Ethereum

Will Solana become a true ‘Ethereum killer’ in 2024? Key data suggests…

Solana’s total value locked has surged by 25%, while its transaction revenue and MEV tips surpass Ethereum.

- Solana’s transaction revenue and MEV tips have outpaced Ethereum.

- Solana total value locked surged by 25%, but ETH remained dominant.

The crypto market has been experiencing high volatility of late, and Solana [SOL] is no exception. However, this month has seen SOL change fortunes in trading volume, market cap, and meme-coins adoptions.

Two days ago, Solana hit the headlines after flipping Binance Coin [BNB] on market cap, as the former’s market cap surged to $85B. At the same time, BNB declined to $83B, according to CoinMarketCap

.Solana continues its growth with higher trading volume, DEXes, and surpassing Ethereum [ETH]

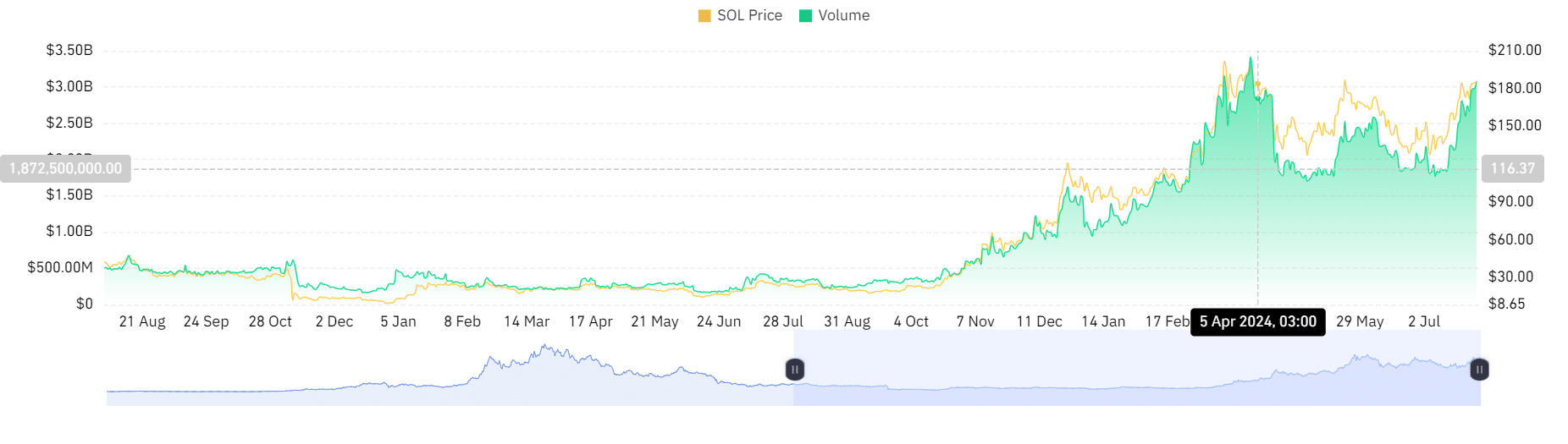

in fees and MEV.Solana DEX trading volume hits $2B

SOL is rising, and its decentralized exchange (DEX) trading volume has surged to a record $2B. In the last 24 hrs, Solana’s DEX trading volume rose 50% to $3.09B from $2.7B, outpacing both ETH and BNB, per Coinglass.

SOL beats ETH in transaction fees

Looking further, Solana has attempted to dethrone Ethereum in key metrics, including total fees and MEV.

On weekly charts, Solana generated $25M in transactional fees (revenue), while ETH reported $21M in the same period.

Dan Smith shared the development through his X (formerly Twitter) page, stating that,

“For the first time ever, Solana surpassed Ethereum in total transaction fees and MEV tips on the weekly timeframe ($25M vs $21M). Solana validators and stakers are absolutely eating this cycle.”

Solana generated much of its revenues from spot DEX trading. In the last 24 hrs, it generated 58% of the value from MEV tips and 37% from fees. The $5.5M revenue has been the highest over the past two months.

Additionally, Solana stakes have enjoyed an extensive rise in revenue, earning $32M in the past. This earning outpaced ETH, which has only generated 3%, while SOL stakes earned 7%.

Therefore, the rise in investment returns is playing a key role in attracting investors, thus raising Solana’s active address and trading volume.

Although Solana has experienced a surge in MEV tips and revenue, it still lags behind in total value locked. It rose by 25% on monthly charts to $5.5B.

Read Ethereum’s [ETH] Price Prediction 2024-25

In this aspect, ETH remains at the top, with a total value locked at $58B. However, Solana surpassed ETH in Total Economic Value with more than $2.2M compared to ETH’s $1.97M.

These shifts in market trajectories position SOL to become the true ETH killer, as it’s called.