Will Q4 of 2021 see Bitcoin hit $64K again, let alone $100K

2021 will be remembered for many reasons and in less than 48 hours, the year will finally welcome Q4. With Bitcoin hitting an all-time high in Q2 of 2021, many in the community have been expecting a bullish rally on the charts. One that will push BTC past its previous high of over $64,000.

While some of the major on-chain narratives are suggestive of such a turnaround, Bitcoin’s potential performance over the next three months needs to be evaluated based on historical turnarounds, investor sentiment, and overall market structure with respect to altcoins.

Bitcoin has done well in Q4 over the years

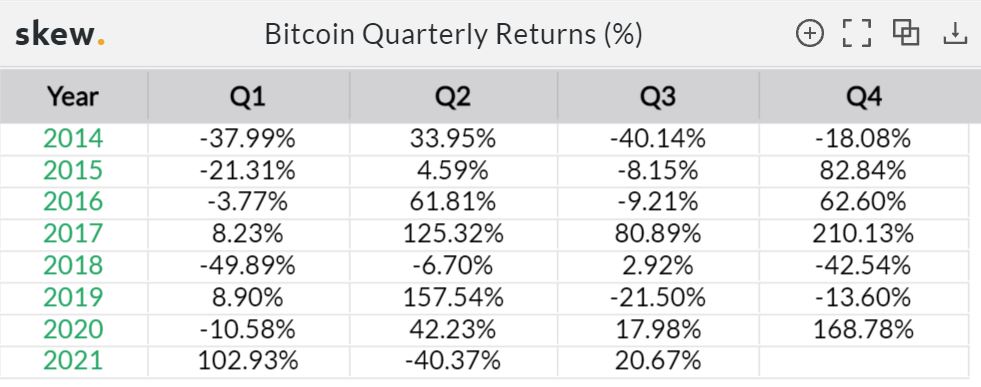

Right off the bat, Bitcoin’s historical performance in Q4 would delight the perma-bulls. Since the beginning of 2014, the two largest quarters for BTC in terms of price growth have been Q4 of 2017 and Q4 of 2020. During both, the price rose by 210% and 168%, respectively. On average, Q4 has also outperformed the rest of the quarters since 2014.

Another important insight from investors’ perspective is that short-term holders are currently holding on to 20% of the supply. The relevancy can be underlined by the fact that similar scenarios were last seen in December 2018 and March 2020 – Both of which saw significant Bitcoin bottoms.

With more than 80% of the supply currently illiquid, selling pressure over the long term is negligible unless there is an uncharacteristic market dump.

Weakening euphoria to be considered?

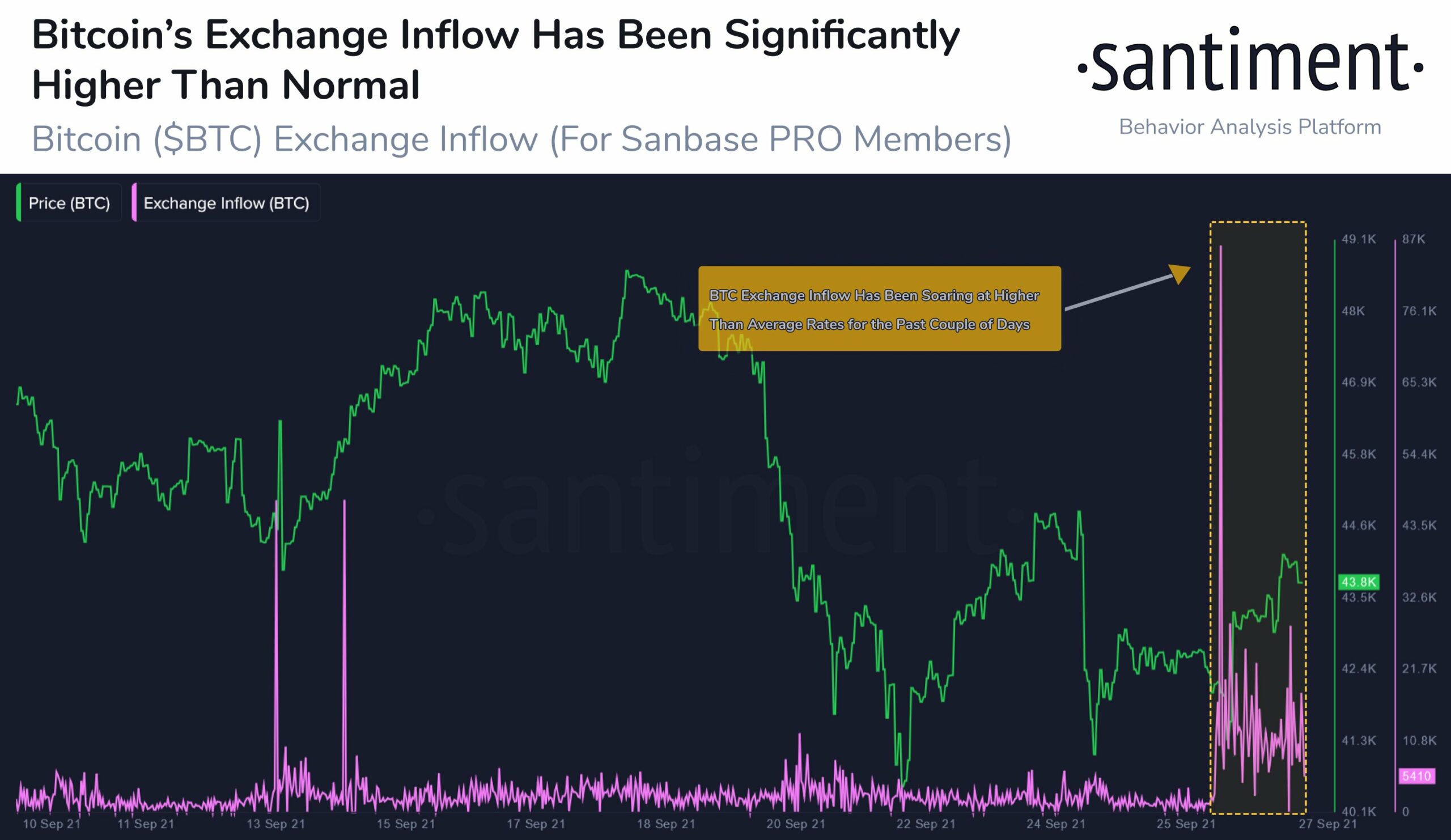

While short-holders might be indicative of reduced sell pressure, higher exchange inflows for Bitcoin over the past week may imply that the bullish euphoria is becoming weak somewhat. As identified by Santiment, BTC exchange inflows over the past week have averaged higher than usual, exhibiting profit-taking across the markets.

Here, the narrative of an altcoin season is equally essential.

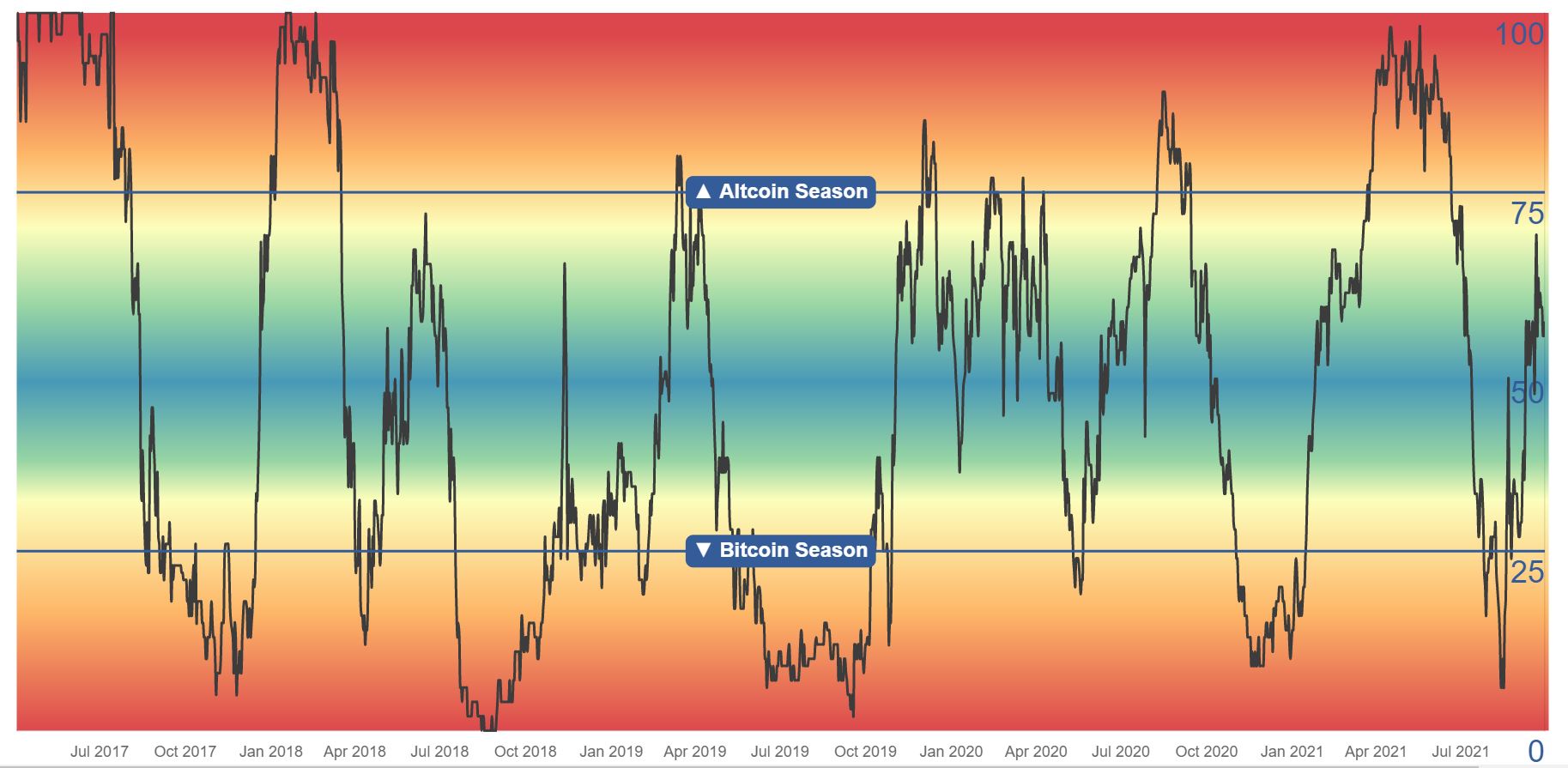

During both rallies in 2017 and 2020, altcoin dominance was at a low with Bitcoin amassing more than 65% in dominance. Presently, BTC’s dominance is around 40%. This means altcoins, collectively, have a higher market cap with respect to the world’s largest digital asset.

In order to swing higher bullish momentum in favor of Bitcoin, the asset would need to rally by 50% in dominance before there is an expectation for a new ATH rally on the charts.

With the rise of DeFi and NFTs, liquidity in the digital asset market is more distributed than ever. And, the concentration of value in one digital asset is almost non-existent right now.

Targets – Achievable or not?

From its press time price point, a 55% hike in Q4 of 2021 would allow Bitcoin to hit its current all-time high of ~$64,000. During bullish periods, such a return on investments hasn’t been unheard of for Bitcoin but reaching the elusive $100,000 valuation would need BTC to jump by a whopping ~138%.

That would be BTC’s third-largest quarterly jump since 2014. This would mean BTC would have jumped by more than 100% in 3 quarters out of the last six. Irrespective of its bullish demeanor, such a bullish market structure is unheard of.

Hence, Q4 could get really interesting. Either history will be repeated with Bitcoin, or a new chapter will be written.