With Bitcoin teetering over the $30k edge, is another market-wide panic underway

As crypto enthusiasts worldwide celebrate Bitcoin Pizza Day, investors and traders are left feeling frantic in light of the ongoing market trend, impacting the performance of the star token with Bitcoin [BTC] registering low trade levels that lead to losses.

Bitcoin can’t stop losing

Although it has been over two weeks since the crash of 9 May, the crypto market has made no significant recovery, with a sentiment of fret and panic over the performance of the token and losses to be incurred among investors.

These ongoing concerns related to the market can be analyzed by considering, not only the crypto space, but considering the overall performance of the stock market as these indexes have been moving hand-in-hand for months now.

As BTC tested the $30k space over the last few days, SPX noted a decline as well. Additionally, given their correlation, it comes as no surprise the latter had an effect on the former.

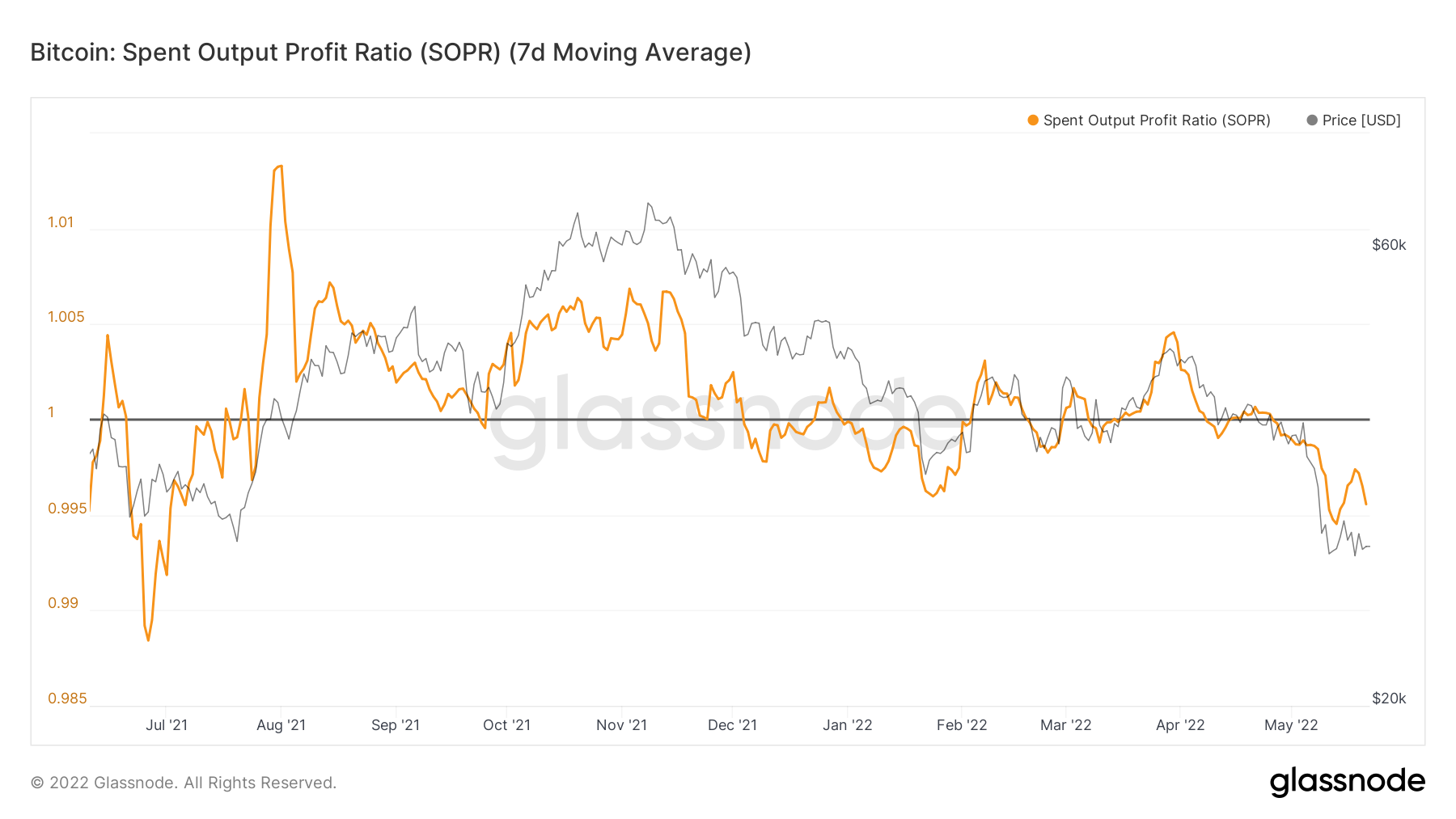

However, BTC’s loss streak peaked this week as most of the Bitcoin involved in transactions since the crash brought the overall profit ratio to its lowest since 2021.

Bitcoin SOPR | Source: Glassnode – AMBCrypto

Whereas the network-wide supply of Bitcoin noted $57.2 billion worth of BTC (1.92 BTC) drowning in losses.

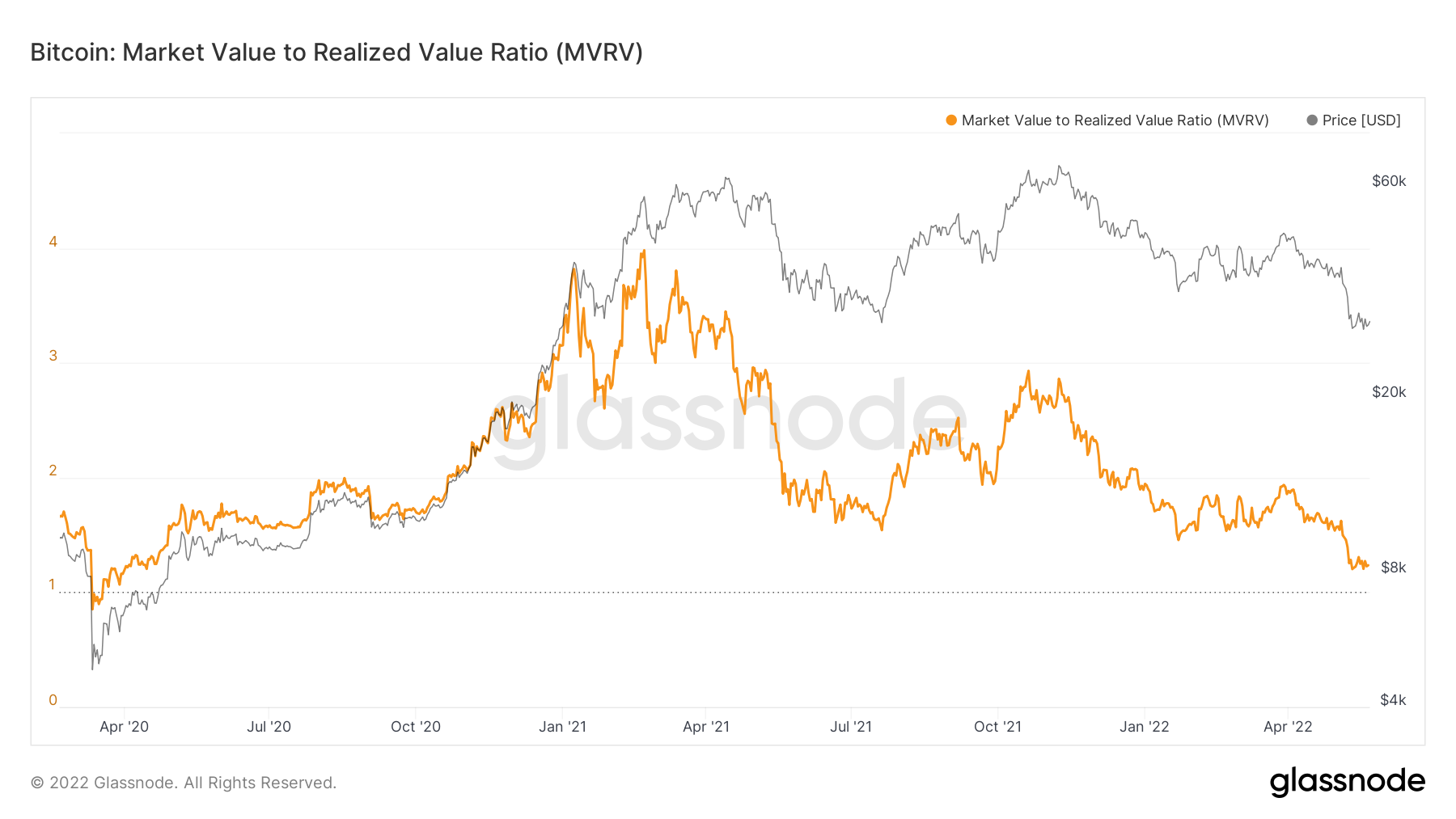

Consequently, the falling price of Bitcoin has resulted in a decline in the market value of the king coin as well, and the token can be considered at its lowest since April 2020.

Bitcoin MVRV | Source: Glassnode – AMBCrypto

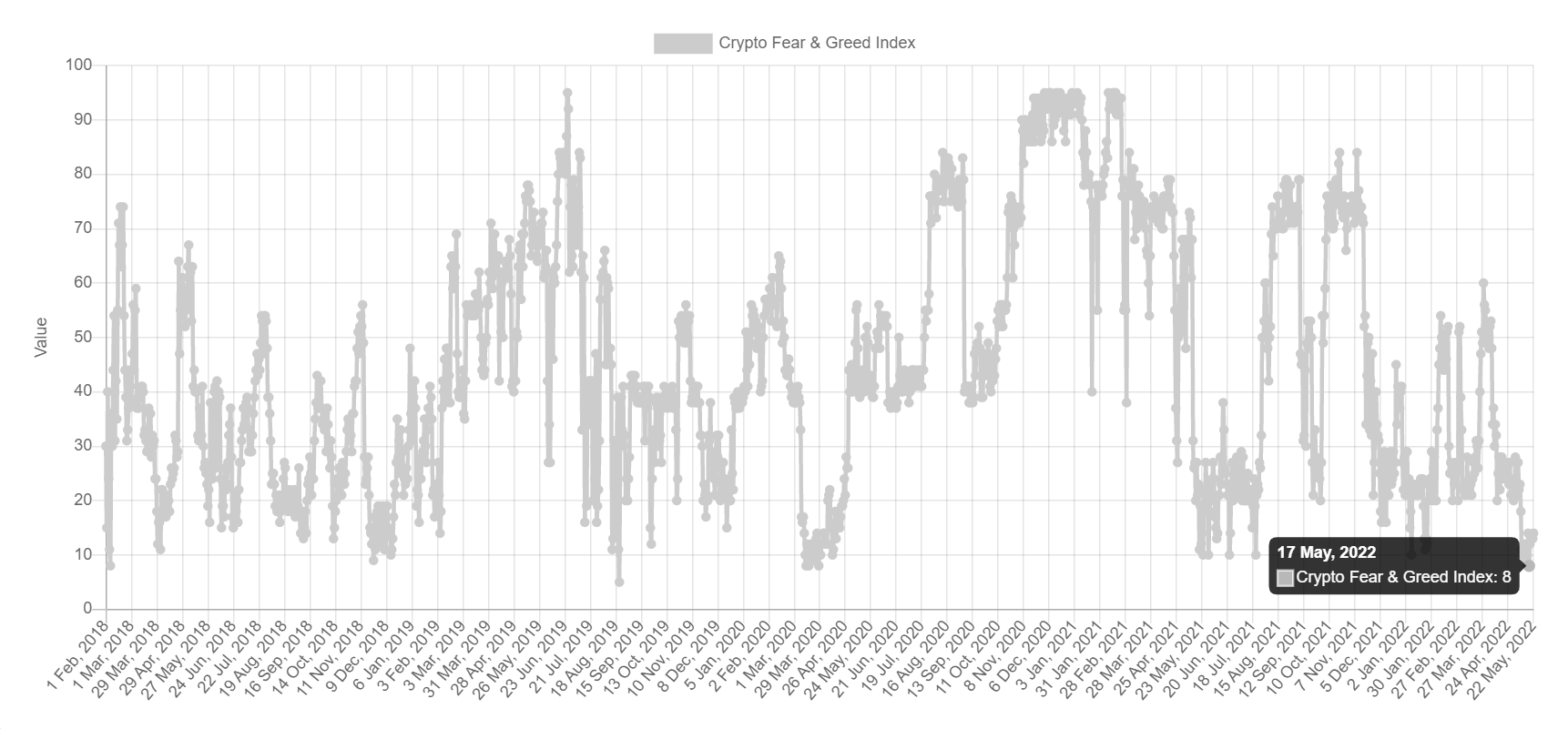

All these developments, have thus, created an atmosphere of panic and worry in the market, with investors losing hope for a recovery in the near future.

As per the Fear and Greed Index, the market was at its lowest point in history for only the second time this week. The last time investors were this frightened was back in August 2019.

Crypto Fear and Greed index | Source: Alternative

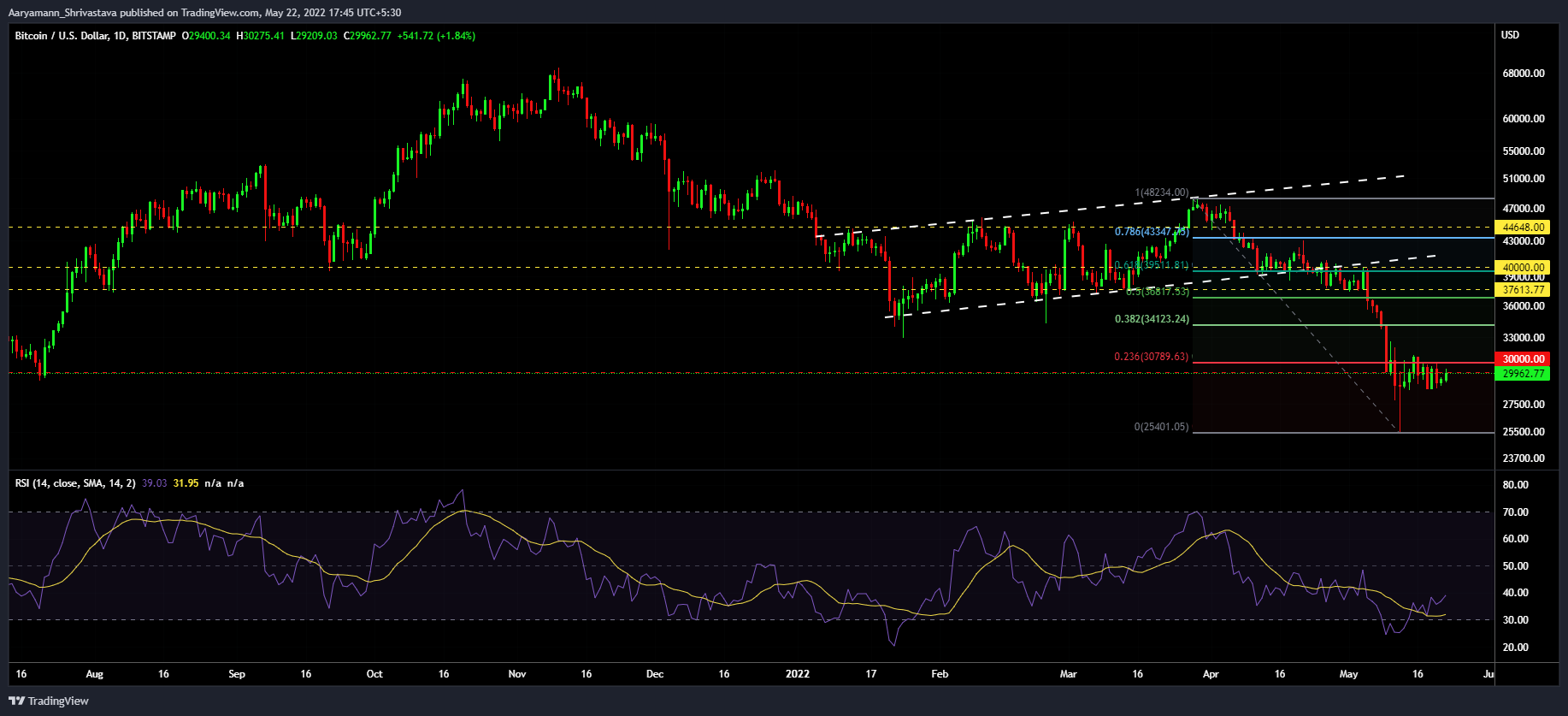

This fear could slightly subside only when Bitcoin makes some noteworthy strides on the chart and places itself above the critical support of $30,789, which also coincides with the 23.6% Fibonacci level.

Bitcoin price action | Source: TradingView – AMBCrypto

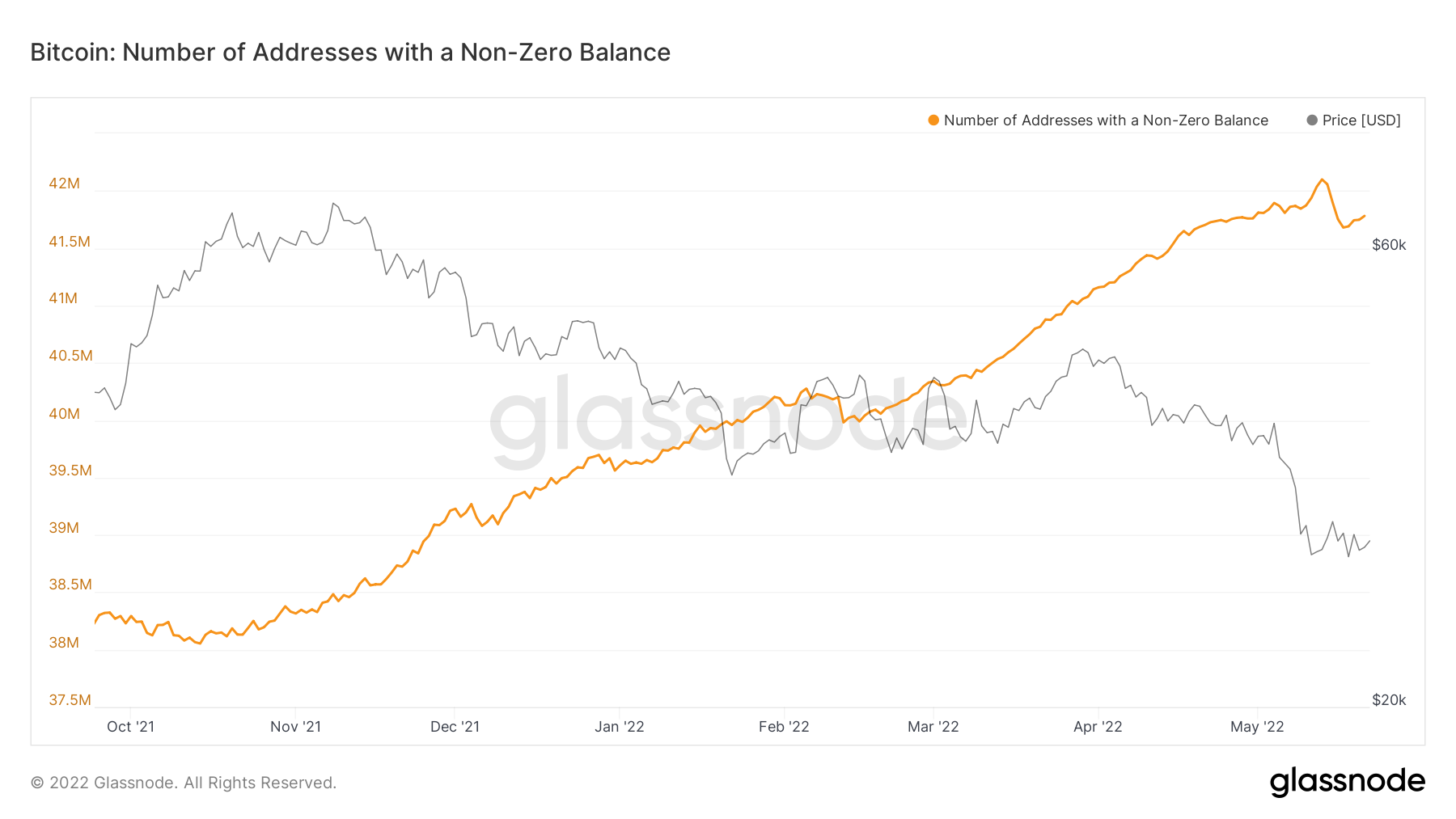

When that happens, the network could return to attracting new investors and keeping the old ones instead of losing 419k investors as it did over the week. Bitcoin will also need the support of its remaining 41.7 million investors.

Bitcoin total addresses | Source: Glassnode – AMBCrypto