Will Sonic target $0.80 next? – What the data suggests

- Sonic broke out from an inverse head-and-shoulders pattern, with a 35% rise potential.

- On-chain signals showed mixed results, but sentiment improved, supporting a bullish outlook.

Sonic [S] is experiencing a notable rally, trading at $0.5957, at press time, with a 9.58% increase over the last 24 hours.

The cryptocurrency recently broke out of an inverse head-and-shoulders pattern, signaling the potential for further gains. This technical formation has historically signaled strong bullish momentum, and Sonic’s price could rise by 35%, reaching $0.80.

However, with key resistance levels ahead, the real question is whether Sonic can maintain this upward momentum or face potential resistance.

Sonic price action analysis: Can the rally continue?

Sonic’s price shows an upward trend after breaking out from the inverse head-and-shoulders pattern. The price recently crossed the $0.55 and $0.60 levels, indicating that Sonic is gaining strength.

Moving forward, the cryptocurrency faces immediate resistance around the $0.63 and $0.82 levels. If Sonic breaks through the $0.82 mark, it could spark a rally towards $0.80. However, if it fails to maintain this momentum, a pullback could occur.

Therefore, traders must closely monitor these resistance levels and be prepared for any momentum shifts.

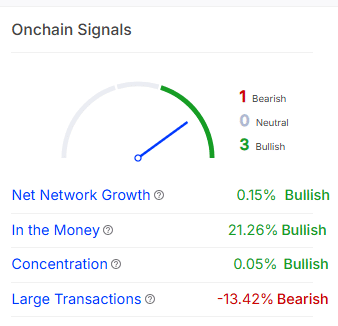

What do on-chain signals say?

Looking at Sonic’s on-chain data, the signals present both bullish and bearish factors. The network’s growth has shown a slight increase of 0.15%, suggesting growing interest.

Additionally, the percentage of Sonic holders “in the money” has surged to 21.26%, indicating that many investors are currently in profit. This could provide support for a continued rise in price. However, large transactions have decreased by 13.42%, which may signal a decline in institutional interest.

Furthermore, concentration has also increased slightly by 0.05%. These mixed signals indicate that while there is support for a bullish trend, some factors could hinder further gains.

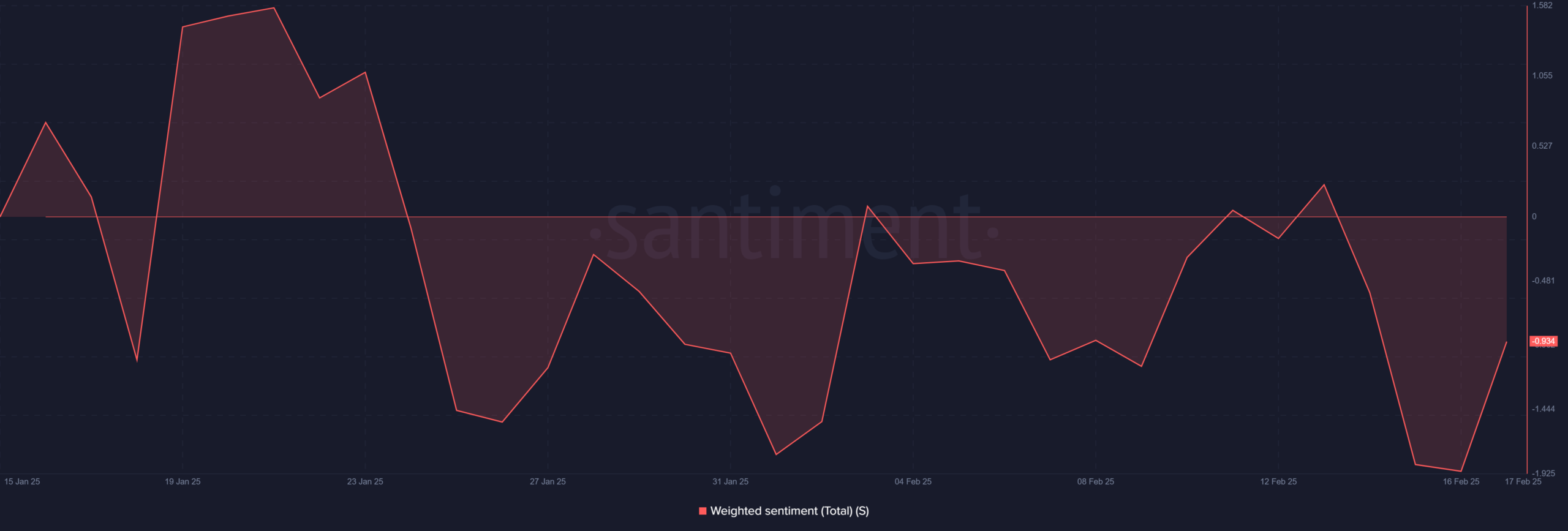

Weighted Sentiment is shifting bullish

Sonic’s Weighted Sentiment has undergone a significant shift in recent days. On the 16th of February, sentiment reached a low of -1.91, but since then, it has steadily improved to -0.934.

The positive shift in sentiment indicates a growing confidence in the coin’s price potential.

This increase in sentiment, combined with the bullish technical indicators, suggests that Sonic could maintain its upward trend in the short term.

Additionally, positive sentiment may attract more investors, driving the price higher.

Will Sonic reach $0.80?

Given the current bullish price action, rising sentiment, and completion of an inverse head-and-shoulders pattern, Sonic has strong growth potential.

Although the on-chain signals present mixed indicators, the overall technical setup and rising sentiment suggest the price could break the $0.80 barrier.

Therefore, Sonic is likely to maintain its bullish momentum and may soon reach $0.80 if it overcomes the upcoming resistance levels.

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)