Will FED’s easing hint spark Bitcoin’s parabolic bull run hype?

- Boston FED President Susan Collins hinted at interest rate cuts

- Analysts are still hopeful that cryptos will continue to surge

Federal Reserve Bank of Boston’s President Susan Collins recently indicated that it might soon be appropriate to start easing interest rates. What this means is that the Federal Reserve could cut rates by as soon as 18 September, potentially triggering a significant bull run in the markets.

However, alarm bells have been ringing in some quarters. Donald Trump, for instance, has raised some concerns, warning that the U.S might be heading towards a severe recession, one similar to the 1929 crash, while also predicting the possibility of a world war soon.

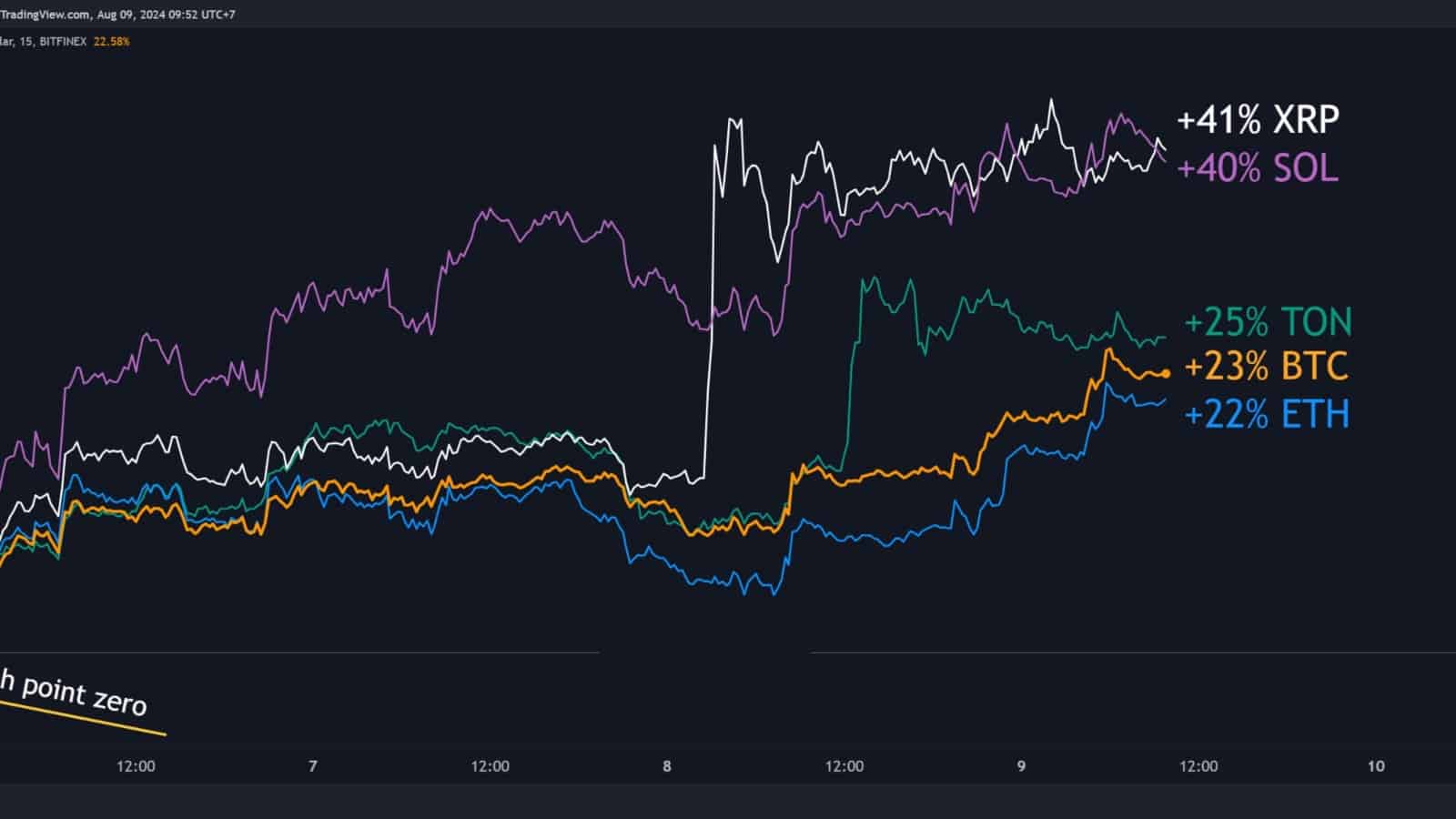

XRP & SOL clear winners as BTC & ETH follow

XRP and Solana have been standout performers over the past week, surging by 41% and 40%, respectively. This boost follows XRP’s settlement with the SEC, which involved a $125M fine. As expected, this has driven XRP’s price up, with expectations of further gains on the charts.

Bitcoin and Ethereum also saw notable hikes, rising by 23% and 22% from their weekly lows.

The Federal Reserve’s hint at potential interest rate cuts could further enhance these gains, as it may make it easier for traders and investors to secure loans to buy these assets.

Bitcoin is up by 23% this week

Major financial firms remain confident in Bitcoin, as neither MicroStrategy nor BlackRock have sold any of their Bitcoin holdings despite the crypto’s recent bouts of price depreciation. For its part, Bitcoin alone has risen by over 20% in the past week from this week’s low.

With the Federal Reserve hinting at potential rate cuts next month, expectations are that Bitcoin’s value will continue to appreciate as investors gain more access to capital.

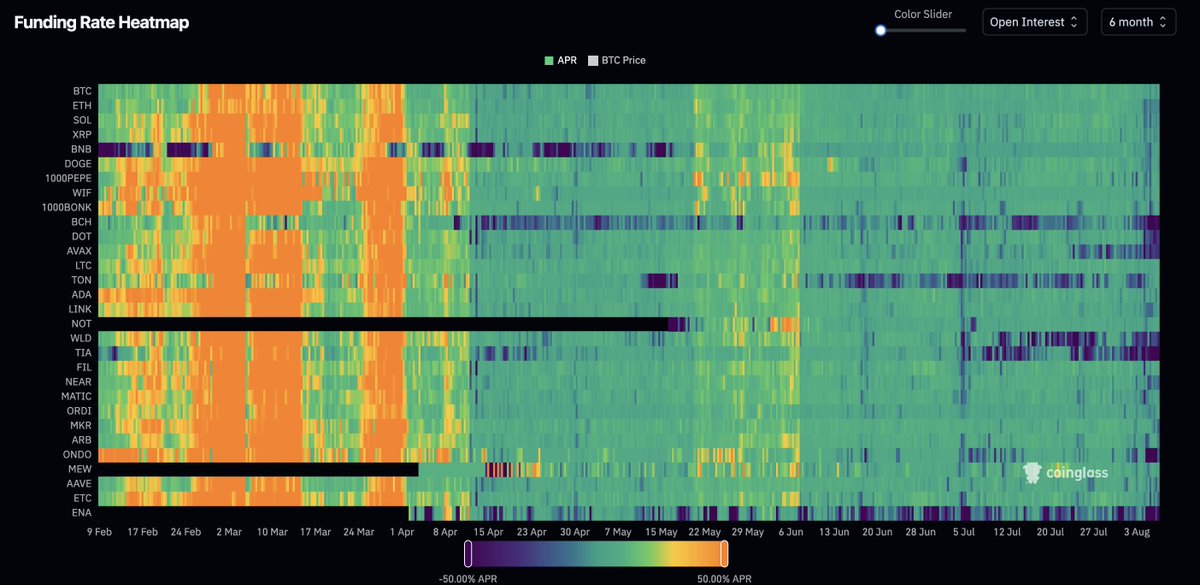

Crypto funding rates for top 30 coins

Crypto funding rates have significantly shifted since the overheated markets of February and March. In fact, currently, they are at their lowest levels of 2024.

Such periods of low rates can last for extended times, but the FED’s recent hints at possible rate cuts could soon alter the market dynamics, potentially driving changes in these funding rates.

Altcoins excluding BTC form a cup & handle pattern

Finally, macro charts have been showing some positive signs again. For instance, the weekly candle returned to the low point of a 2.5-year cup & handle pattern.

Thus, after the FEDs hinted at rate cuts, an upward trend is inevitable. The market has been held back long enough, and this final upward move could soon happen, with the candle closing in two days.