Will Tron remain bullish? THESE levels give off major clues

- Tron has been bullish over the past week.

- The range formation idea could see the token rejected near $0.14.

The price action of Tron [TRX] was one of the exceptions among the major altcoins. After the 8th of August, Bitcoin [BTC] and the rest of the market began to experience losses.

BTC has shed 5.1% since that day, but TRX was up by 6%.

The network activity of Tron also surpassed that of the Ethereum [ETH] network. The growth in Tether [USDT] payments through the network is a possible reason.

Is it an uptrend of a range?

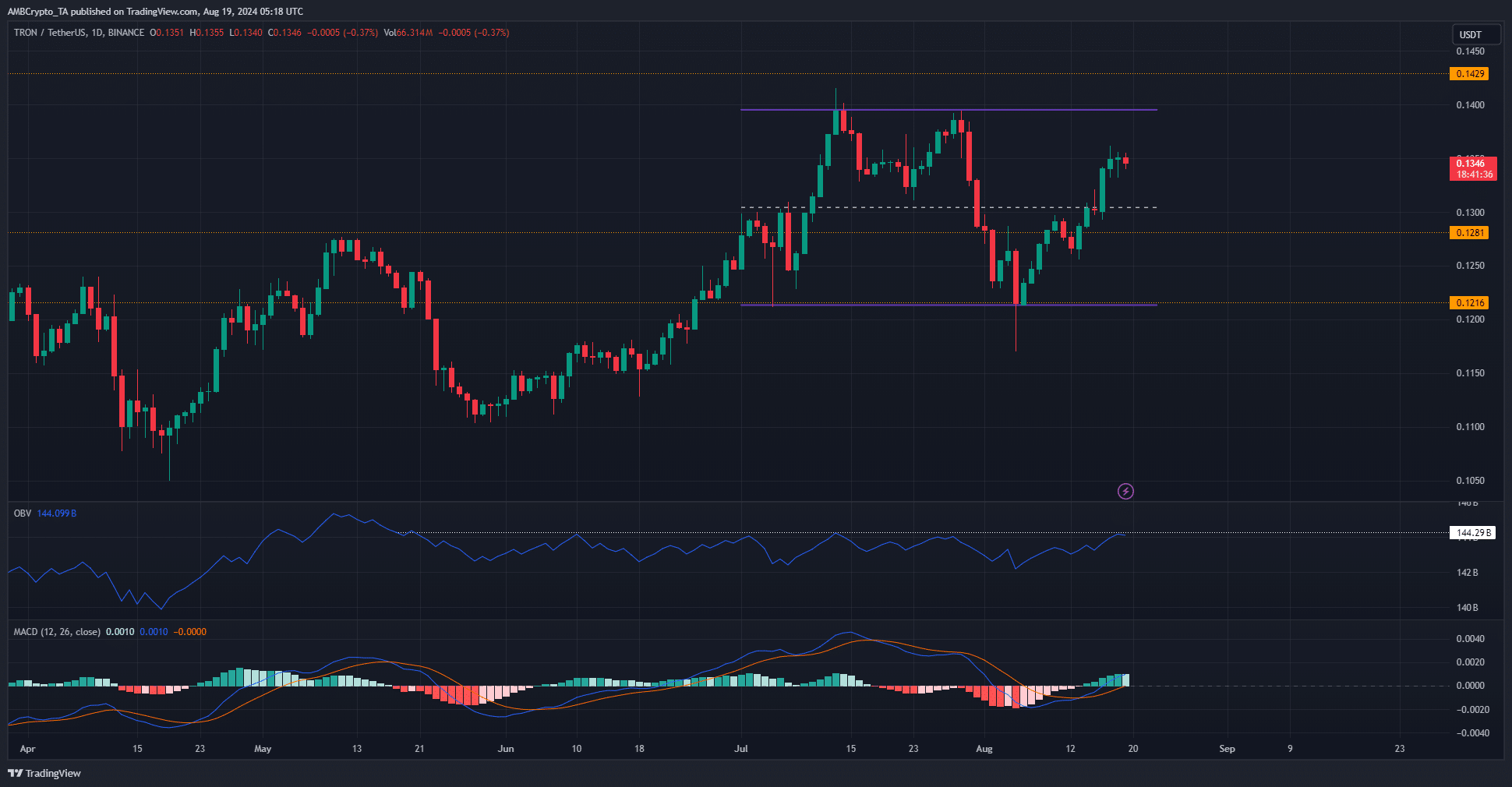

After the retracement to $0.108 in mid-April, TRX has slowly trended higher. It formed a series of higher highs and higher lows till mid-July but has fallen into a range formation since then.

The market structure on the daily chart was bullish, but traders might have better luck treating expecting a rejection at the range highs than trading a breakout.

This was because the OBV was at a resistance level that stretched back to mid-May.

The MACD showed strong bullish momentum, and the mid-range level at $0.13 was flipped to support. Swing traders could buy at this level, anticipating a move to $0.14.

The TRX liquidity pool at $0.14 could be pivotal

Source: Hyblock

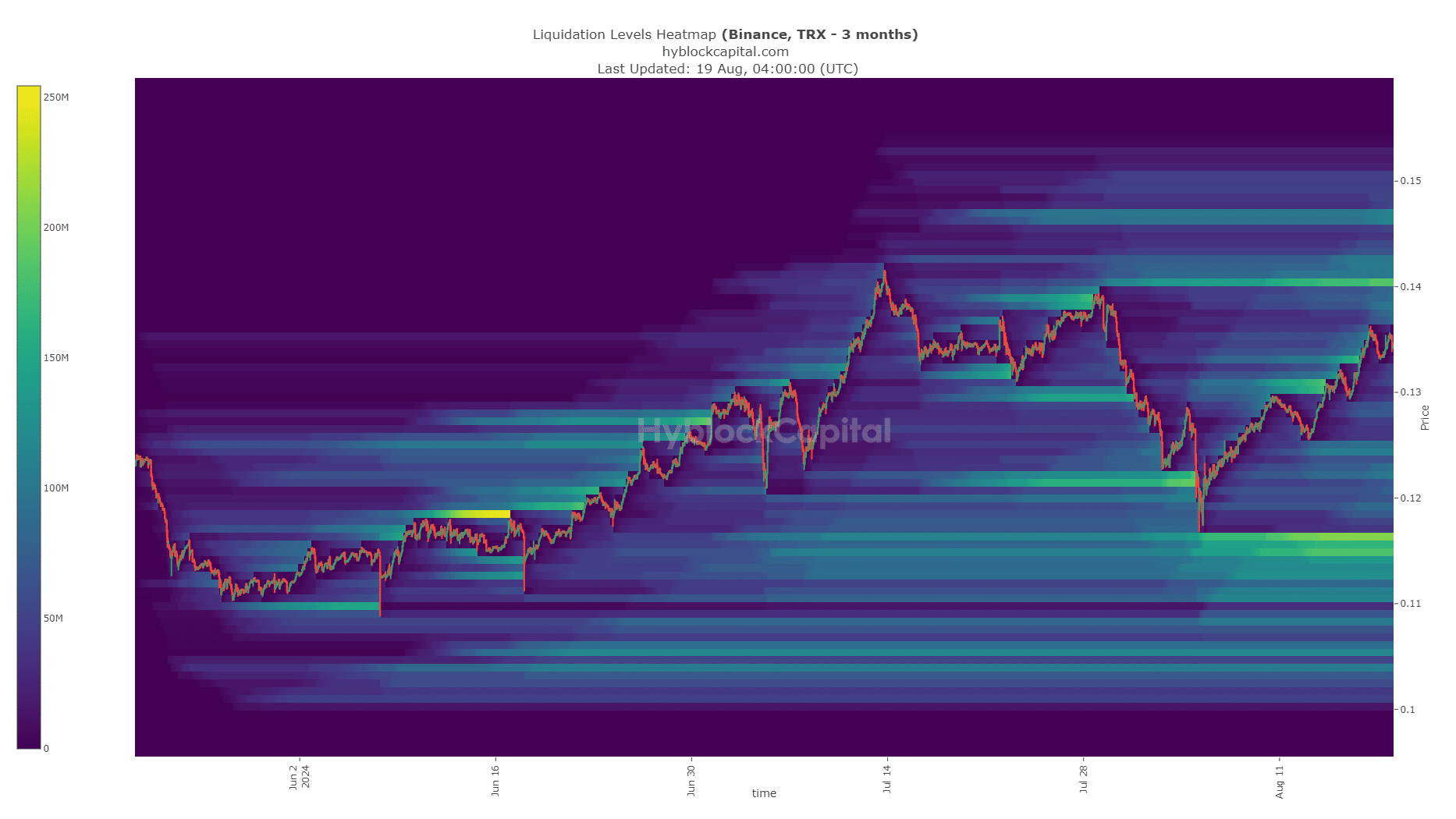

Another reason why the $0.14 level is a focal point is the concentration of liquidation levels there. Price is attracted to liquidity and will likely be driven toward the range highs soon.

Read Tron’s [TRX] Price Prediction 2024-25

It might overshoot it slightly in the event of a liquidation cascade.

However, once swept, a move toward the liquidity cluster at $0.116, just below the range lows, would be the next target.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion