Analysis

Worldcoin bulls spring into action – But is it too late for WLD?

Since the low of the 13th of April, WLD has gained 52%- but seller dominance remained prevalent.

- The Worldcoin structure and momentum were on the sellers’ side in the 1-day timeframe

- The short-term gains were more of a respite than a recovery due to lack of demand

Worldcoin [WLD] announced its plans for the Layer 2 solution Worldchain, which is scheduled for launch later this summer. The token WLD will play a role and be utilized for gas fees

alongside Ethereum [ETH].While the announcement saw prices tick upward, it was not enough to undo the long-term downtrend that WLD has embarked on.

The first step will be a move beyond $7.48, but are the bulls strong enough to achieve this?

The WLD indicators and price action both showcase one direction forward

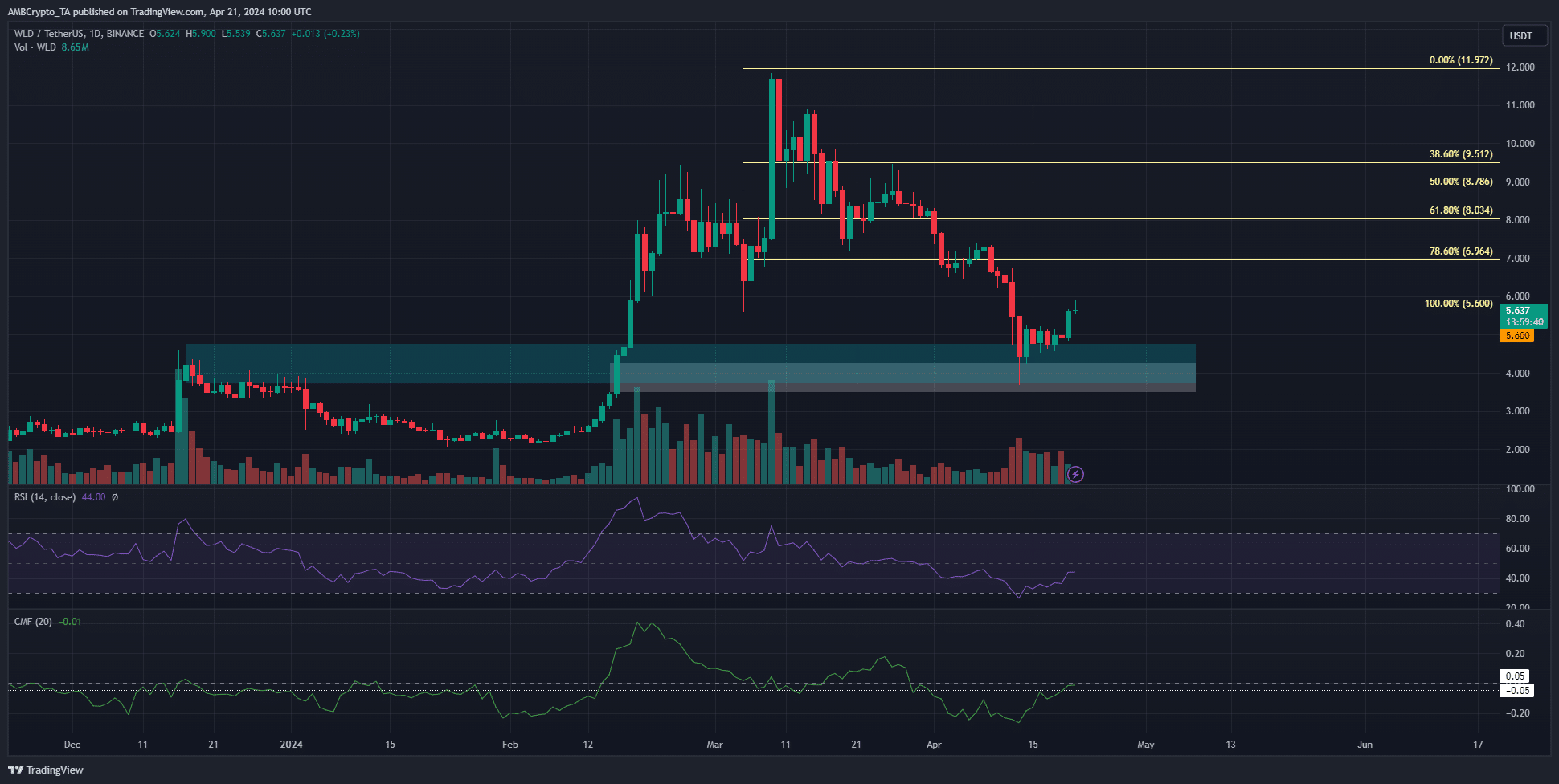

The Fibonacci retracement levels (pale yellow) showed that the current retracement has beaten the previous swing low at $5.6.

The bullish breaker block (cyan) and the fair value gap (white) at $3.7-$4.2 were tested on the 13th of April.

Since the low of that day, WLD has gained 52%. Yet, its market structure on the one-day chart was firmly bearish.

The lower timeframe charts showed that $5.4-$5.5 was a region the bulls must defend to keep bullish short-term hopes alive.

The CMF on the daily chart was at -0.01. It showed that buying pressure was not significant yet and that an uptick in prices was not yet anticipated.

Similarly, the RSI also stayed below neutral 50 to signal that bearish momentum was in play despite the bounce.

The short-term market sentiment was tiptoeing toward bullish

Source: Coinalyze

The gains of the past few days saw the Open Interest trend higher. From the 15th to the 21st of April, the OI rose by just over $50 million.

This showed speculators were willing to bid WLD and believed in its upward momentum.

Read Worldcoin’s [WLD] Price Prediction 2024-25

Conversely, the spot CVD saw a minor bounce from the 14th to the 17th of this month. The following four days to press time saw the demand in the spot market trend downward.

Hence, WLD’s short-term bullish enthusiasm might meet an early end.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.