With 6.69% spike in trading volume, what does the NEAR future hold

Near protocol is ranked as the third most commonly held asset by crypto funds as of Q3 2021. It is, however, awaiting an upcoming launch of its USN stablecoin. And, a potential listing on Coinbase’s exchange is underway.

Now the question an investor would ask is- What do price charts tell us about NEAR’s performance?

NEAR so far…

After breaking the $13 resistance level which it had maintained since November last year, a look at price charts revealed that the NEAR Protocol reached an all-time high of $20.44 on 16 January 2022. Since then, however, the Protocol had been on a steady decline.

At the time of this press, the price of the NEAR token was pegged at $16.84, representing a 0.29% decline within the last 24 hours and an 18% decrease from its ATH. The Protocol had since formed a new resistance around the $14 region.

Furthermore, in February, the 50 EMA of the protocol maintained a steady position above the price indicating an elongated bearish run. The bulls, however, quickly intervened around 9 March forcing the trend line below the price. The Protocol had maintained this bullish run from March till the time of the press.

So far this year, the highest RSI the Protocol has observed is 74.77 which was on 10 April. Since its launch, it recorded its highest RSI of 90 on 23 August 2021.

Similarly, the lowest RSI the Protocol has observed is 31.19 which was recorded on 21 February. Notably, at the time of this press, the RSI stood at 59.06, a level just above the 50 neutral position. Now, for an investor to understand the coin’s trajectory thoroughly, a look at on-chain metrics is a must.

What do the metrics state

The market capitalization for the NEAR token stood at $11.60b at the time of this press. This represents a spike from the $8.85b market cap recorded on the first day of the year. This is also an indication of an increasing level of accumulation. In the last 24 hours, the trading volume for the token was $1,483,630,221b, a 6.69% spike.

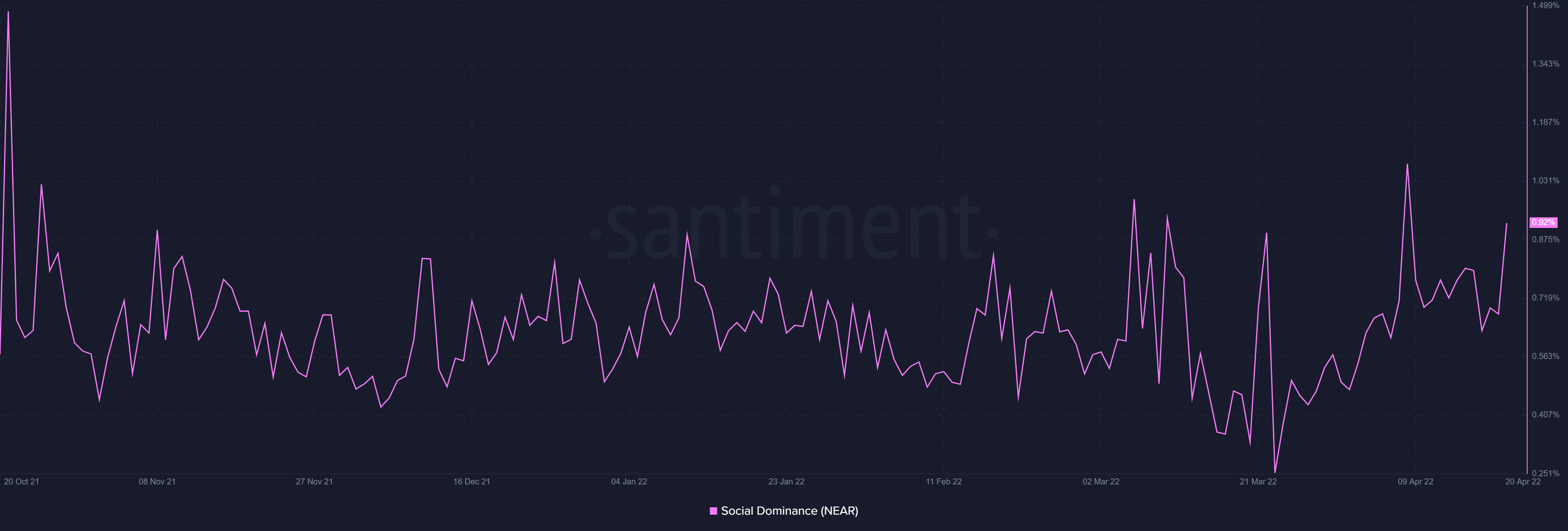

With an increasing gradual acceptance of the coin, the social dominance of the coin at the time of this press stood at 0.92%.

Further to this, a spike in development activity is expected for the NEAR protocol following the launch of the $USN stablecoin. At the time of writing, the development activity stood at 161.

Higher development activity is important for this protocol. It will show investors that the protocol is serious about its business propositions and likely to ship new features in the future.

LUNA holders be Terra-fied?

Available information suggests that it may be possible for the $USN coin following its launch to overtake Terra’s $UST coin. The possibility of this happening is further heightened if the protocol delivers on the high yields that the USN coin is supposed to offer.