Worldcoin nears $3 support again: Will WLD rise to the challenge this time?

- Worldcoin was bullish over the past few weeks, but bears have returned.

- $3 has historically been a sore point for WLD.

Worldcoin [WLD] has become one of the most popular new cryptocurrencies in recent months. It has been bullish for the last two weeks, but sellers have been pushing the price down for the past three days.

If the market can break through the resistance level just a few pips above the press time price, things could look much better for holders. Let’s take a closer look to see if WLD Coin can close above its previous highest level.

Worldcoin price action

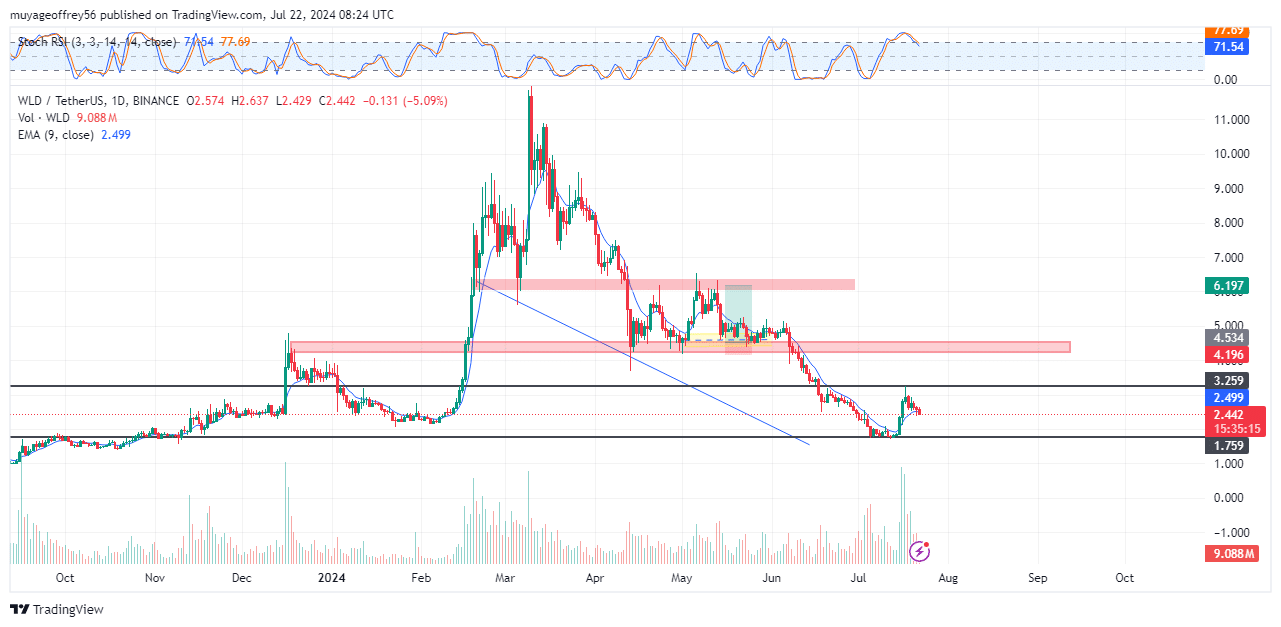

WLD was down 6.31% in the last 24 hours and was trading at $2.448 at press time. Trading volume has surged due to positive news about its technological advancements, boosting investor confidence.

At the time of writing, WLD’s price was $2.55 per CoinMarketCap. Its support levels were at $2.50 and $2.30, with resistance at $2.70 and $3.00.

Market sentiment

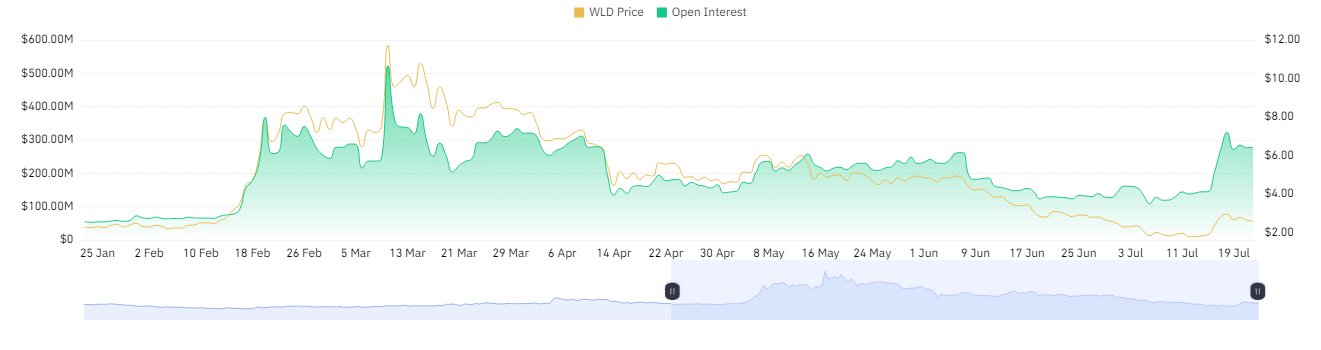

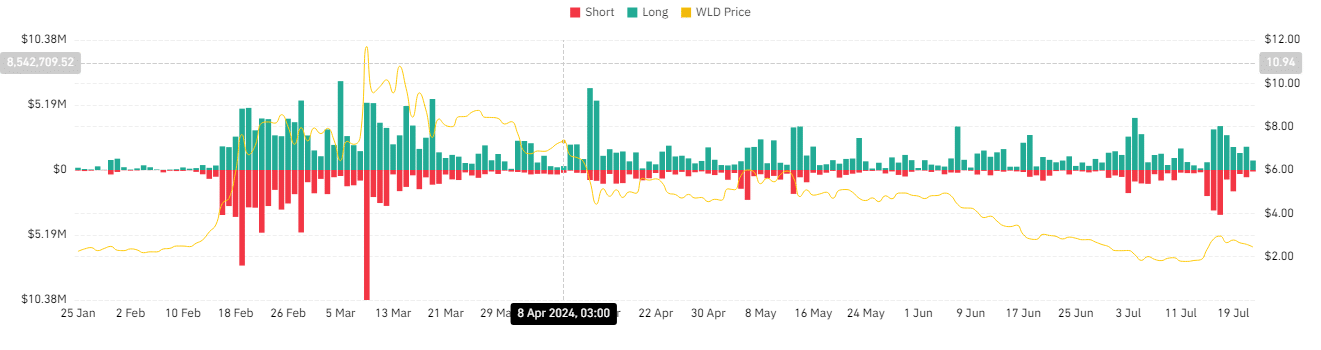

Worldcoin experienced a significant rebound, surging 90% from its recent low of $1.72. This unexpected rally triggered many short liquidations, as traders who expected a continued downtrend faced a short squeeze.

With the token unlock for early investors and team members set to start on the 24th of July, the market anticipates a potential influx of supply.

Despite a sharp rebound, WLD has struggled to break through the key $3 resistance level. Although the token surged nearly 100% over the past week, it hasn’t firmly exceeded its high of $3.2.

Contrary to retail investors’ actions, Worldcoin whales adopted a different strategy.

Addresses holding between 1 million and 10 million WLD accumulated approximately 13 million WLD, valued at over $36 million, within the same three-day period.

Historically, such accumulation has triggered price recoveries, as seen in February and May.

Crypto influencer Defi Squared has been outspoken, claiming that Worldcoin’s tokenomics are engineered to manipulate the market. He noted that just 2.7% of the 10 billion WLD tokens will be released into circulation.

Defi Squared believes this restricted supply is a strategic move by the Worldcoin team to manage the token’s price.

Technical analysis

Looking at the technicals, WLD has shown bearish movement in the last two days after reaching a resistance point, particularly as it approached the support level at $3.

This level has proven to be a reversal point, resulting in a battle between bulls and bears.

A breakout above the resistance point could act as a major price driver, potentially stopping the ongoing sell-off and pushing prices higher.

This move might signal renewed bullish movement and increased market confidence.

On the downside, the $1.79 range serves as a crucial support zone. If WLD breaches this support, it could drop to around $1.00, which might invalidate hopes for a recovery in the near future.

Read Worldcoin’s [WLD] Price Prediction 2024-25

Conversely, Coinglass’ liquidation data showed that if the price bounces back from this low support level, it could start a new recovery phase for the coin.

This bounce could trigger liquidations and lead to a bullish movement in the near future.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.