Will Ethereum’s potential short-squeeze help ETH escape $1.5k trap

Ethereum [ETH] witnessed a major decline below the $1,600 zone against the U.S. dollar. ETH even declined below $1,500 at press time on CoinMarketCap. Now any recovery of more than $1.5k could face hurdles but again, surpassing the line remains a possibility.

Rising amidst a storm

The largest altcoin, at the time of writing, traded around the $1.45k mark after suffering a fresh 3% correction. Herein, ETH failed to gain pace above the $1,660 and $1,675 resistance levels. But a potential price uptick remains in play due to a short squeeze in the market.

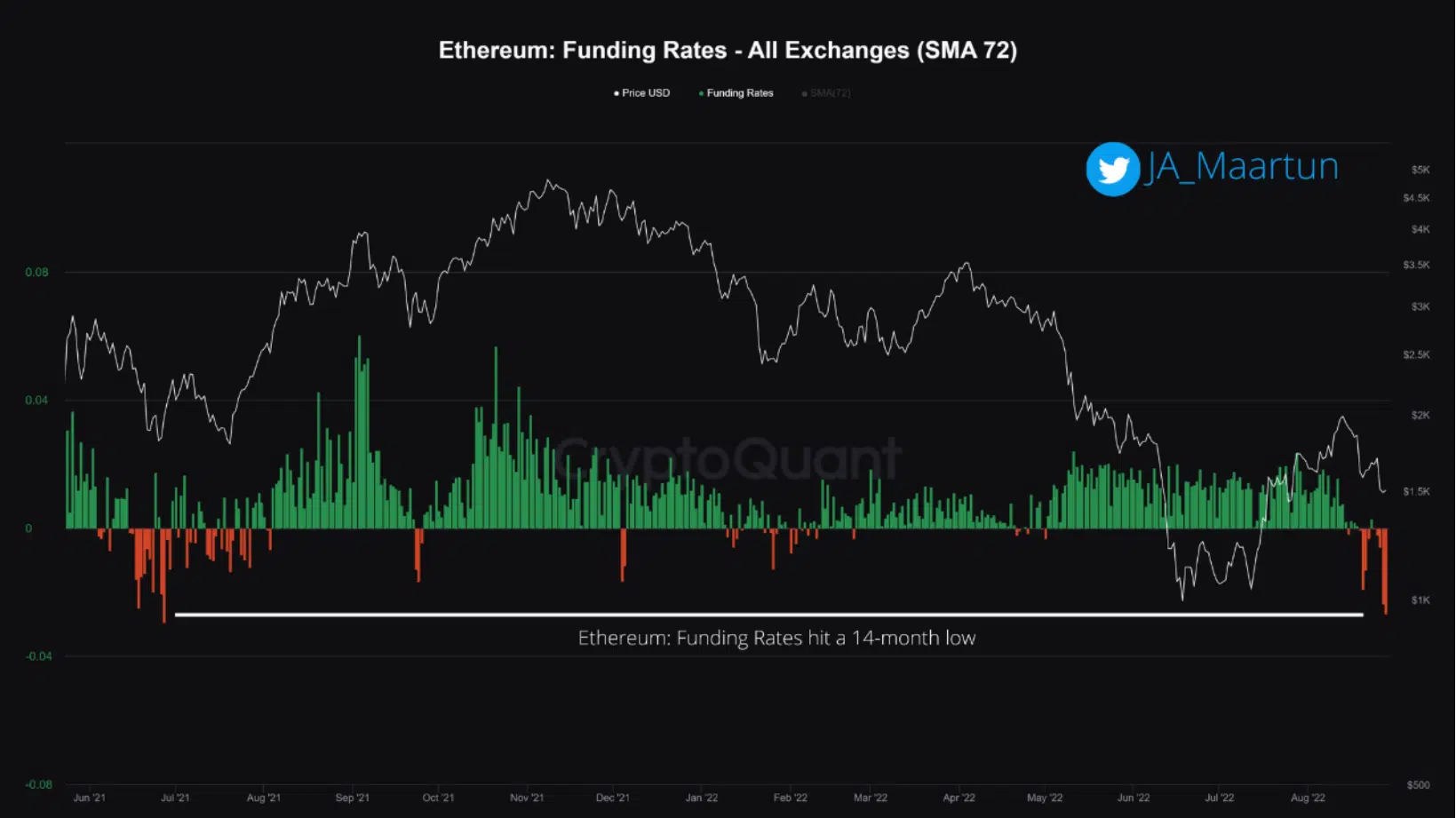

Interestingly, Ethereum funding rates have declined to the lowest value in 14 months, something that could pave way for a short squeeze in the market. CryptoQuant’s post by a crypto analyst highlighted the semi-bullish narrative.

As seen above, the ETH funding rates stood at their least value since July 2021, their lowest value in 14 months. A negative value signified that short traders paid a premium to long traders in order to hold onto their positions.

Well, the “funding rate” is an indicator that measures the periodic fee that traders in the Ethereum futures market are exchanging with each other.

Notably, this fall (despite the bearish tone) could aid ETH’s potential uptick. The last time Funding Rates were this negative, ‘it was in July ’21 just before a huge short-squeeze on Bitcoin & Ethereum,’ the blog post added.

A short squeeze happens when the price of an asset sharply increases due to a lot of short sellers being forced out of their positions.

Similarly, ETH could see a price swing up while the market remains overleveraged and liquidate a large amount of shorts. These liquidations push the price up even higher, leading to more shorts flushed down.

As short sellers close their positions, a cascading effect of buy orders takes place. As such, a short squeeze is typically accompanied by an equivalent spike in trading volume. This was exactly the case as can be seen in ETH’s trading volume on Santiment.

Just in 24 hours, ETH saw trading volume (interested buyers jumping in) surge by more than 26 billion.

In addition, the constant affection from dominant buyers, or whales too played a huge part in the same.

One thing led to another

Needless to say, such constant attention did, indeed, lead to some unprecedented traction/demand for the flagship token.

Especially, now ahead of the much-talked-about Merge. According to OKLink, the amount of ETH burned in Ethereum exceeded 2.6 million, which is about $3.76 billion at the current price.

Interestingly, since the implementation of EIP-1559, the annual inflation rate of Ethereum has dropped by 50.77%

![Can Injective [INJ] reclaim the $35 level, trigger a rally?](https://ambcrypto.com/wp-content/uploads/2024/10/Lennox-INJ-400x240.webp)