With the highest daily gains in the market, is Revain really a good investment

With Bitcoin still under $50,000 and Ethereum slipping below $4000, the larger market yet again struck bearish tones. Most of the top altcoins seemed to follow the top coin and the larger market’s stagnant trajectory left few altcoins for traders to look at.

At this point, market participants seemed to turn their eyes towards mid-cap and low-cap altcoins that noted higher gains and reaped higher ROIs.

As per data from CoinMarketCap, at the time of writing, Revain (REV) seemed to be recording the highest daily gains of 29.53%, followed by Oasis Network (ROSE) and Curve DAO Token (CRV).

For Revain, however, this isn’t the first time the token has been performing against the market trend. Towards the end of August this year, REV presented over 230% gains entering into September 2021, hitting its multi-week high of $0.036.

Now, in light of its more recent gains, is there an interesting opportunity for traders to jump in on this train?

What’s Revain?

Revain is a review platform that completed four years in September and aims to curate and reward user feedback on products and services through blockchain technology. While Revain has similar functions to review sites such as Yelp, it claims to have more options and advocates transparency.

The platform is built on both Ethereum and Tron, as per data from Kraken Intelligence. Notably, while Ethereum slipped under the $4000-mark presenting 0.53% daily losses looking mostly bearish, Revain seemed to be having a good time.

In the last 24 hours, REV/USDT on Kraken saw an <108% jump. By doing so, the altcoin bridged the fair-value gap that extended from $0.01933 to $0.00937, putting the altcoin back on track towards its ATH.

The altcoin attempted to make a run for its ATH of $0.06 in August too, but it could only manage to make a multi-week high of $0.036. So, what might be different this time?

Well, for one, the altcoin recorded the largest single-day price hike since its ATH in May on 13 December. This also marked the highest vertical spike in the Relative Strength Index on a daily chart since.

A good investment?

With over 50% daily gains, REV is one of the only assets in the top with double-digit daily gains. Since the middle of November, the altcoin has been an asset with lower risk than average – As evidenced by the coin’s MVRV divergence model.

Source: Santiment

At the time of writing, however, its Sharpe Ratio registered a figure of -4.5, making the asset a relatively risky asset now, as opposed to November.

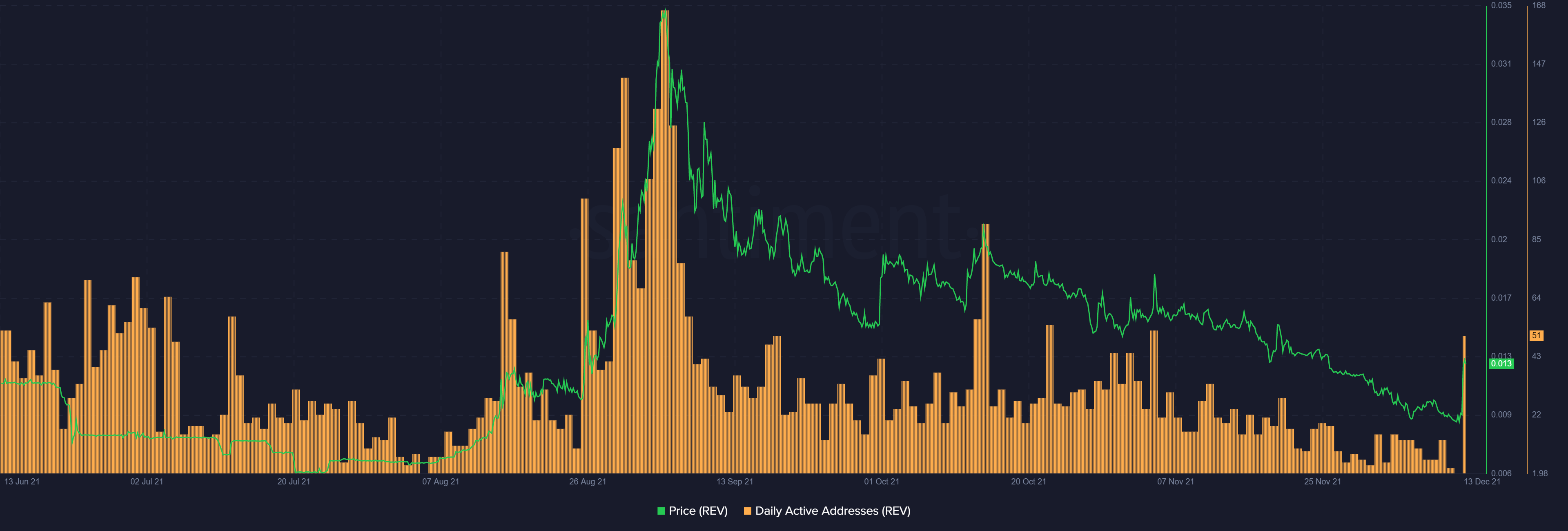

Nonetheless, the crypto’s active addresses and active deposits have seen major spikes. These are signs of higher activity on the network.

In fact, daily active addresses hiked by almost 400% over the last couple of days.

Furthermore, with the cryptos’ trade volumes hitting new ATHs, retail FOMO seems to be driving the current rally. Especially since whales didn’t make any major movements.

Once the altcoin establishes itself above the crucial $0.02-mark, it could eye new ATHs. However, the trade will still remain risky in the short term. Even so, with the project gaining limelight and looking at its high long-term ROIs, it could maybe be a good investment.