Will USDC succeed amidst Circle’s efforts to revamp? What the data suggests

- Circle maintained strong reserves to back USDC despite market volatility.

- USDC’s marketcap continued to decline.

USDC Coin [USDC] was the stablecoin that faced the most issues, as its Silicon Valley Bank (SVB) holdings collapsed. Despite the hurdles faced by USDC, Circle, the issuer of the stablecoin, continued to capitalize on its growth.

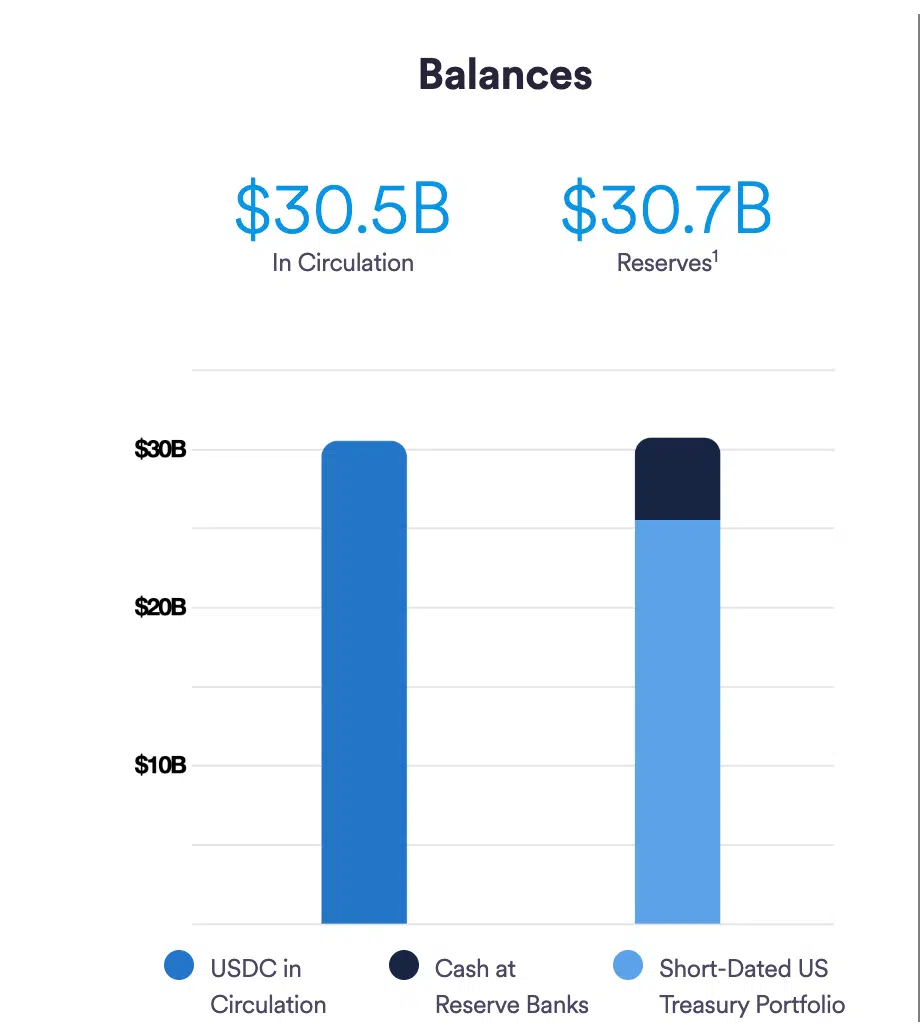

From April 20 to April 27, Circle issued a total of USD 700 million in USDC, redeemed USD 1.1 billion in USDC, and reduced circulation by about USD 500 million. USDC has a total circulation of $30.5 billion and reserves of $30.7 billion, including $5.2 billion in cash and $25.5…

— Wu Blockchain (@WuBlockchain) April 29, 2023

High on reserves, low on faith

Circle, over the past week, has redeemed $1.1 billion in USDC, reducing its circulation by about $500 million. Despite this, the stablecoin still had a high circulation of $30.5 billion with ample reserves of $30.7 billion at press time, including $5.2 billion in cash and $25.5 billion in short-term U.S. Treasury bonds.

The strong reserves held by USDC, including a significant amount in short-term U.S. Treasury bonds, may also provide reassurance to users that their holdings are backed by reliable and secure assets.

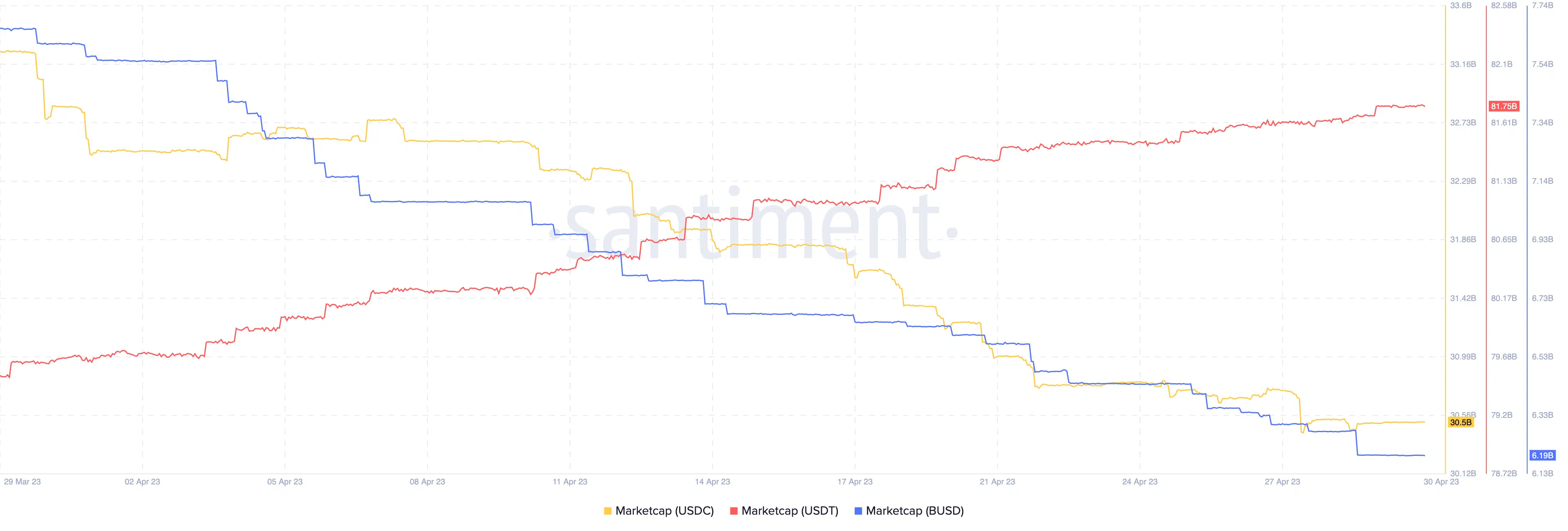

Despite showing proof of reserves, USDC’s market cap continued to decline. USDT continued to erode the market share of the former at press time.

USDC caught in legal matters

However, new legislation could soon improve the state of USDC and other stablecoins. Circle Chief Strategy Officer and Head of Global Policy, Dante Disparte, recently testified at a hearing entitled “Understanding Stablecoins’ Role in Payments and the Need for Legislation,” held by the House Financial Services Committee’s Subcommittee on Digital Assets, Financial Technology and Inclusion.

Mr. Disparte highlighted that payment stablecoins like USDC can transmit a dollar-denominated form of electronic cash, which is a critical innovation that can advance both the US economic competitiveness and national security interests.

This innovation has the potential to change how people send, spend, save, and secure their money in digital form on any internet-connected device, provided national regulatory frameworks fall into place. He also noted that comprehensive payment stablecoin legislation enacted by Congress is necessary for this to become a reality.

If the U.S government takes swift action and provides more clarity on the stablecoin space, it could improve the state of the market.

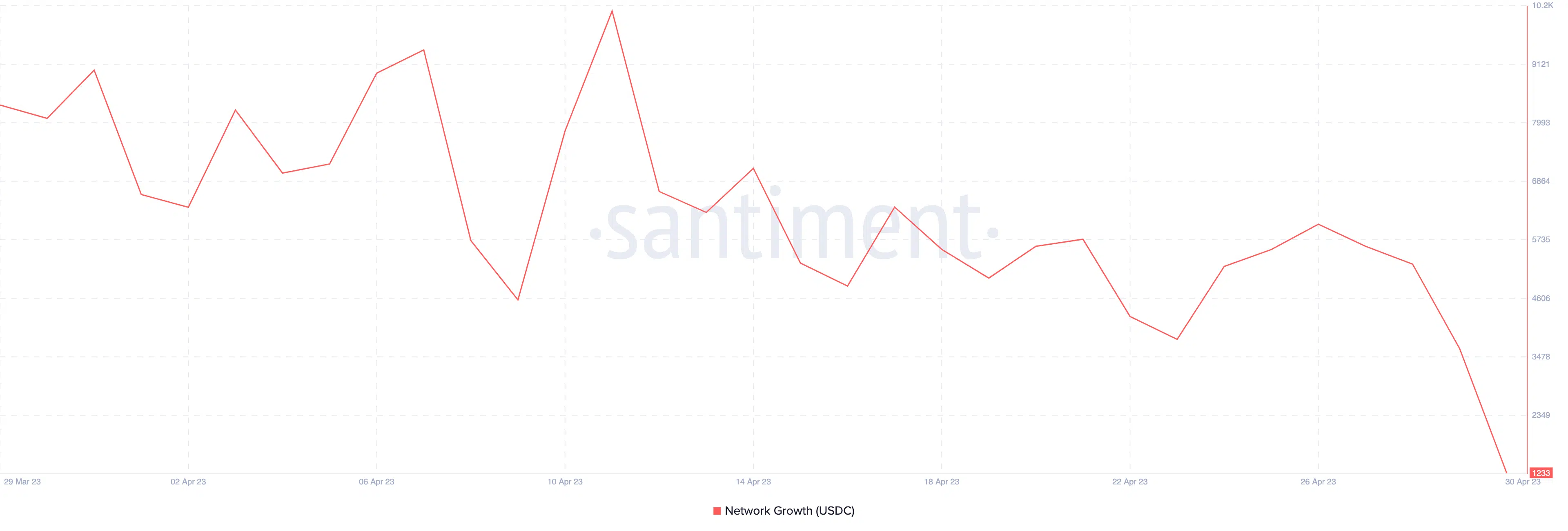

However, at press time, interest in USDC continued to decline. New addresses also lost interest in the stablecoin. This was showcased by the declining network growth of the stablecoin over the last month.