Solana

Will Solana rally to $192? Watch out for THIS key pattern

Amid Solana’s continuous surge, a crypto analyst has pointed out a bullish pennant pattern.

- Solana has experienced a 500% increase in price, trading above $150 at press time.

- Technical analysis identified a bullish pennant, suggesting potential for continued price rallies.

Solana [SOL], recognized as one of the largest crypto assets by market capitalization, has exhibited a remarkable performance since the beginning of the year.

With a year-to-date increase exceeding 500%, SOL’s price has soared to levels above $150. Over the last 24 hours alone, SOL has recorded a 1.4% gain, with its press time trading price at $161.03.

This consistent upward trajectory has not only positioned Solana as a standout performer, but has also drawn increased attention from traders and investors looking for robust growth opportunities.

Bullish pennant pattern emerges

The recent market activity around Solana has caught the eye of crypto traders, especially with the formation of a bullish pennant pattern on its price chart.

This technical formation on the 1-day chart, as revealed by CryptoBusy, is often regarded as a predictor of potential price rallies.

The emergence of the pattern followed an 18% increase in Solana’s price over the past week.

Such patterns are typically formed through price consolidation after substantial upward movements, indicating continued investor interest and potential for further gains.

Meanwhile, a prominent crypto trader, known as Honey, pointed out that Solana has recently exceeded “short-term price targets.”

However, she advised caution, particularly regarding the use of leverage at this juncture, which she describes as a pivot area.

Honey noted,

“Short term target reached at $160. This is a pivot area and I’d be cautious with longs if you’re entering here. reclaim = $192 next. reject = $140s next. go easy on the leverage.”

Solana market fundamentals

Besides the technicals, from a fundamental perspective, Solana’s market dynamics were equally promising.

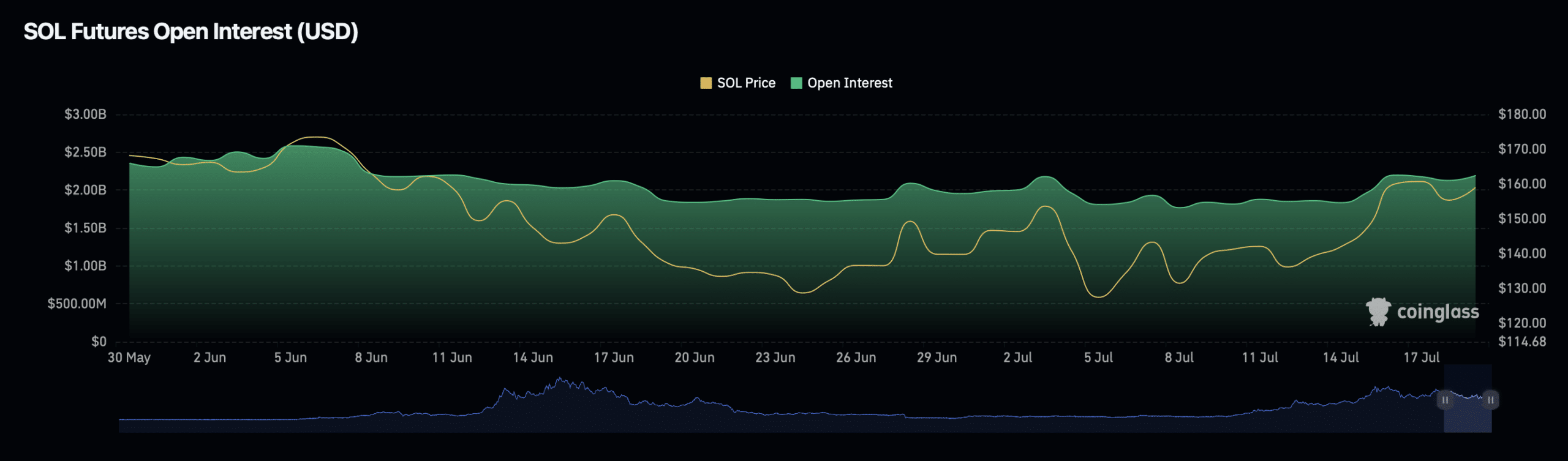

According to data from Coinglass, there has been a notable increase in Futures trading activity related to Solana, with Open Interest up by 5.39% and trading volume rising by 7.45% in the last 24 hours.

This surge has elevated Solana’s Open Interest to $2.30 billion and its trading volume to $6.82 billion, reflecting heightened market activity and investor confidence.

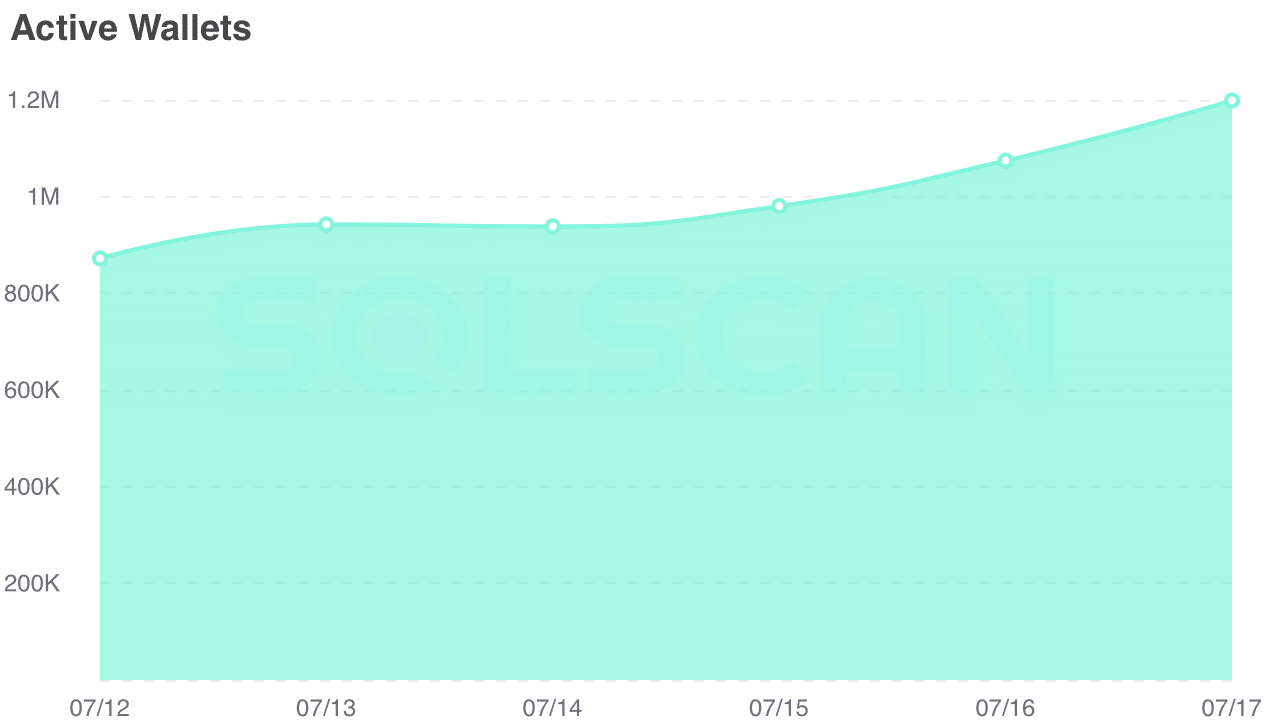

Furthermore, Solana’s network activity has seen an uptick, with the number of active wallets rising from below 900,000 to nearly 1.2 million in the past week.

Is your portfolio green? Check out the SOL Profit Calculator

This increase in active participation is significant, as it aligns with the bullish sentiment observed in the trading patterns.

It is worth noting that this bullishness from SOL follows the recent spotlight on the asset concerning a spot exchange-traded fund (ETF).