Altcoin

Will TAO’s ‘Cup and Handle’ pattern push altcoin to $1,000?

TAO’s Cup and Handle pattern projected a breakout towards $1,000, with a 65% surge from its press time levels.

- Bittensor is eyeing a $1,000 target with its bullish Cup formation

- Positive spot inflows signaled strong momentum ahead for TAO

Over the last five weeks, Bittensor [TAO] has registered significant upward movement. In fact, at the time of writing, the altcoin was just 5.1% below its 11 April 2024 peak of $767.68. In the last 24 hours, the price surged by 1.67% to trade at $725.50.

Additionally, the altcoin’s trading volume increased by 17.42%, hitting $641.62 million on the charts.

This surge can be mainly attributed to rising trading activity and increasing Open Interest – A sign of growing market momentum.

TAO heating up with the cup and handle pattern

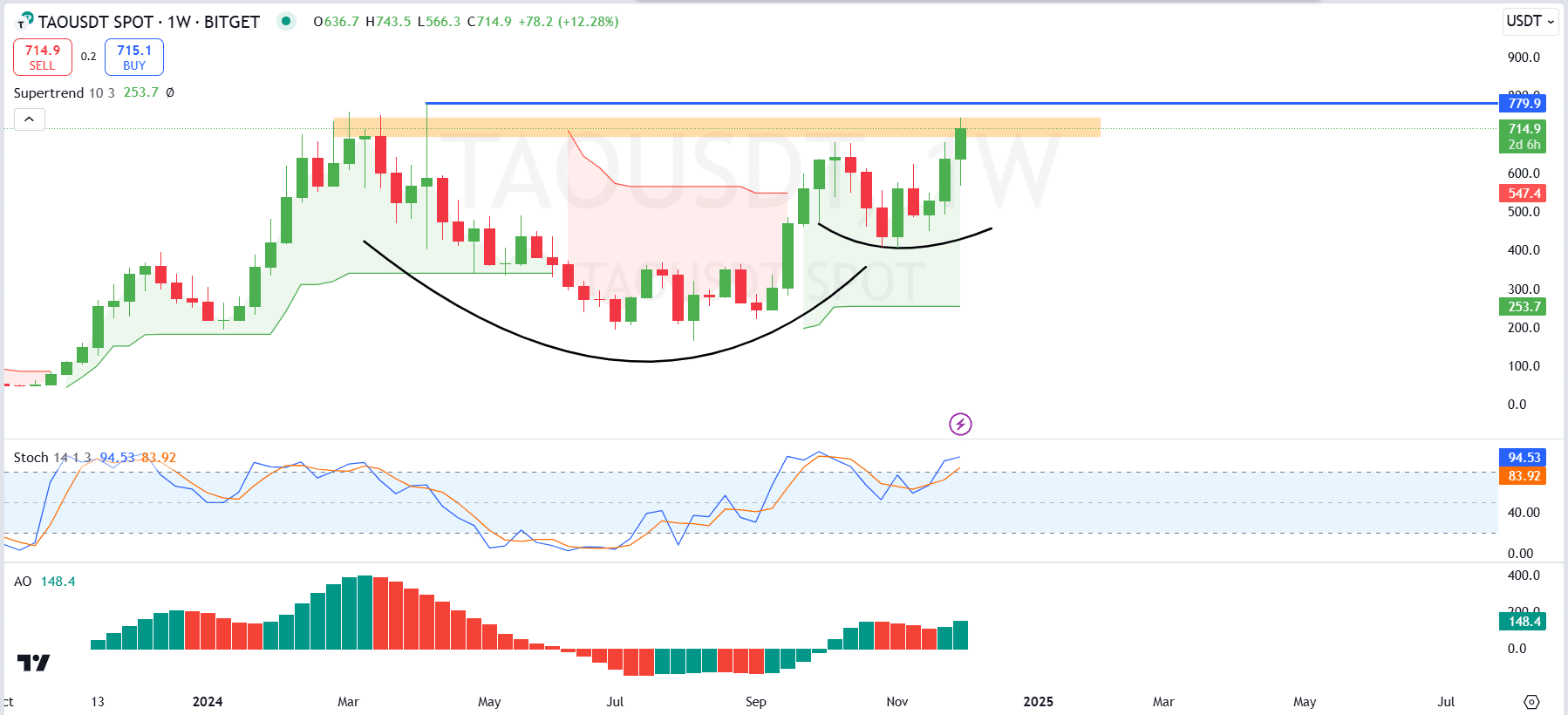

On the weekly charts, TAO, at press time, was forming a classic “cup and handle” pattern – Alluding to a potential breakout. Here, it’s worth noting that the asset did register weekly gains of 16.10%, with volatility visible between $661.02 and $741.29.

A critical resistance zone lies between $720 and $780, where previous rejections have occurred, making this level crucial for determining the altcoin’s next move.

The cup formation, formed between March and October 2024, indicates accumulation, while the handle pattern from October to November signals consolidation. If TAO successfully breaks above $780, it could target $1,000 to $2,000, based on the cup’s depth.

Key indicators like the Stochastic RSI and Awesome Oscillator supported a bullish outlook, with the Supertrend indicator also remaining positive.

However, if TAO fails to breach its resistance, a retracement toward $600–$550 is possible. This will offer a re-entry opportunity at lower levels.

Positive funding rates fuel a $700 breakout

TAO’s funding rate trends have been closely linked to its price movements. Initially neutral, the funding rate shifted into negative territory in September, signaling bearish sentiment.

However, as TAO began to recover in late September and October, the funding rate became predominantly positive, aligning with price gains and increasing long positions.

In November, the funding rate spiked in tandem with TAO’s sharp uptick, particularly as the price neared the $700-level.

This positive funding rate continued to drive momentum, with traders increasingly confident in the crypto’s upward movement. By December, TAO’s price surged past $700 too, further reinforced by moderate positive funding rates – Another sign of sustained bullish sentiment.

Positive spot inflows could propel TAO’s $800 rally

Spot inflows have been crucial to TAO’s recent rally. Between February and June 2024, significant outflows caused price drops due to heavy selling pressure.

However, by October, spot inflows surged, peaking at over $12 million in late November, marking a strong accumulation phase. This influx of spot capital has provided the necessary support for TAO’s price to climb from $400 to above $700.

Read Bittensor’s [TAO] Price Prediction 2024–2025

Sustained positive netflows throughout November and December created favorable conditions for further growth.

In light of these positive inflows and the prevailing market momentum, TAO might be positioned to potentially break through its $800 resistance level and reach new heights.