Worldcoin: How Visa could help WLD surpass $1

- WLD continues talks with Visa about creating a payment wallet that enables stablecoin transactions.

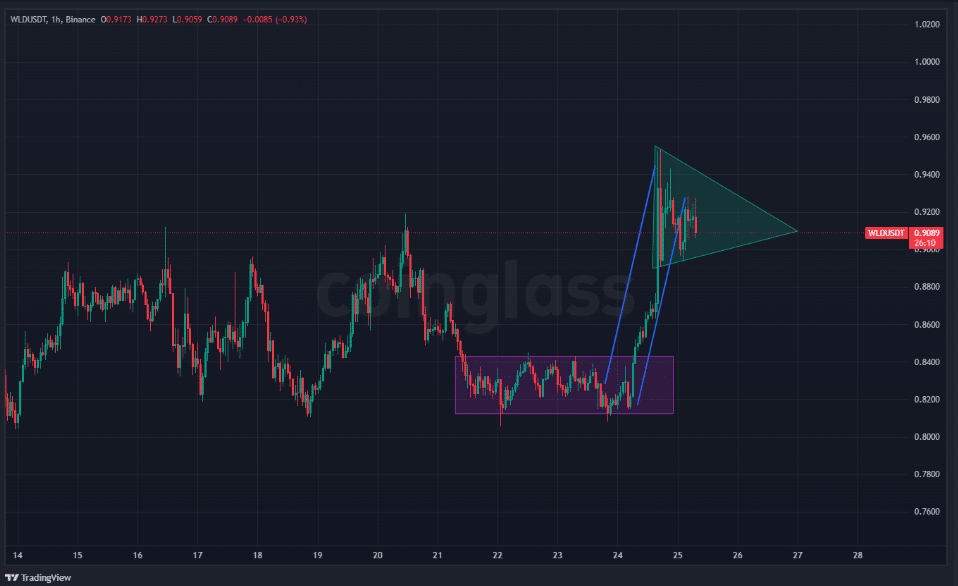

- WLD consolidated within a tight range of $0.7800 to $0.8600, signaling market accumulation.

Worldcoin [WLD] is in discussions with Visa to develop a payment wallet for stablecoin transactions. This partnership has the potential to transform the financial sector by bridging traditional payment networks with blockchain systems.

Worldcoin’s digital identity verification system, which uses iris-scanning technology, aims to make stablecoins more accessible for mainstream payment use.

Visa’s entry into this market could boost legitimacy, encouraging businesses and end users to adopt stablecoins. Stablecoins, tied to traditional monetary systems, offer reliable value stability, making them ideal for transactions.

If the partnership progresses, Worldcoin could dominate stablecoin transactions by integrating its WLD token into Visa’s extensive financial network.

Social media rumors suggest this collaboration could help Worldcoin expand its financial system for retail and institutional users, aligning with its mission of global economic inclusivity.

The potential impact on WLD and the stablecoin market

A partnership between WLD and Visa could revolutionize WLD’s position in the cryptocurrency market by increasing demand and practical value. Integrating WLD into Visa’s infrastructure would drive adoption and elevate token value as consumers and merchants embrace it more widely.

Worldcoin’s identity verification system enhances security for stablecoin transactions by addressing digital asset safety concerns.

However, this move positions WLD against competitors like USDT, USDC, and DAI, all vying for market dominance. Visa’s entry into the stablecoin space could encourage financial institutions to participate, spurring regulatory improvements and industry growth.

The 2020 PayPal crypto integration set a precedent for adoption and value growth in legitimate assets. Similarly, Worldcoin could lead the stablecoin market as a preferred option for mainstream financial transactions.

What next?

Moreover, technical analysis of the WLD chart in a one-hour timeframe illustrates a compelling market reaction to the Visa partnership news.

Between the 14th and 20th of March, WLD consolidated within a tight range of $0.7800 to $0.8600, signaling market accumulation.

A breakout occurred on March 21, pushing WLD to $0.9200 by the 23rd of March, with increased trading volume confirming strong bullish sentiment.

At the time of writing, WLD was trading at $0.9290, marking a 25.10% surge. The price action currently forms a symmetrical wedge pattern, indicating a potential continuation of the uptrend.

Resistance at $0.9500 and support at $0.9000 define the next critical levels. A confirmed breakout above $0.9500 could propel WLD toward the psychological $1.0000 mark, reinforcing market confidence and attracting further investment.

Market sentiment remains optimistic, driven by the potential Visa partnership. If confirmed, WLD’s value could extend beyond $1.0000, potentially reaching $1.1000 in the short term.

However, if negotiations fall through, a retracement to the previous consolidation zone around $0.8600 is possible.

Finally, Worldcoin’s potential partnership with Visa represents a pivotal moment for both the project and the broader crypto ecosystem. Successful integration into Visa’s infrastructure would drive mainstream adoption of stablecoins, reinforcing WLD’s market position.