Will Jack Dorsey’s Block decision to go ‘all in on crypto’ pay off?

- The worth of Bitcoin held by the company jumped to $573 million from $220 million.

- Dorsey opined that BTC was not a speculative asset like other cryptos, hence the decision to stick to it.

Block, the financial technology company led by Jack Dorsey, had decided to use 10% of profits from its Bitcoin [BTC] products to buy crypto every month.

The company made this known in a Q1 shareholder release recently. Block started investing in Bitcoin in 2020. At that time, Dorsey did not hide his love for the financial instrument.

Some of his posts, at that time, led users to tag him a Bitcoin maximalist. However, it was not until 2020 that Block began releasing Bitcoin-related products.

“3% is not enough”

Instead, in 2018 became the first public company to add products related to the coin. However, in the report, Block mentioned that only a small size of resources were committed to Bitcoin products. The statement read,

“Less than 3% of company resources are dedicated to Bitcoin-related projects. All of which have been more than fully covered by the profits from our bitcoin exchange, which is Cash App’s fourth largest gross profit stream.”

For context, Block owns CashApp and serves as a peer-to-peer payment system. The product has 21 million active users, and since it integrated the product with Bitcoin, it has been able to improve global remittances.

Furthermore, the report noted that Block’s Bitcoin investment has increased by 160%. In 2020, the firm investment was $220 million. As of this writing, the value has increased to $573 million.

Dorsey, who wrote the letter, explained that the growth it has experienced was one of the reasons it planned to dedicate 10% of its returns to crypto investment. He noted that,

“We also believe in investing in the overall asset of the ecosystem, and holding bitcoin in our treasury. Going forward, each month we will be investing 10% of our gross profit from bitcoin products into bitcoin purchases.”

As it stands, Block’s major investment would be in BTC. However, it was uncertain if the team was considering adding other cryptocurrencies to its portfolio.

But this might seem unlikely, especially as Dorsey has hardly displayed his love for “Bitcoin only.” At press time, Bitcoin’s price was $64,142.

This was a 118.87% increase within the last year. Should the price of the coin revisit $73,000, Block’s Bitcoin holding might surpass $600 million.

Block’s recent announcement reinforces the notion that many institutions might continue to adopt Bitcoin, and crypto at large. First, Microstrategy, led by Michael Saylor, has doubled down on his Bitcoin holdings.

Tesla, which has Elon Musk as its chief, also disclosed that it had not sold any of its BTC for some time. Should these institutions continue to hold the coin, there is a high chance that prices might surge in the coming years.

Also, this gives credence to the possibility that Block’s decision to buy crypto every month might yield good returns.

CashApp plays its part; the firm targets mining

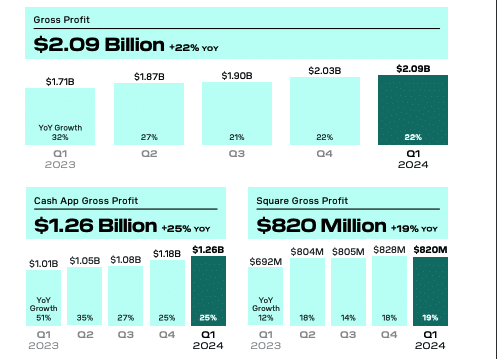

Meanwhile, CashApp, Block’s major product, has been responsible for the hike in revenue. According to the report, Block’s profit increased by 22% to hit $2.09 billion.

A breakdown showed that CashApp contributed $1.26 billion. Square, which is another firm under Block Inc. generated $820 million in gains.

This was a 19% increase on a Quarter-on-Quarter (QoQ) basis. Furthermore, the financial statement revealed that,

“We delivered improvement across all profitability measures in the first quarter of 2024. Operating income was $250 million while Adjusted Operating Income was $364 million. Net income attributable to common stockholders was $472 million and Adjusted EBITDA was $705 million, up 91% year over year.”

If Block continues to generate this kind of income consistently, there is a chance that the 10% dedicated to the investment might increase.

Is your portfolio green? Check the Bitcoin Profit Calculator

Apart from this investment, Block mentioned that it was working on designing chips for Bitcoin mining systems. In conclusion, the firm noted that its goal of creating an open protocol for money might not allow it to consider other cryptocurrencies:

“Why Bitcoin versus all the other “cryptos?” Satoshi designed Bitcoin to solve a very specific problem around payments, which the world has since found to be immensely valuable. The majority of other projects are either solving different problems or attempting to be a speculative trading asset.”