Will USDT continue to reign over the stablecoin sector? Data suggests…

- USDT reached an all-time high in terms of market cap, thus capitalizing on the downfall of USDC.

- However, thefts of USDT through scams increased, raising concerns.

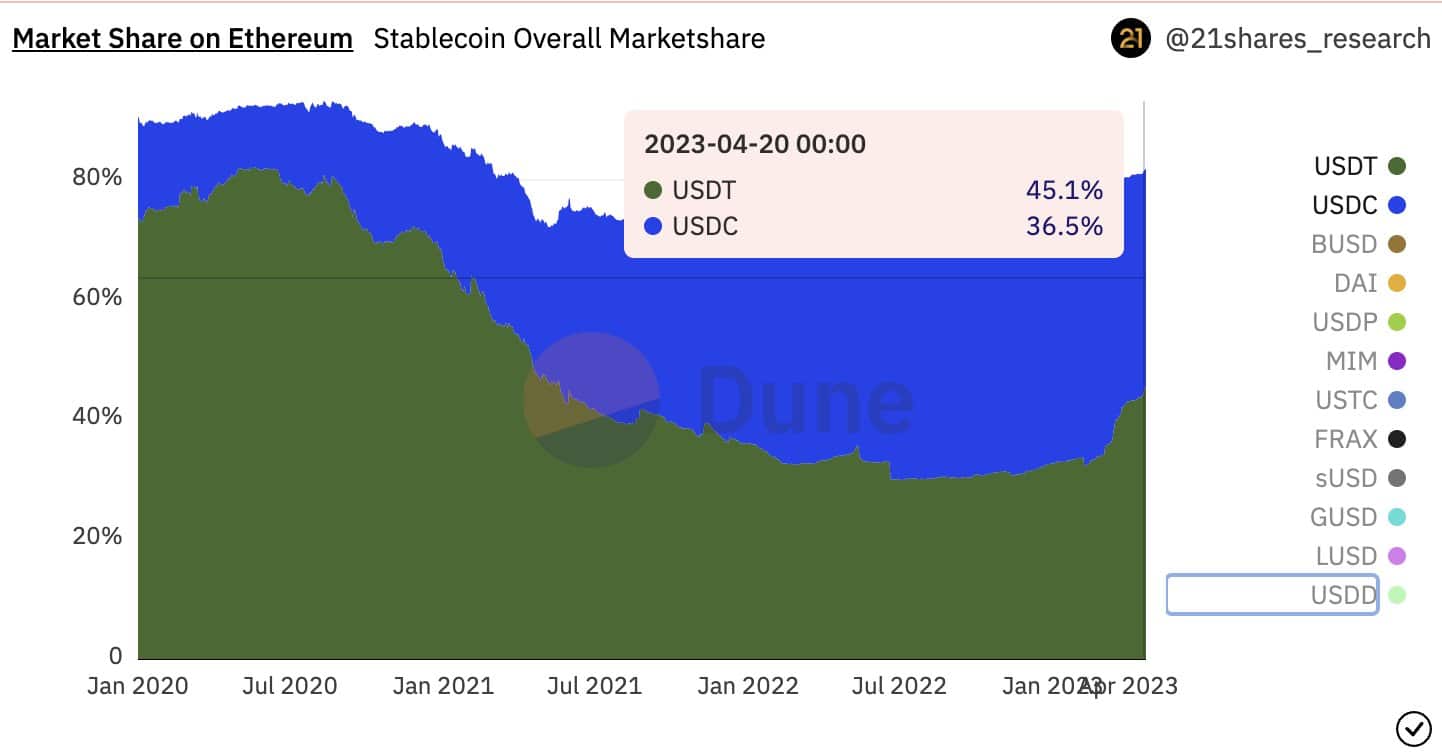

In recent months, the stablecoin industry witnessed significant instability following the collapse of SVB. This impacted the market capitalization of several stablecoins, and Tether [USDT] emerged as the leader in the market.

All-time highs!

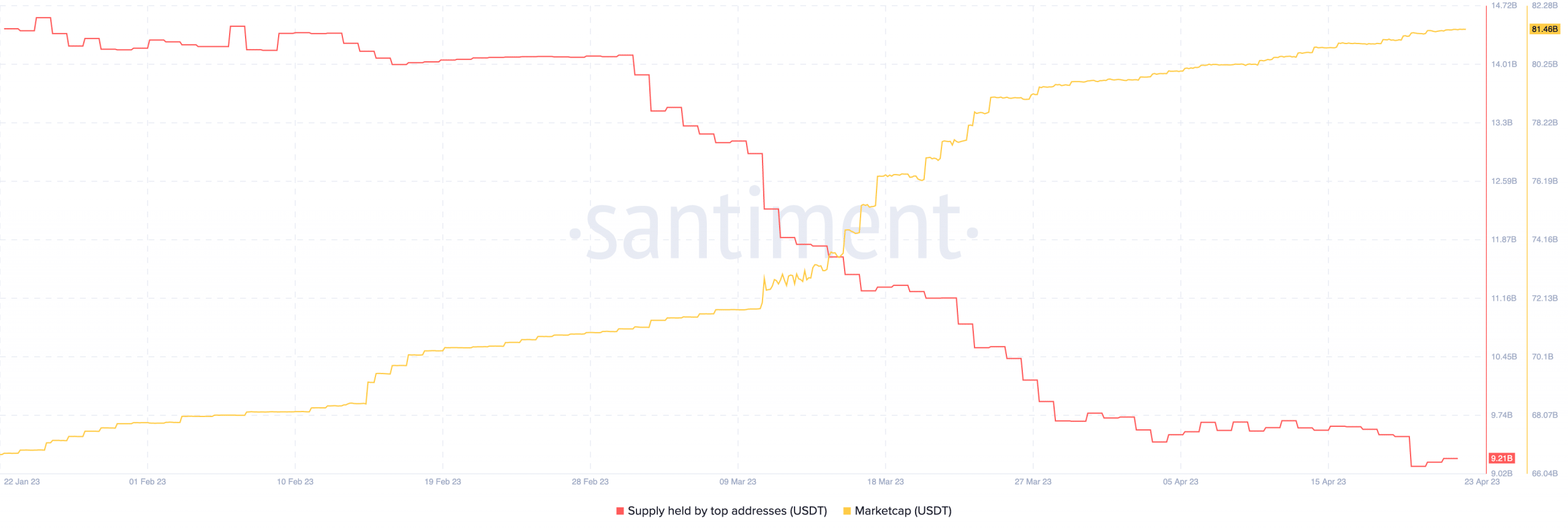

At press time, it was observed that USDT’s market capitalization nearly returned to its all-time high value of approximately $82 billion. USDT previously touched this mark when LUNA collapsed last year.

On the other hand, during the current period, Circle’s USD Coin [USDC] witnessed a decline of about 36% in market value.

Despite a decrease in the interest of large addresses toward USDT, its market capitalization has continued to surge. This trend indicated that the growth of USDT’s market capitalization was fueled by retail interest.

Tether, the company that issues USDT, maintains a diverse treasury to support the stablecoin’s value. As per information available on its official website, cash and cash equivalents such as treasury bills and bank deposits account for 82.13% of Tether’s treasury.

The remaining portion of the treasury is divided among corporate bonds, secured loans, and other digital assets, including ETH and BTC.

Thieves lurking in the shadows

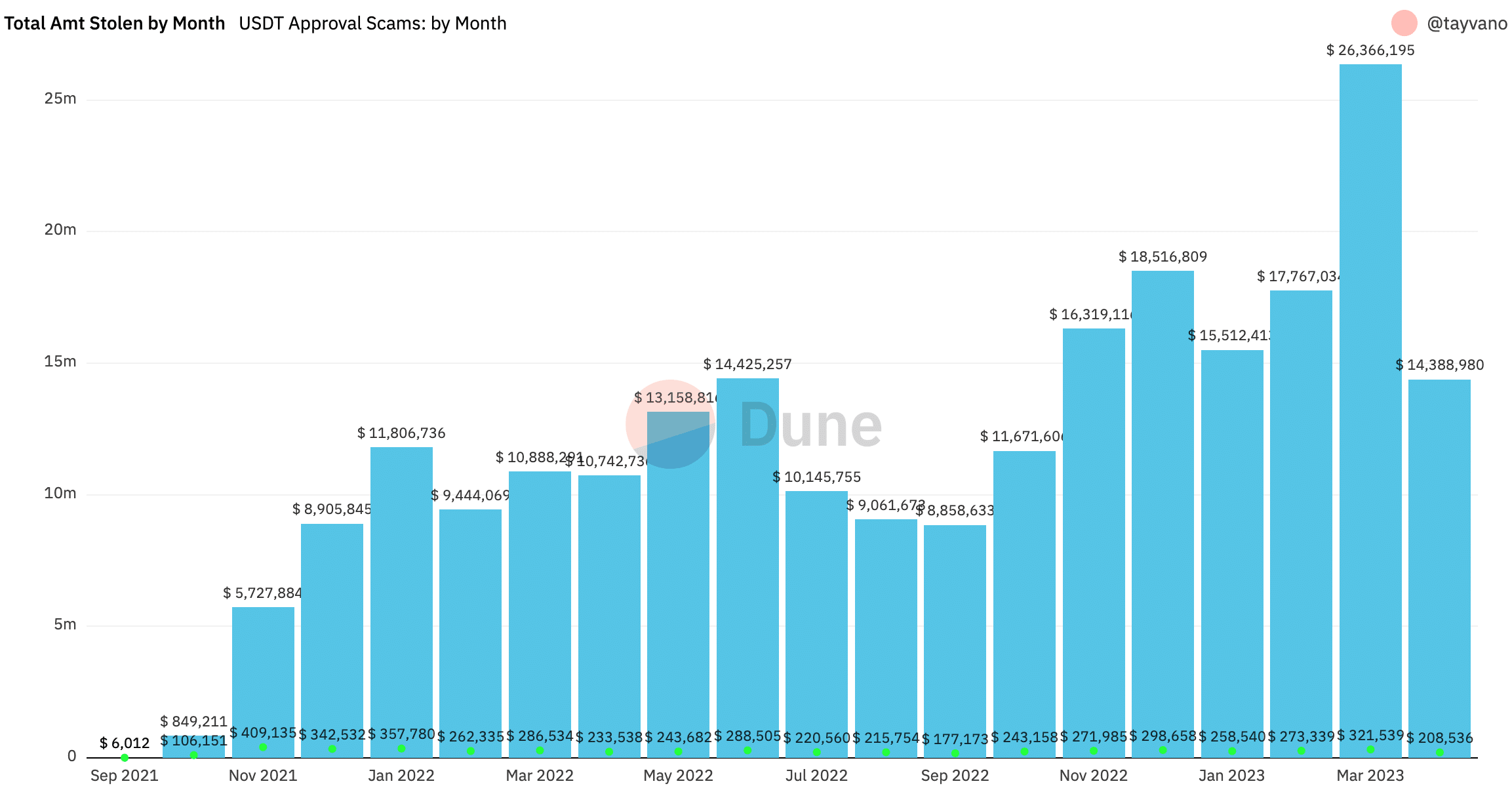

Even though USDT was currently dominating the market, its position could be threatened by external factors such as theft.

According to Dune Analytics’ data, the amount of USDT being stolen by scammers has increased materially. In the month of March alone, $26.36 million worth of USDT was stolen from unsuspecting victims.

The scam is known by many names such as Approval Mining, Liquidity Mining, and Sha Zhu Pans.

The con starts with a young woman making contact with the victim on social media, gaining their trust over time. She introduces the victim to passive income, crypto, and business opportunities, and coaches them through account setup on an exchange and wallet creation.

Then, the victim is directed to a scam site to “invest” their money. The site appears to make money and allows for withdrawals, but in reality, it steals any USDT that enters the victim’s wallet.

Victims make multiple deposits, sometimes in the hundreds of thousands, and are unable to withdraw any money.

The scam sites have live customer chat and users are blocked from customer support and/or the website when they lose patience. Victims are told their account is “frozen” due to money laundering suspicions or unpaid taxes and are asked to deposit more money to withdraw their funds.

These types of scams could pose a great threat to USDT and may impact its sentiment negatively in the future.