Will Ethereum’s [ETH] 16% spike set it up for a rally to $2,500

The road to recovery is not always an easy path, and recovery amidst a volatile cryptocurrency market is not easy, especially when the cryptocurrency is Ethereum, the king of altcoins.

But as it turns out to be, a very good recovery might as well be on the charts for the altcoin given its current momentum, which has brought ETH towards a critical zone.

Rise of the phoenix from its ashes?

In the last 48 hours, Ethereum has posted green candles, pushing the price up by 16.09%, leaving the coin to trade at $1,984, bringing it closer to $2k, a psychological level that is critical in resuscitating the investors.

This is because, in the same duration as the price went up, investors sold about 200k ETH of their holdings which amounts to $379.5 million.

Well, ETH holders have been looking to find profitable exit points, which they couldn’t come across in these last few days as Ethereum seems to be recovering from the local low and not rallying.

Ethereum supply on exchanges | Source: Santiment – AMBCrypto

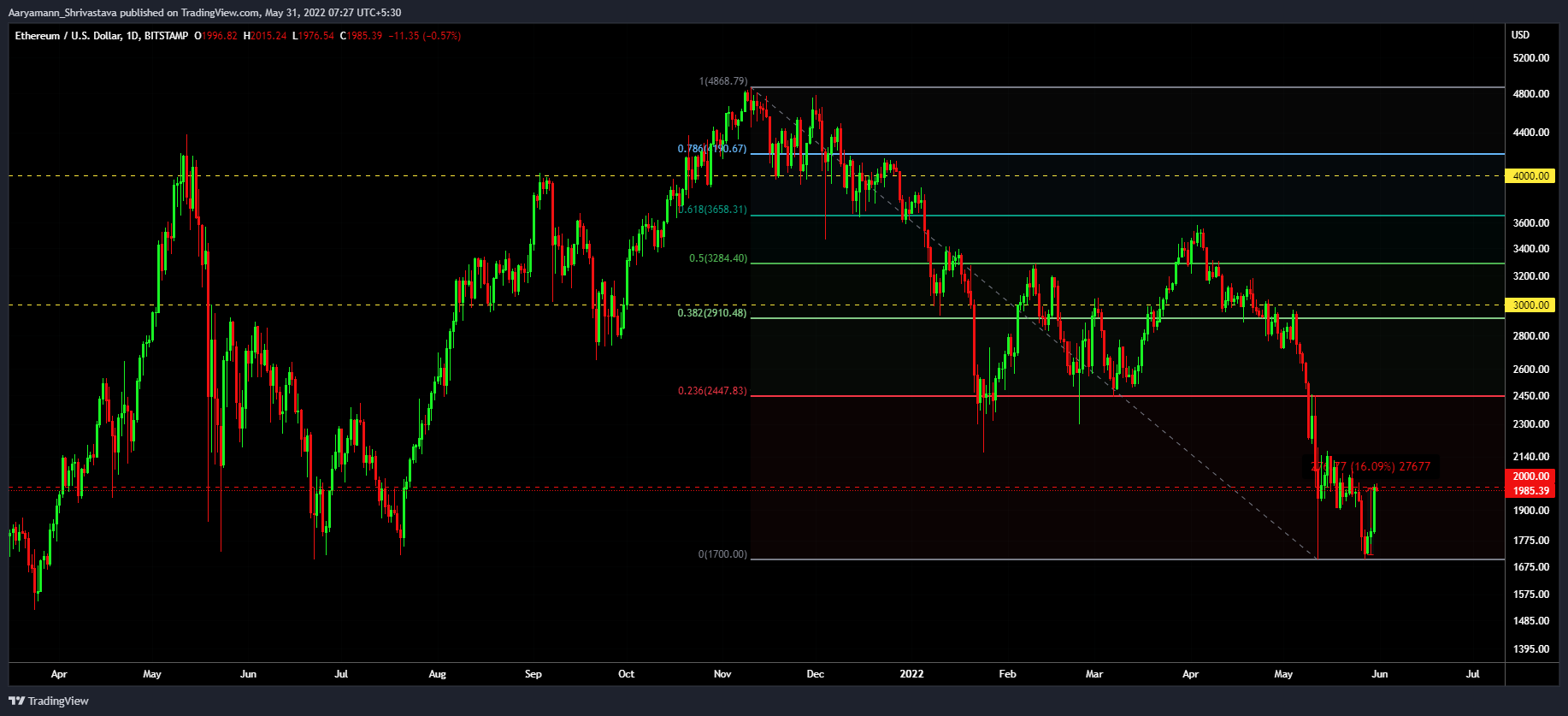

After Ethereum fell to $1,700 three days ago, it established the lowest level the cryptocurrency had dipped to in almost a year. Thus, until ETH can close above $2k, it won’t be able to prepare itself for the next major support level, which currently stands at $2,447.

Furthermore, as per the Fib retracement tool, this level coincides with the 23.6% mark, which is crucial for Ethereum if it ever plans on reclaiming $3k and $4k.

Ethereum price action | Source: TradingView – AMBCrypto

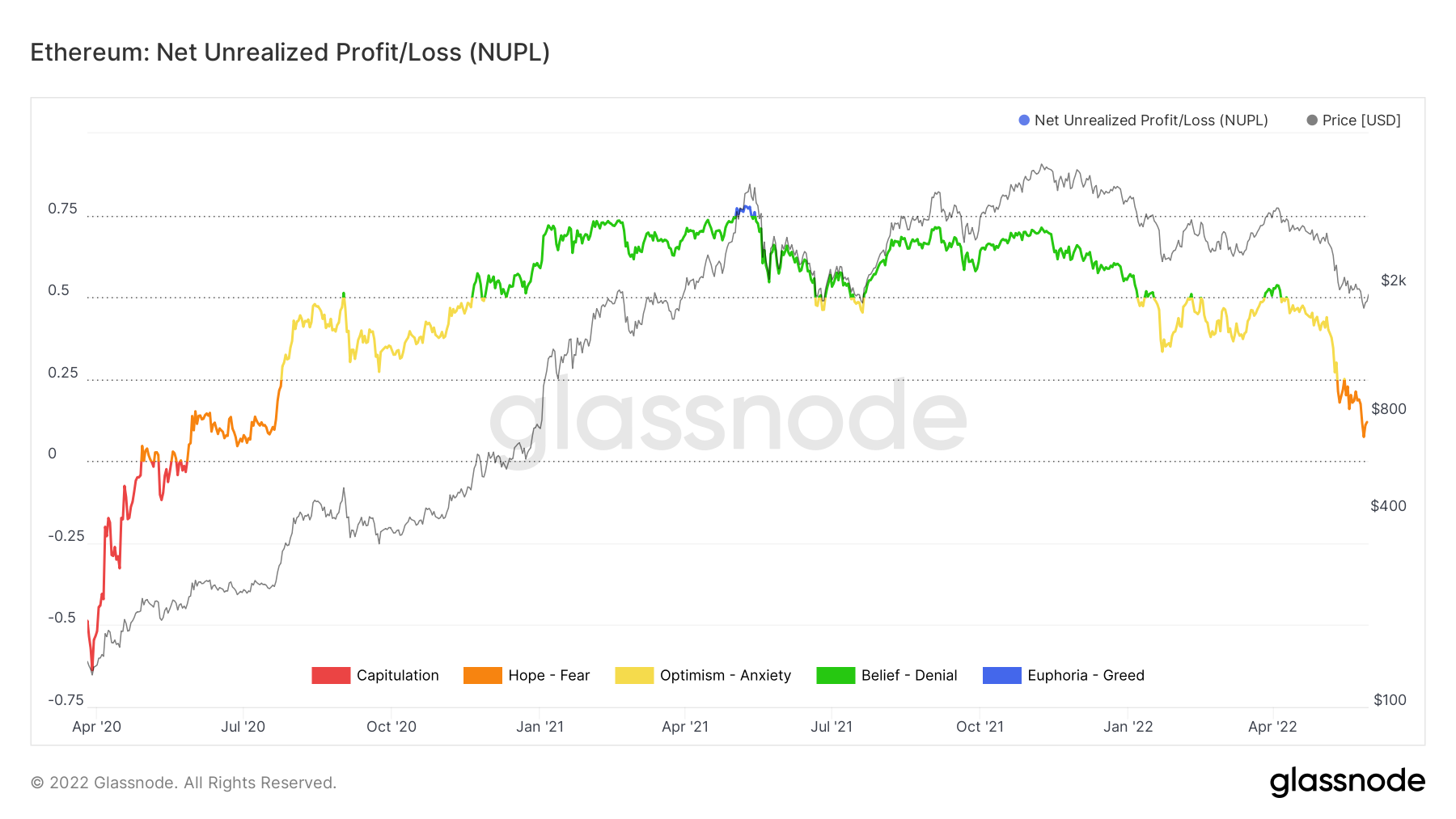

This would also be a positive trigger for the investors that are currently sitting in fear over uncertainty concerning the altcoin. ETH holders still do hold out hope that their investment will turn into profits again soon and provide them with some optimism.

Ethereum investors in fear | Source: Glassnode – AMBCrypto

The panic, although it isn’t as extensive as one would expect after a 61% drop in price in the span of five months.

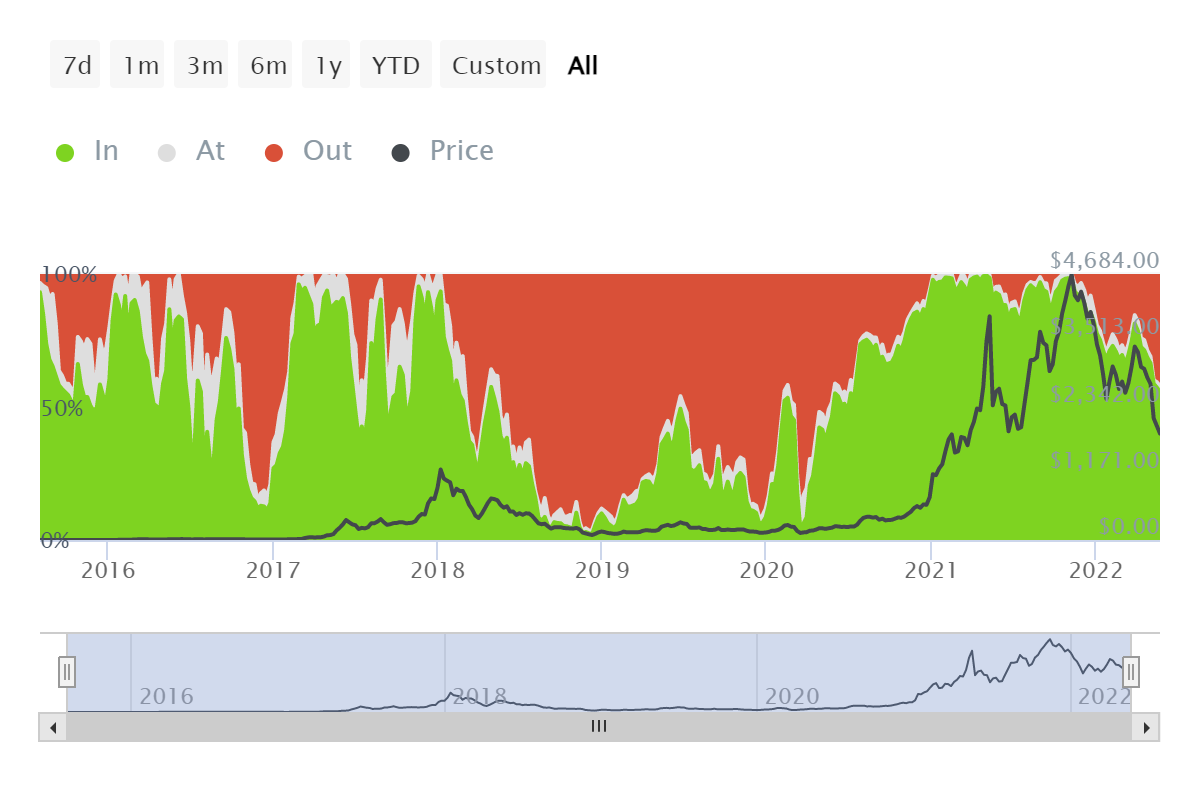

This is because most of Ethereum’s holders have been holding their ETH tokens since before the price drop began. Consequently, more than half of all the investors are far from losses still.

Ethereum investors in loss | Source: Intotheblock – AMBCrypto

Put simply, if Ethereum manages to rise to the next crucial level, it could act as a trigger for investors that are yet to see any profits, bringing their presence back into the market.