG47wAcs

— glassnode alerts (@glassnodealerts) March 18, 2023

The cryptocurrency is currently at a new 6-month high and the bulls are relentlessly pushing further. However, it is also rapidly approaching overbought conditions where we might witness some selling pressure.

ETH still has some ground to cover before reaching the $2,000 resistance level. But can cryptocurrency sustain this momentum? It all comes down to the same banking collapse that triggered the current rally.

More liquidity will continue flowing into the crypto market if the dominos continue falling in the banking industry.

Glassnode’s analysis of daily on-chain exchange flows reveals that Ethereum had a positive net flow of $35.8 million.

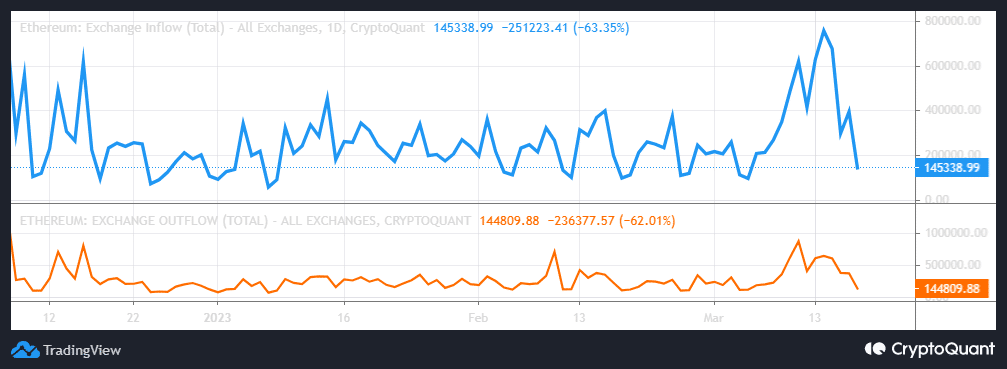

Meanwhile, the ETH exchange inflows and outflows suggested that the bullish momentum was about to be challenged. Exchanges, at press time, were experiencing higher inflows than outflows.

More importantly, the flow of funds both on and off exchanges was slowing down, at the time of writing. This outcome might pave the way for the bears to pose a challenge for the bulls especially if the situation with the banking industry is rapidly salvaged.

How many are 1,10,100 ETHs worth today

Is there a risk of another sharp ETH selloff?

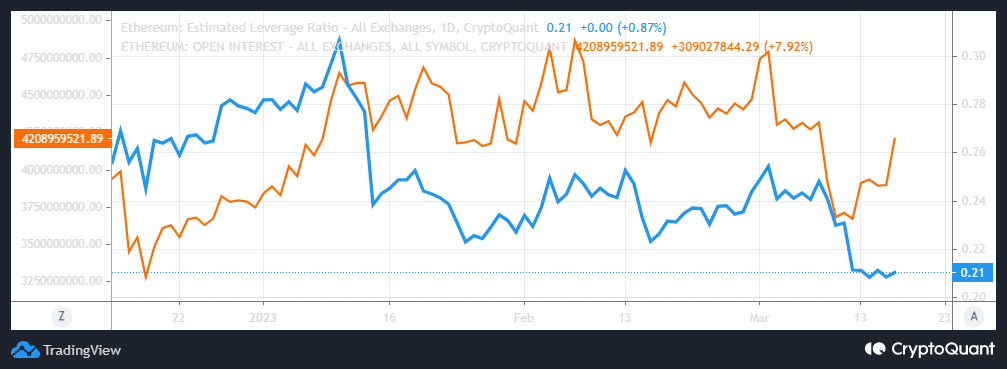

A retracement from current levels would carry some degree of severity if it is loaded with a lot of leveraged long liquidations.

The open interest metric confirms that the demand for ETH in the derivatives market has indeed surged in the last 7 days.

Despite the surge in derivatives demand, the amount of leverage remains low. This is likely due to the expectations of higher volatility and unpredictable market moves, thus discouraging leverage traders.