With Bitcoin whales up against these traders, BTC could head this way…

- Bitcoin’s previously observed drop in confidence among short-term traders yields pivot.

- A recent peak in short-term supply at a loss underscores sell-side weakness.

Glassnode’s latest Bitcoin [BTC] weekly analysis is out and it offers interesting insights into the current state of the market. It also provides a perspective into the position of the market in the current cycle based on historical patterns.

How many are 1,10,100 BTCs worth today

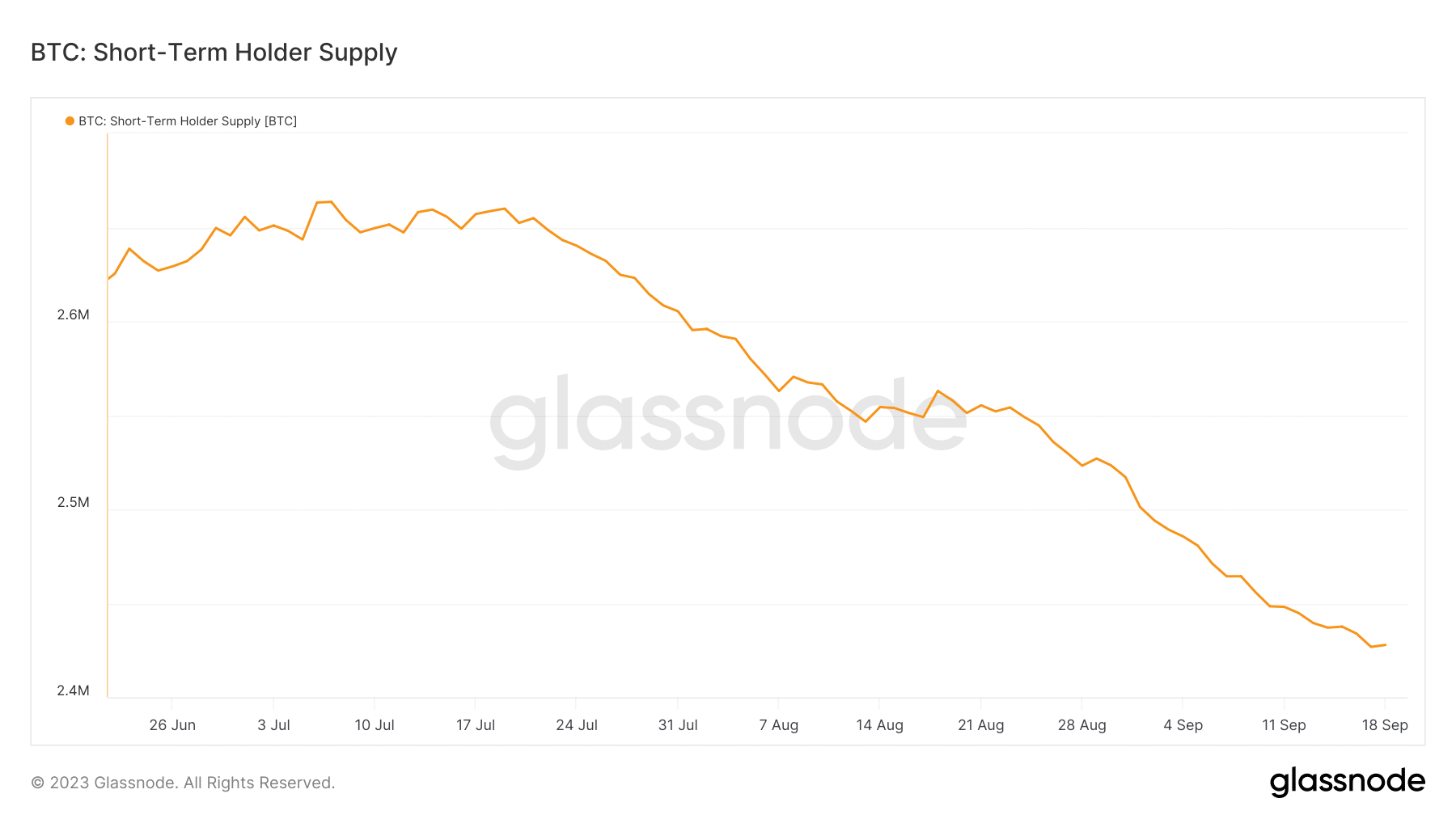

Among the key highlights of the Glassnode analysis investor confidence was seen dwindling. As a result, prices dipped toward $26,000. The loss of confidence was particularly evident looking at Bitcoin’s short-term holder supply which recently dropped to a three-month low.

This was around the same time that Bitcoin started giving up the gains it achieved up to its June highs. Prior to that, we saw a substantial amount of demand near the $30,000. This represented the stage at which the market gained some confidence and prices were expected to rally past the $35,000 range. Interestingly, the Glassnode report noted this in regard to accumulation above the $30,000 range.

“During the rally above $30k, this metric reached complete profit saturation for the first time since the Nov-2021 all-time high. However, since selling off below $26k in recent weeks, more than 97.5% of STH supply is now held at a loss.”

What was also worth taking note of was the level of short-term supply at a loss because it is a historically relevant figure. It is the level of loss at which the probability of seller exhaustion grows exponentially. In other words, this is around the same level of loss at which demand starts flooding back in.

Is Bitcoin headed back towards the $30k range?

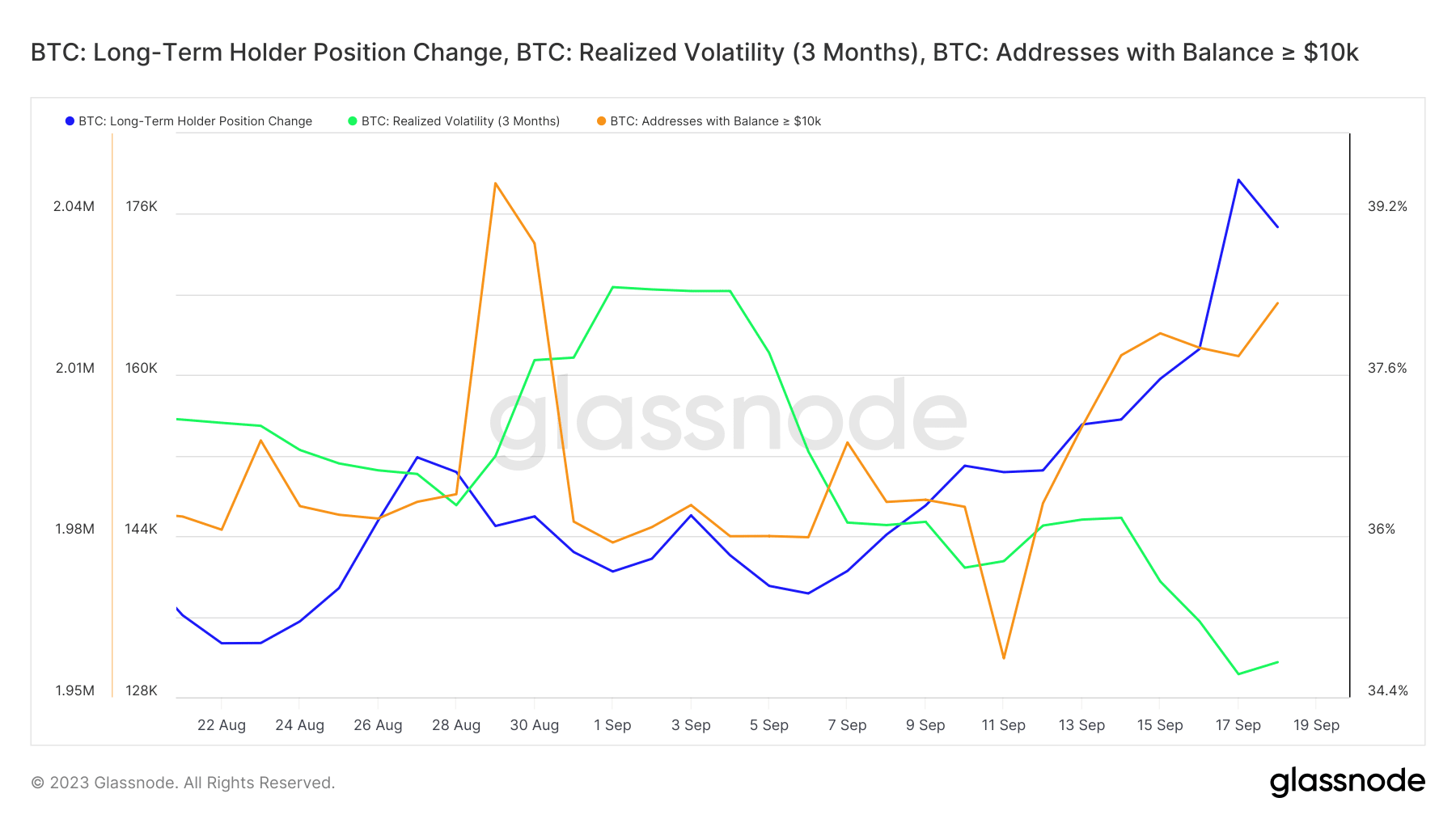

With short-term holder capitulation losing steam, natural progression suggested that the next outcome should be accumulation. Interestingly, Bitcoin’s long-term holder position change has been on the rise since 6 September and at press time stood at a monthly high. This was accompanied by a dip in whale outflows which may have been a copout because the whales started accumulating on 12 September.

Despite the above observations, the realized volatility metric just registered a monthly low. This suggested that the market was still far from peak excitement. Nevertheless, the observed accumulation by whales and long-term holders reflected the bullish performance that has prevailed since 12 September.

Is your portfolio green? Check out the Bitcoin Profit Calculator

In summary, the recent drop in short-term holder profitability may underscore the bottom range of short-term sell pressure. The fact that whales were accumulating once again and driving up the price could be taken as a testament to the market dynamics that are currently at play.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)