Will the ‘The Sandbox x Mastercard’ partnership generate positive returns

Payment giant Mastercard, recently announced its partnership with The Sandbox and other non-fungible token (NFT) marketplaces. The partnership was entered into “bring its payments network to Web3”.

According to the publication confirming the partnership, Mastercard stated that the marketplaces with which it entered into partnership were Immutable X, Candy Digital, The Sandbox, Mintable, Spring, Nifty Gateway, and Web3 infrastructure provider MoonPay. Together, these marketplaces “generated more than $25 billion in sales in 2021 — from art to sports to video games to collectibles to metaverse platforms.”

Speaking on the objective of the partnership, Raj Dhamodharan, Executive Vice President of Digital Asset Blockchain Products & Partnerships at Mastercard stated that:

“With the help of these companies, Mastercard’s expanding adoption of Web3 — a new version of the internet based on blockchain — adds to our existing work bringing our payment network to Coinbase’s new NFT marketplace, which opened to all Coinbase users in May.”

However, since this announcement, SAND, the native token of The Sandbox, has not made any significant traction. Let’s take a closer look.

Ashes to ashes, dust to dust

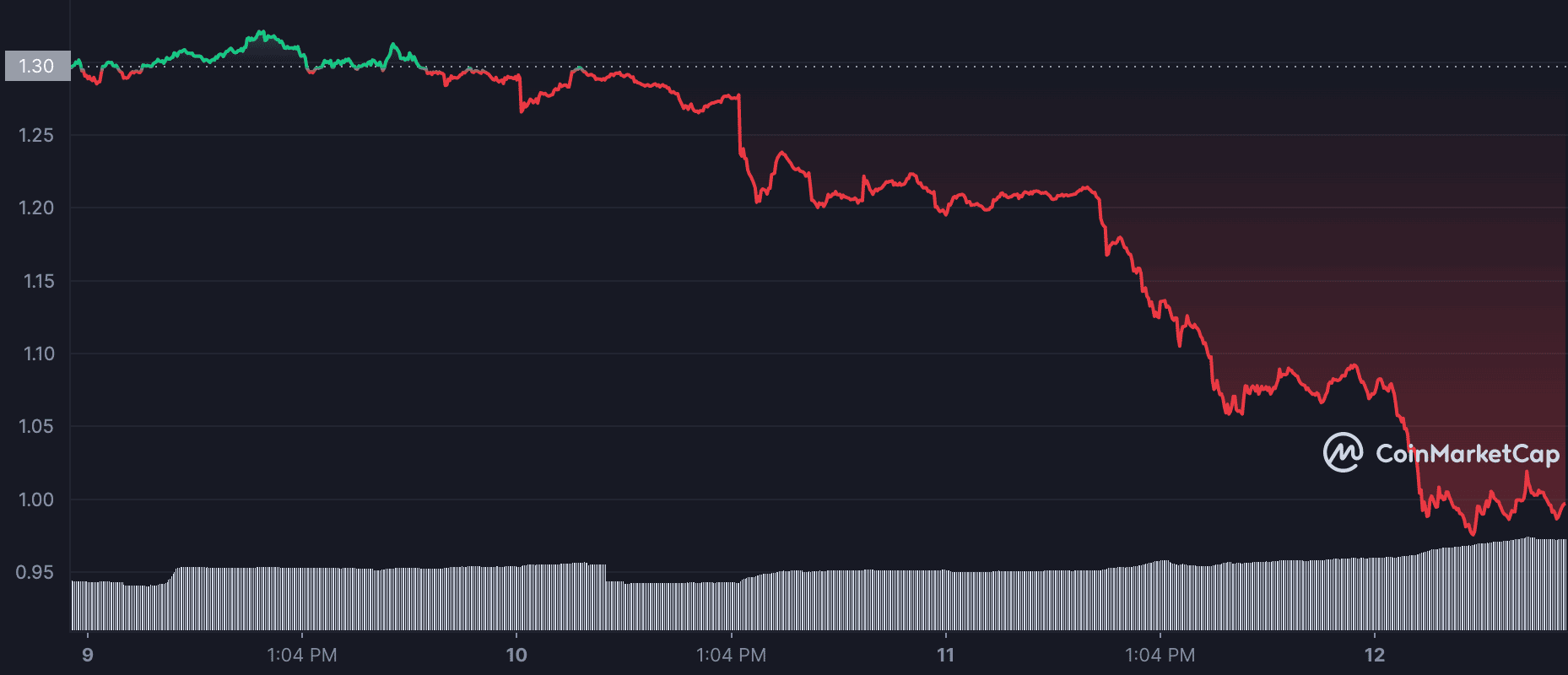

Three days after the announcement of its partnership with Mastercard, The Sandbox’s native token proceeded to record a 24% decline. At an index price of $1.30 on the day of the announcement, the bears overpowered the bulls and pushed the price downwards. At press time, the SAND token exchanged hands at $0.99. With the price position marked at press time, the token was 88% shy of its ATH of $8.14.

In the last 24 hours, the price per SAND token dropped by 13%. Although a 37% spike was registered in trading volume in the last 24 hours, the lack of a corresponding growth in price only pointed at accumulation at the time of writing.

Within the last three days, the market capitalization also recorded a 23% drop to be pegged at $1.23 billion at the time of writing.

What happened on 11 June?

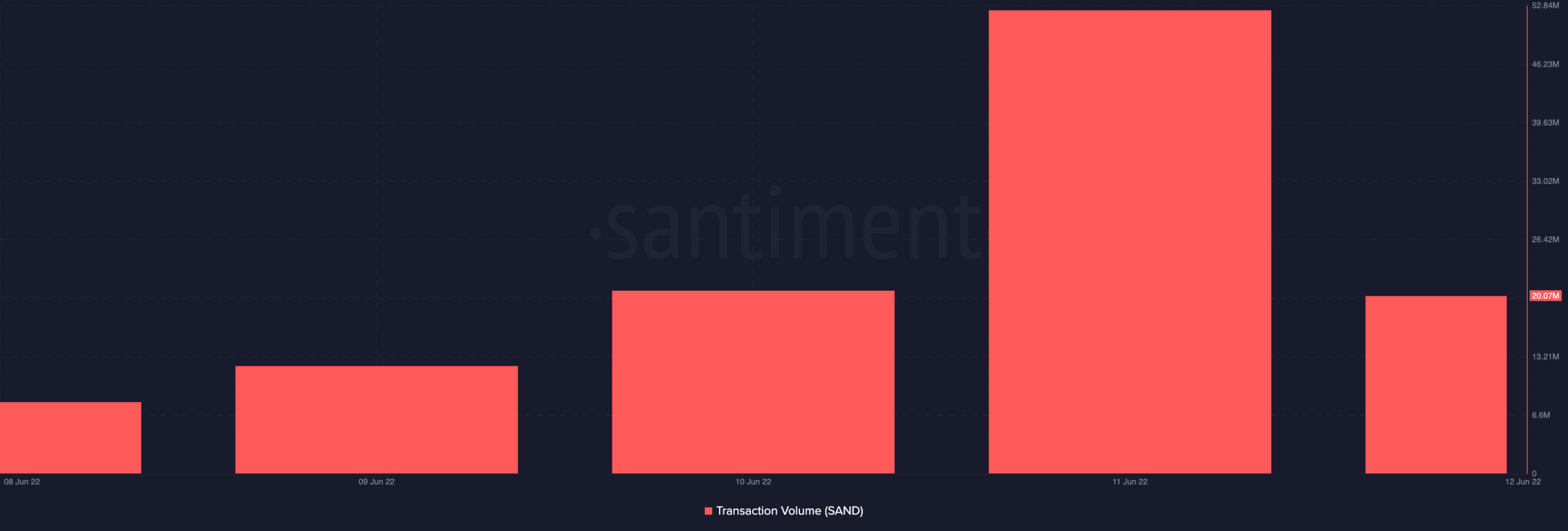

On-chain analysis revealed interesting movements by the SAND token on 11 June. The token recorded spikes in some major metrics on that day.

The transaction volume also registered a high of 52.32 million on 11 June. This was a 60% growth from the 20.67 million recorded a day before. However at press time, this had quickly declined by 61%.

The number of addresses transacting the SAND token also saw a spike on 11 June. With a total of 890 daily active addresses recorded, the token saw a 22% uptick from the 690 recorded a day before. By press time, this had dropped by 44% to be pegged at 490 addresses.

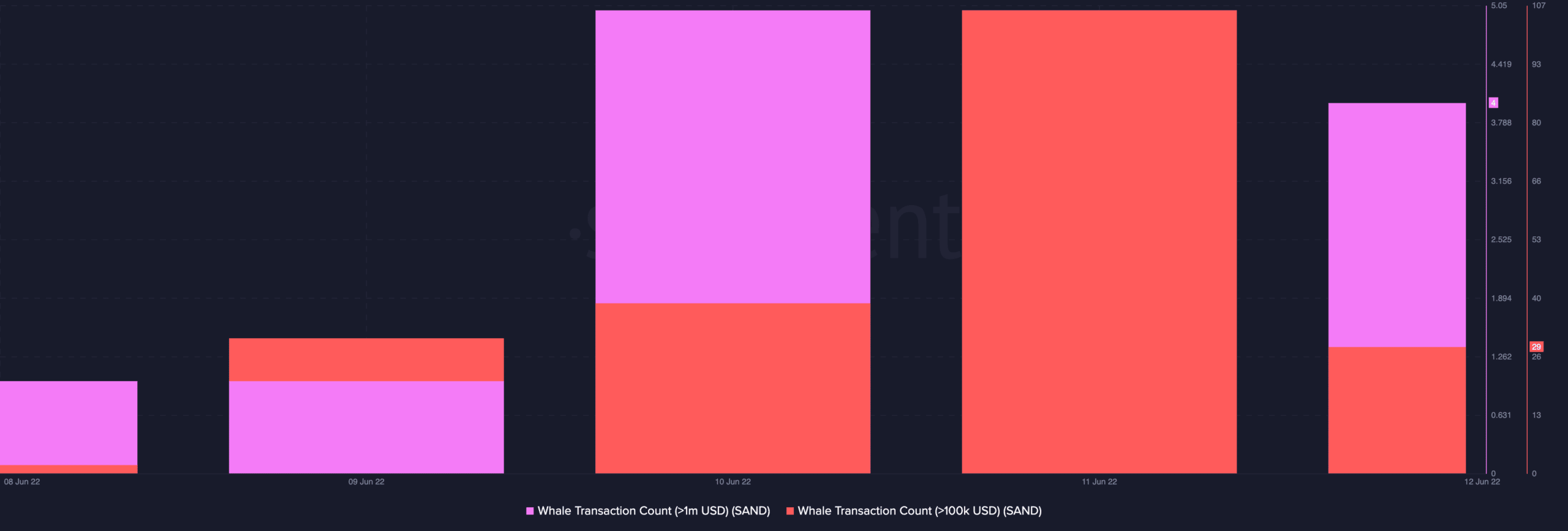

The whales also rallied on 11 June as an uptick was spotted in the number of whale transactions count. For transactions above $100k, a transactions count of 106 was registered on 11 June, a 63% growth from the 39% recorded on 10 June. At press time, this was spotted at 29 transactions. For transactions above $1 million, a count of five transactions was registered. At the time of writing, a 20% decline had been recorded in this figure.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)