Worldcoin bulls rejected at $8 – How far will the retracement go?

- Worldcoin rallied immensely but might retrace a good chunk of the recent gains.

- The FVG and order block coincidence presented an interesting area for buyers to watch.

Worldcoin [WLD] has registered gains of 270% in the past two weeks. The $3.8 zone was expected to act as resistance, but when the WLD bulls broke the $2.6 resistance, they did not halt at this resistance.

Instead, the buyers could zoom straight past this resistance to the $8 mark. This highlighted heavy buying pressure and strong bullish conviction.

Fibonacci retracement levels could play a role in the coming weeks

Based on the rally from $2.165 to $7.996, a set of Fibonacci retracement levels were plotted (pale yellow). It assumes that the current rally has halted at $8, but it is still possible that the price could bounce higher despite the retracement toward $6.8 in the past 24 hours.

The 61.8% and 78.6% retracement levels sat at the $4.392 and $3.413 levels. The current retracement could likely drop to these regions. The 78.6% level was particularly interesting. Late December and early January saw WLD prices form a range above the $3.34 support level.

This region also demarcated a support zone (former bearish order block) where buyers would likely be eager to step in.

It also coincided with a fair value gap (FVG, white box) at the $3.8 area. Hence, the $3.3-$3.8 zone is an area of interest for the buyers.

The short-term market data showed sentiment was turning bearish

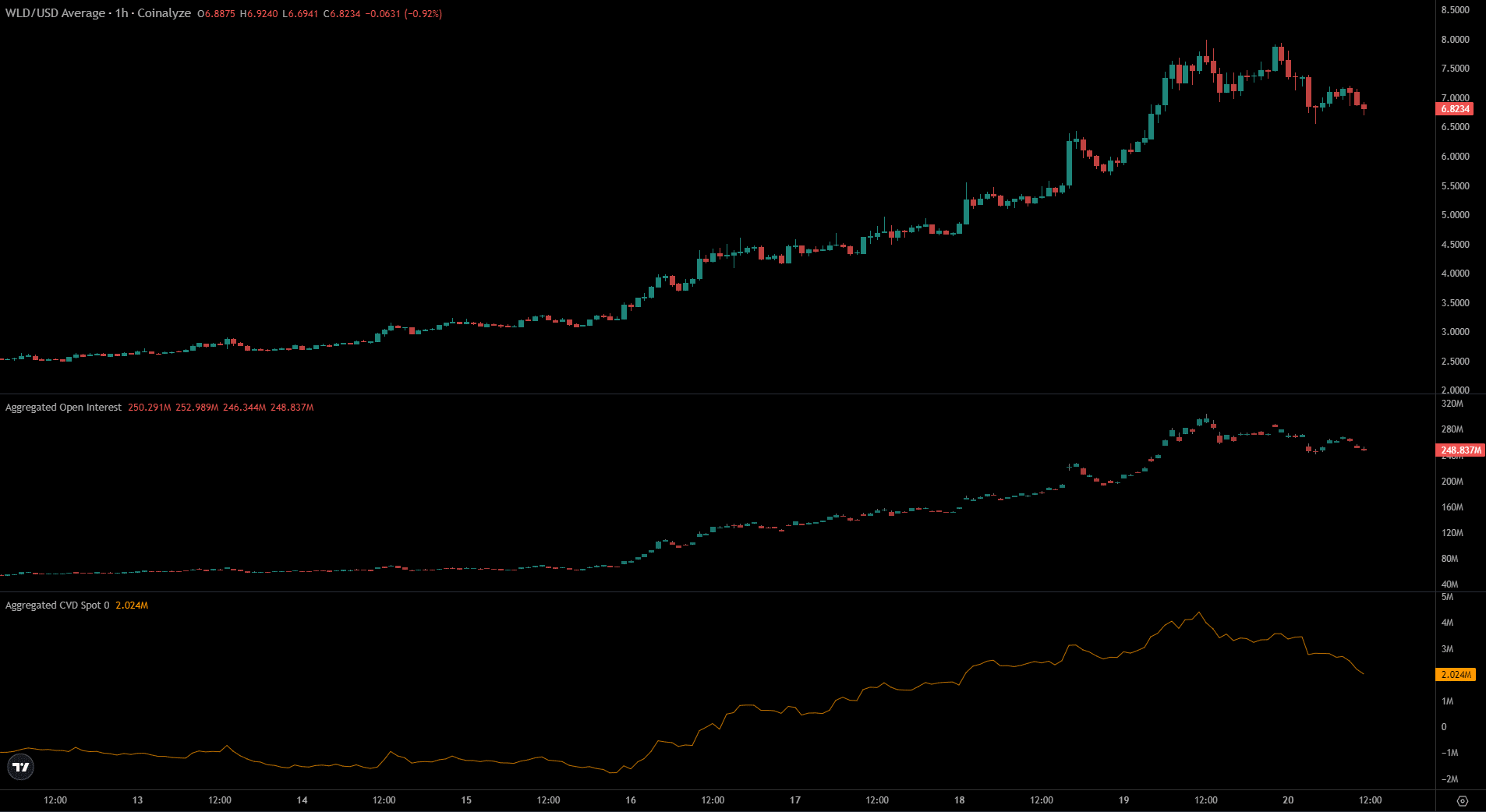

Source: Coinalyze

The data from Coinalyze indicated that the Open Interest had plateaued over the past 24 hours. The prices have also dropped from $8 to $6.823 at press time. The slight dip in the OI alongside the prices was indicative of a shift in sentiment in favor of the sellers.

Realistic or not, here’s WLD’s market cap in BTC’s terms

The spot CVD also began to trend downward over the past 24 hours. This highlighted selling volume in the spot markets.

It was likely from profit-taking activity and could initiate a short-term downtrend which could slide beneath the $5 and $4 levels toward the area of interest highlighted earlier.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.