Will Lido benefit from the surge in ETH withdrawals? This data indicates…

- Withdrawals on Lido rise. The protocol keeps up with the demand and processes transactions successfully.

- LDO’s price rises, whales show interest.

Lido has been dominating the DeFi space in terms of the TVL on its protocol since the beginning of 2023. After the launch of the Shanghai upgrade on the network, the interest in Lido increased. This could help the protocol retain its dominance in the sector going forward.

Is your portfolio green? Check out the Lido Profit Calculator

According to Delphi Digital’s data, over $10 billion ETH was enabled to be withdrawn from the Lido protocol this week. This has occurred due to the recent launch of Lido v2 which allowed in-protocol withdrawals at a 1:1 ratio for all ETH stakers.

Heat rises as Lido meets Celsius’ demands

The reason for a large amount of ETH being withdrawn from the Lido protocol could be due to the behavior of whale addresses.

For instance, on 16 May, Celsius sent a request for withdrawing 428,000 stETH from its protocol. During that period, Celsius contributed 96.8% of the total withdrawal requests on the network.

Despite the large request made by the Celsius network, Lido was able to successfully process a large number of withdrawals on the protocol with the help of node operators.

At press time, Lido had a group of 30 node operators. They were vetted by the team and approved via a governance vote by LDO holders. The nodes are entrusted with the responsibility of acting as validators.

LDO starts seeing green

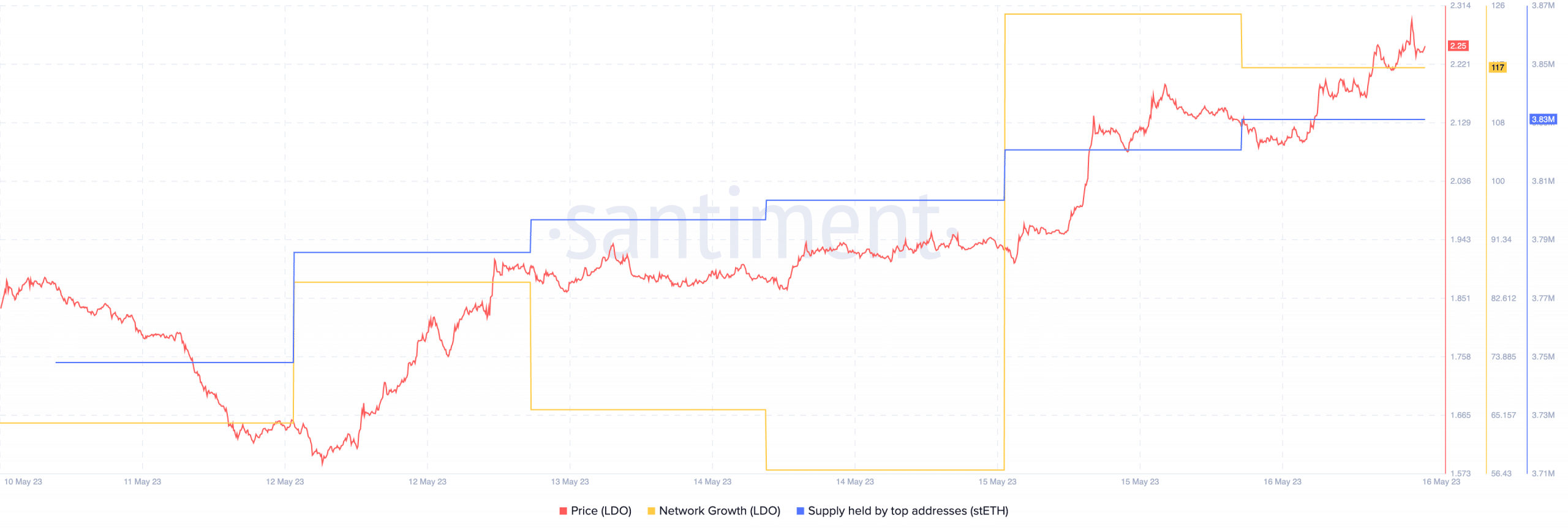

The faith in the liquid staking sector’s solvency rose after Lido processed a large number of withdrawals. Due to this, there was a spike in the price of the LDO token. The token saw a surge of 35% in its price due to these developments.

Realistic or not, here’s LDO’s market cap in BTC terms

Large addresses contributed immensely to the spike in LDO’s price. Santiment’s data indicated that the number of top addresses holding LDO has increased in tandem with its price.

Coupled with that, the network growth for the LDO token has also been on the rise. The rising network growth suggested that new addresses were starting to show interest in the LDO token as well.