Worldcoin sees continued bearish pressure – Can bulls save WLD?

- While the recent increase in volume and Open Interest showed a slight bullish edge, the broader market sentiment remained bearish.

- Traders should watch the $1.7 resistance closely, as a break above this level could signal a stronger recovery.

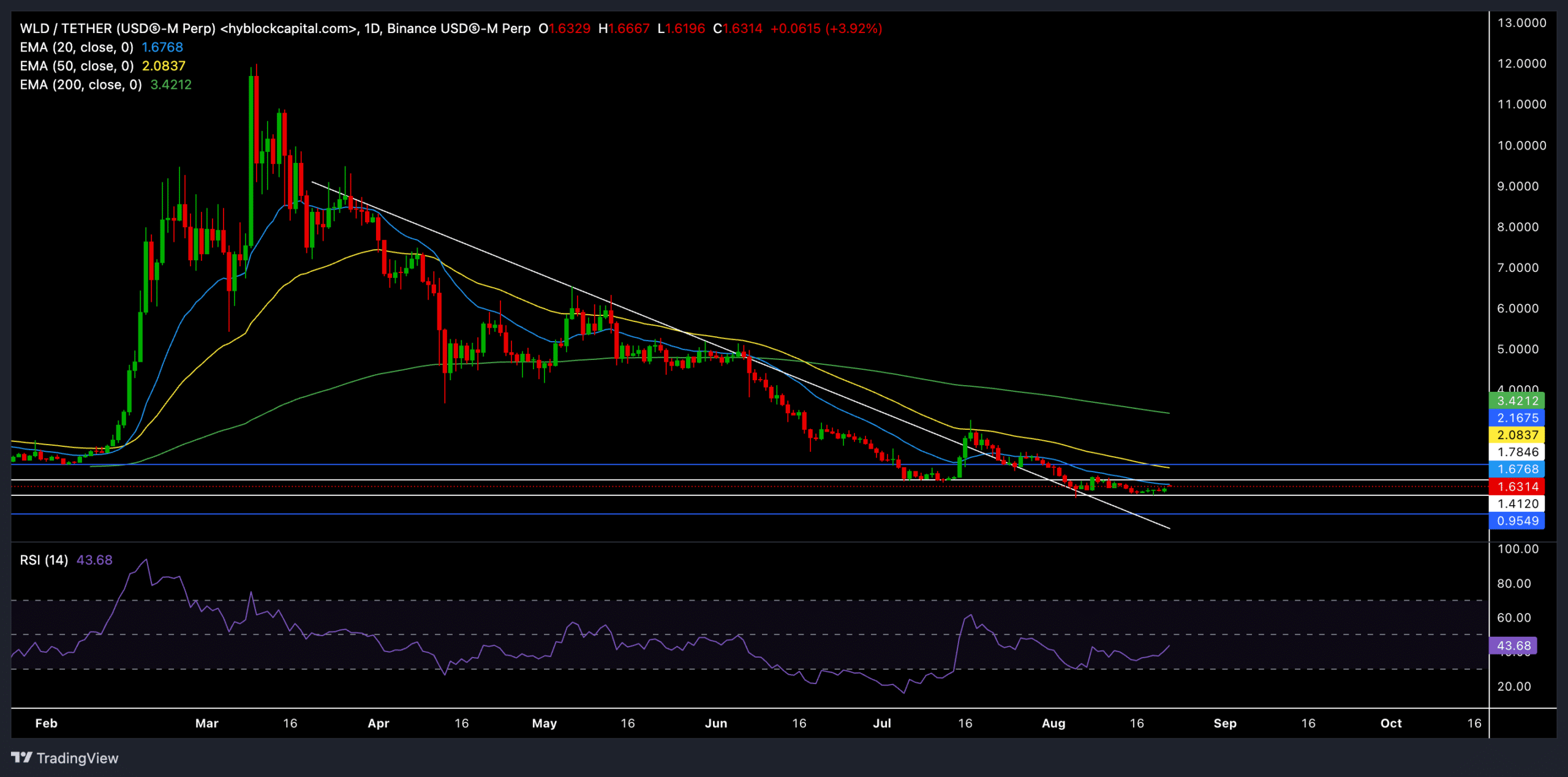

As the Crypto Fear & Greed Index showed a bearish sentiment at the time of writing, Worldcoin [WLD] continued its long-term downtrend and fell below key support levels on its daily chart.

However, a few triggers can provoke a short-term recovery. WLD traded at around $1.63 at press time, up nearly 10% in the last 24 hours.

Worldcoin bears continue to exert pressure

The ongoing downtrend put WLD below all major EMAs toward its 11-month low, with the 20-day EMA at $1.67, the 50-day EMA at $2.08, and the 200-day EMA at $3.42.

These levels now serve as significant resistance points for any potential recovery.

The current price action suggests that WLD is struggling to break above the 20-day EMA, which could be crucial for a sustained recovery.

The downward-sloping EMAs indicate that the sellers are still in control, and any bounce from current levels could face strong resistance.

For the bulls to gain control, WLD must close above the 20-day EMA and sustain this level.

The recent increase in volume and Open Interest suggested that there was potential for a bounce, but the broader market sentiment still favored the bears.

The RSI hovered below the 50-mark and showed a slight bearish edge at the time of writing. Buyers should look for a potential close above equilibrium to gauge the chances of an immediate recovery.

Key levels to watch

The immediate resistance is at the 20-day EMA ($1.67). If WLD can break and hold above this level, the next target would be the 50-day EMA at $2.08, followed by a potential test of the 200 EMA level.

On the downside, the support at $1.41 is crucial. A break below this level could lead to a steeper correction, with the next support around $0.95.

It’s worth noting that the volume increased significantly by 60.25% to $528.67 million, and Open Interest also rose by 12.52% to $144.08 million.

This suggested growing interest in WLD, but the question remained whether this was driven by buyers stepping in or more sellers looking to short the asset.

The long/short ratio for the last 24 hours is almost balanced at 1.0068, indicating a neutral sentiment among traders.

Realistic or not, here’s WLD’s market cap in BTC’s terms

However, the WLD/USDT long/short ratio on Binance was highly bullish at 2.7341, showing that many traders hoped for a potential recovery.

Buyers should also monitor external factors, such as macroeconomic trends and Bitcoin’s sentiment, as these will likely influence WLD’s price action in the near term.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion