Worldcoin rebounds from key demand zone: Could $3 be the next target?

- The asset has recently rebounded from a key demand zone, a move that could help fuel its upward trajectory.

- Despite a prevailing bullish sentiment, one indicator suggested this rally may face some resistance.

Worldcoin [WLD] has struggled under bearish pressure, dropping 16.01% in the past week to trade at $1.99 at press time. However, market conditions were showing signs of recovery, and WLD appeared poised to benefit. Upon entering a bullish zone, the asset has already risen by 0.17%, according to CoinMarketCap.

WLD takes first bullish step in new rally attempt

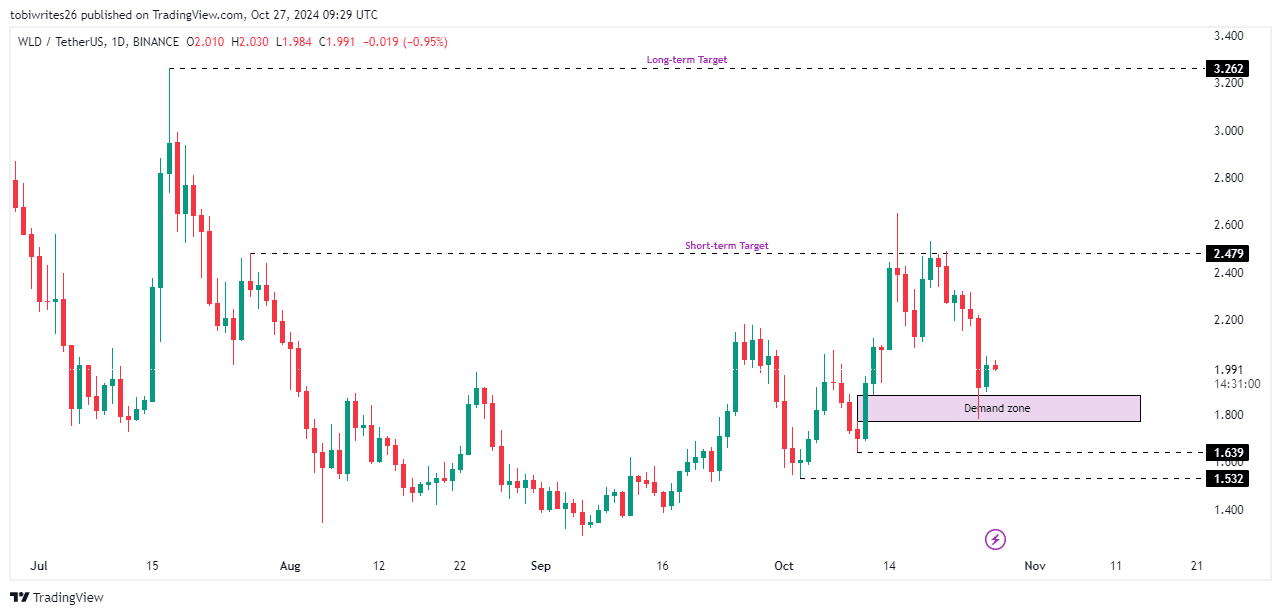

WLD has taken its initial bullish step toward a potential rally after dipping into a demand zone, resulting in a green candle and another one currently forming.

This demand zone, between $1.880 and $1.720, could push WLD toward a short-term target of $2.479 if enough buying pressure builds, with a longer-term goal set at $3.262.

However, if Worldcoin fails to hold this zone, the asset may retrace to the $1 range, potentially testing supports at $1.693 and $1.532.

According to AMBCrypto’s analysis, bullish sentiment appears to dominate, with traders supporting an upward move.

WLD’s rally remains a matter of time

Multiple on-chain metrics indicated that WLD was set for a significant upward movement. Currently, both Exchange Netflow and Chaikin Money Flow signaled promising trends.

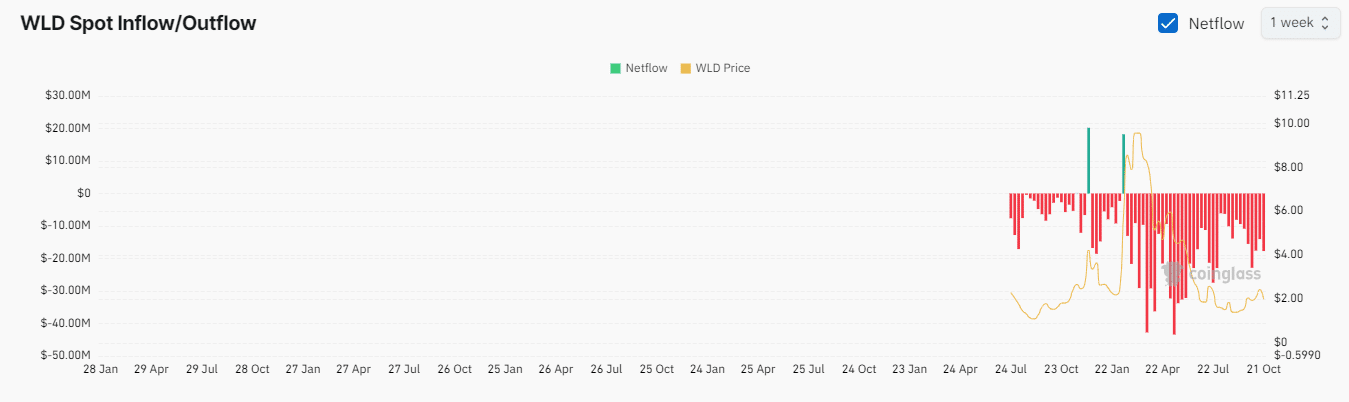

Exchange Netflow according to Coinglass has been predominantly negative. In the past 24 hours and the last seven days, WLD has seen massive withdrawals from exchanges, totaling $602.62 thousand and $17.88 million, respectively.

A negative Exchange Netflow suggested that there was a greater outflow of Worldcoin from exchanges than inflow, indicating increased trader confidence. This dynamic can lead to a price rally as fewer WLD assets become available on exchanges.

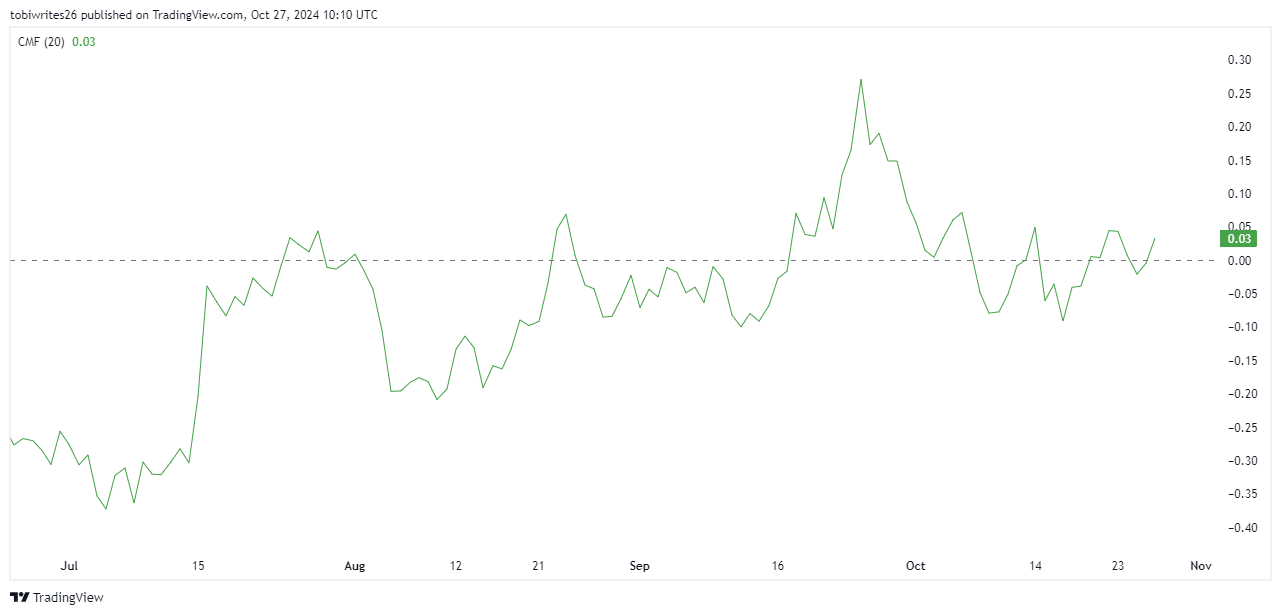

Similarly, the Chaikin Money Flow, which measures liquidity inflow, revealed that while significant withdrawals were occurring, there was also active buying of WLD.

If this trend continues, demand for WLD is likely to rise. Especially as the supply diminishes and traders seek to capitalize on the tightening availability, it remains only a matter of time before a major move up.

Slight delay in the rally

WLD’s rally may face a slight delay. Despite positive momentum and increasing interest in the asset, liquidation data was unfavorable for short positions.

Realistic or not, here’s WLD market cap in BTC’s terms

At press time, long liquidations have totaled $496.77 thousand, compared to just $139.11 thousand for shorts. This indicated that while the market remained bullish, the current losses in long positions may postpone a significant upward move.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)