Ripple

Will XRP skyrocket 15%? What key levels suggest

Ripple’s native token XRP looks bullish as its on-chain metrics indicate that its price is poised to skyrocket.

- XRP’s Relative Strength Index (RSI) formed a bullish divergence, signaling a bullish trend.

- Following the breakout of the descending trendline there is a high possibility that XRP could soar by 15%.

In this bearish market sentiment, Ripple [XRP] looked bullish as its on-chain metrics indicated that its price was poised to skyrocket.

Since August 2024, XRP, along with other major cryptocurrencies experienced a massive price decline, potentially due to the significant drop in Bitcoin’s [BTC] price.

XRP could rise by 15%

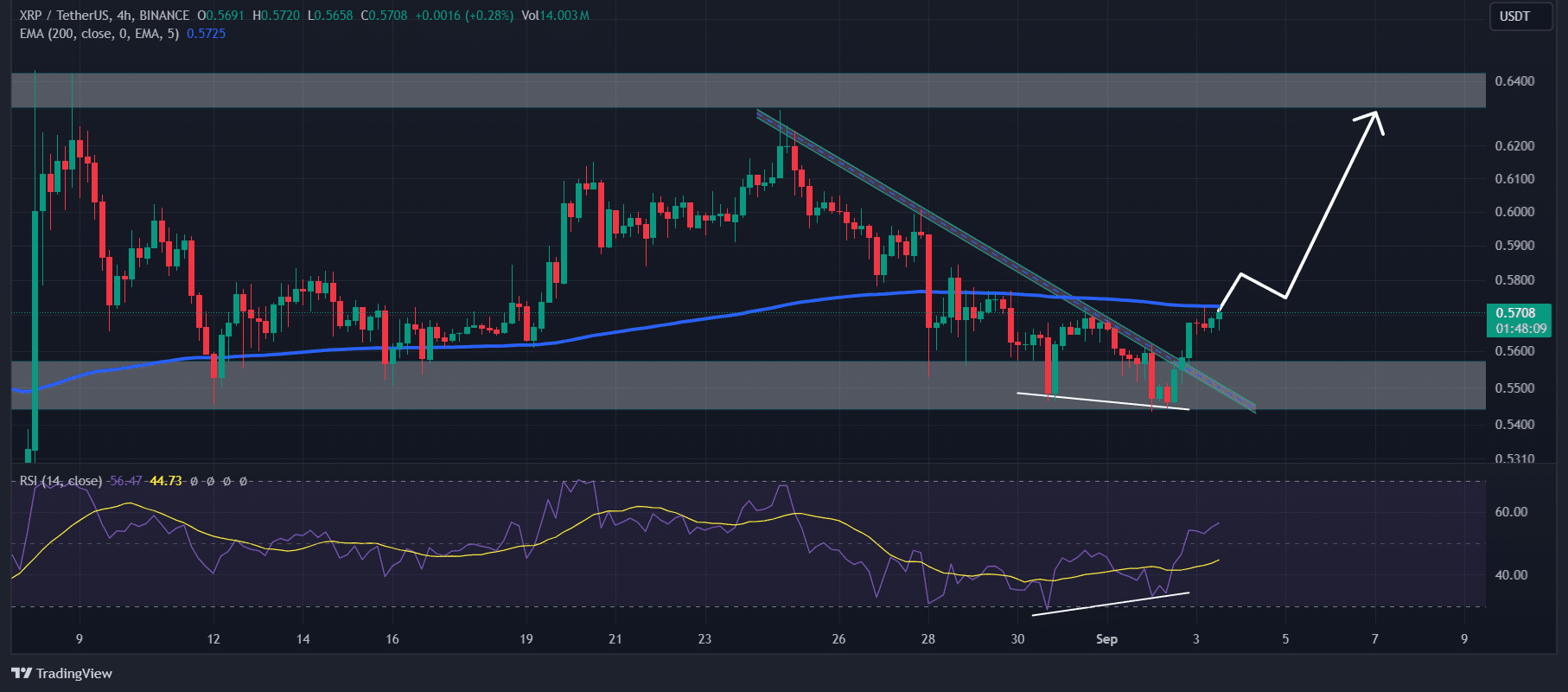

Looking at the XRP’s key on-chain metrics, a recent trendline breakout and bullish divergence on the chart have created a bullish outlook for the token.

However, there is a high possibility that it could soar by 15% in the coming days.

According to AMBCrypto’s analysis, XRP has recently taken support from the crucial level of $0.55 and the 200 Exponential Moving Average (EMA) on a daily time frame.

Since July 2024, XRP has revisited this support level multiple times, and each time it has experienced a price surge of almost 14%.

This time, there is a high possibility that history might repeat itself and XRP could reach the $0.65 level or even more.

Meanwhile, on a four-hour time frame, XRP recently gave a breakout of the trendline. Additionally, its Relative Strength Index (RSI) formed a bullish divergence, signaling a bullish trend.

In the recent market downturn, XRP’s price formed a lower low, while its RSI has made higher lows, resulting in this bullish divergence. Traders and investors view this as a potential buy signal.

On-chain metrics

According to the data from the on-chain analytic firm CryptoQuant, XRP’s exchange reserve was at its lowest level, which potentially supported this bullish outlook.

A decline in exchange reserves or a lower level indicated that investors or whales were accumulating tokens from the exchanges, leading to a continuous decrease in reserves.

Additionally, CryptoQuant’s XRP exchange inflow was comparatively lower than on other days, indicating a buying opportunity.

Currently, the major liquidation levels are near $0.555 on the lower side and $0.59 on the upper side, as traders are over-leveraged at these levels, according to the CoinGlass data.

If the market sentiment changes and the XRP price rises to the $0.59 level, nearly $6.8 million worth of short positions will be liquidated.

Read Ripple’s [XRP] Price Prediction 2024–2025

Conversely, if the sentiment remains bearish and the price falls to the $0.555 level, approximately $7.6 million worth of long positions will be liquidated.

Thus, bulls were dominating the asset at press time, having the potential to liquidate short positions.

![Monero [XMR] freefalls 15% - But why this may not last](https://ambcrypto.com/wp-content/uploads/2025/05/3F5408D6-1D85-4F5B-9690-B0F79E647BEC-400x240.jpeg)