Will MKR derail above $1400?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

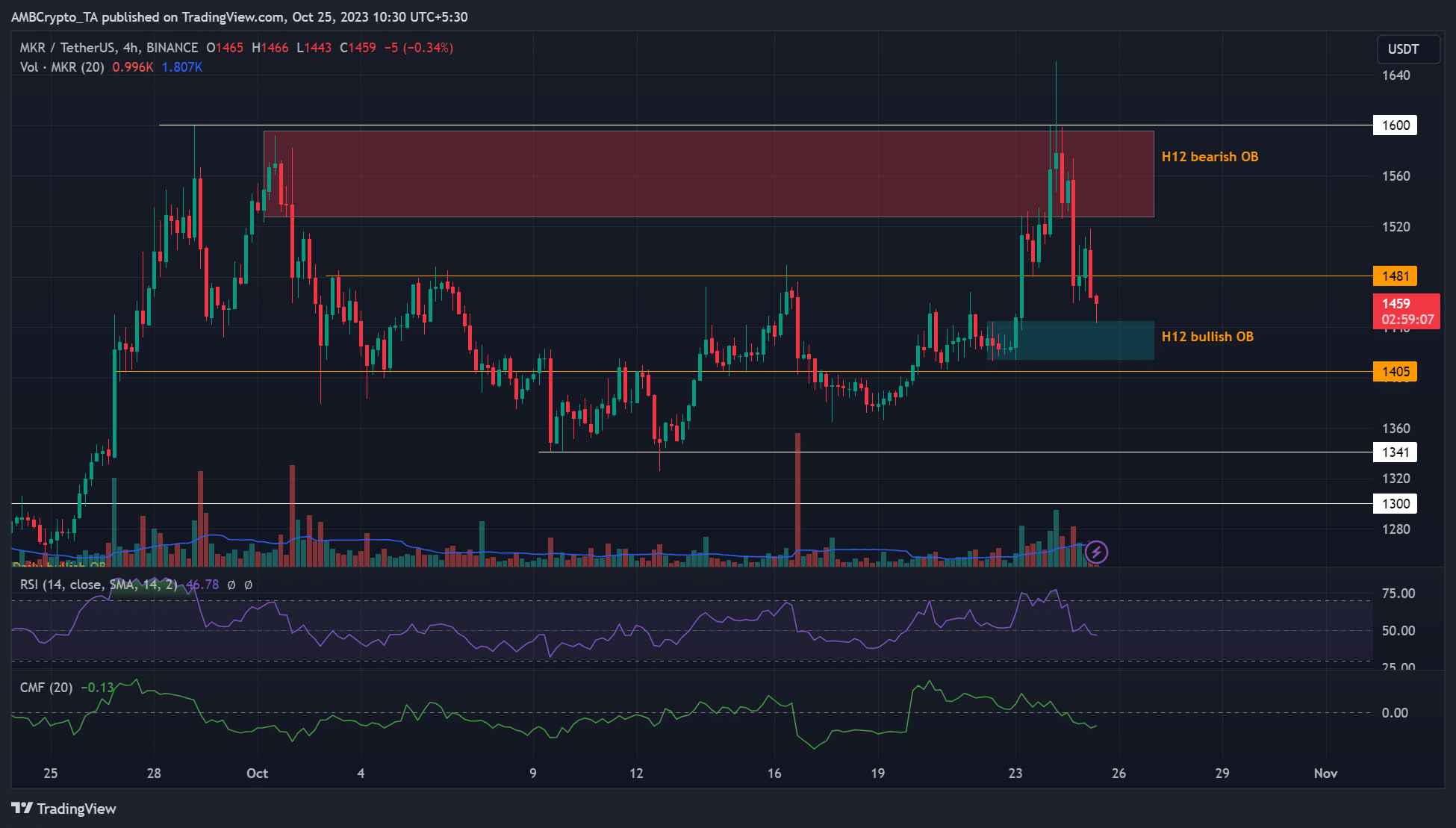

- MKR dropped to an H12 bullish zone, just above the $1400 psychological level.

- The bullish zone aligned with a high liquidation zone, which could make a reversal likely.

Bitcoin [BTC] posted over $1000 loss after dropping from $35.2k. At press time, the king coin struggled to defend $34.0k. The losses made Maker [MKR] chalk a sharp pullback from $1651 to a bullish order block (OB) at $1430 – a 12% loss.

Is your portfolio green? Check out the MKR Profit Calculator

Can MKR reverse recent losses?

At press time, the pullback hit the H12 bullish OB of $1413 – $1444 (cyan). The bullish zone sat slightly above the key $1403 support, and the stretch could post resistance to bearish efforts.

Should sellers exit at the above area, a bullish reversal could be feasible. But MKR bulls must clear the $1481 resistance to hit the overhead roadblock and H12 bearish OB below $1600.

Meanwhile, the RSI cracked below 50, underscoring heightened selling pressure. Coupled with massive capital outflows as denoted by the downward sloping CMF, the negative readings showed sellers had the upper hand at the time of writing.

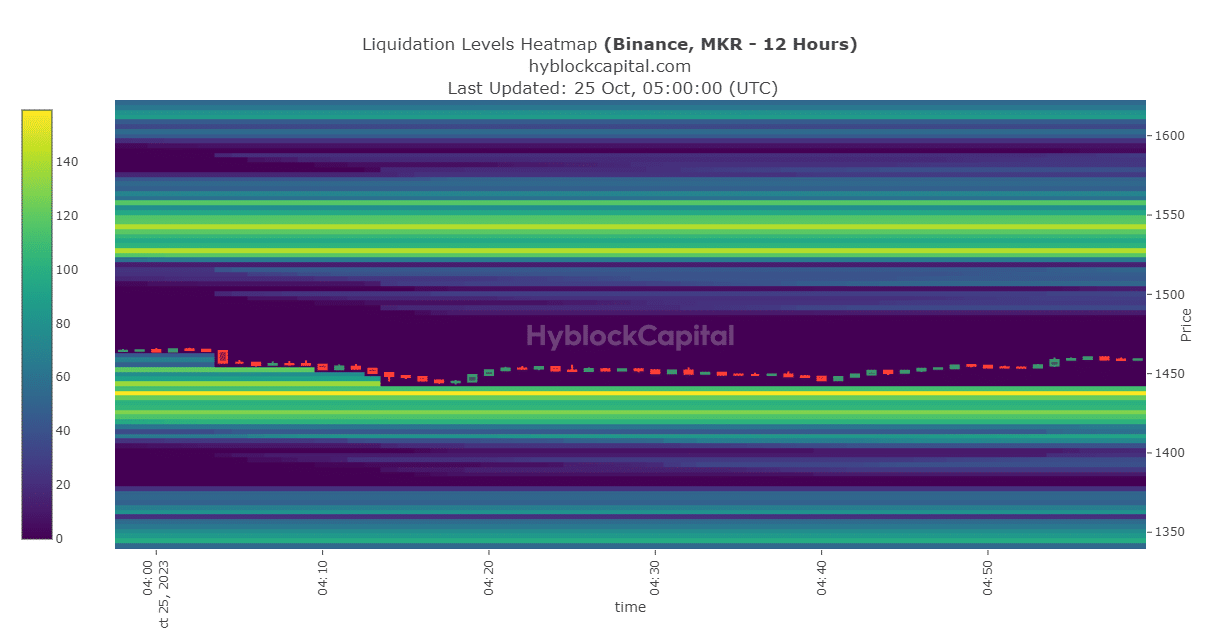

Major liquidation levels existed below $1550 and $1450

Data from Hyblock provided further nuanced areas where MKR’s price could head next. Based on the Liquidation Heatmap, the orange areas below $1450 and $1550 were major liquidation zones.

Conventionally, prices tend to react strongly at major liquidations zones, which are major risk levels for leveraged traders. As such, we could see MKR’s price collect the liquidity below $1450 before an attempt to grab the rest below $1550.

How much are 1,10,100 MKRs worth today?

Since the $1450 was within the H12 bullish zone, MKR’s prices could react to the bullish zone, especially if BTC doesn’t post more losses.

So, a bullish reversal at the H12 bullish zone was feasible if a liquidity hunt pans out, as evaluated above. Alternatively, more BTC losses could push MKR towards $1350.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)