Worldcoin under pressure thanks to Alameda’s sell-off – Here’s why

- Worldcoin (WLD) faced pressure from Alameda Research’s ongoing sell-offs, affecting its price

- Most WLD holders (79%) were “out of the money,” indicating bearish sentiment

Lately, Worldcoin [WLD] has emerged as a standout performer in the cryptocurrency market, generating significant bullish momentum and achieving double-digit gains.

However, the project, which integrates artificial intelligence with cryptocurrency, now faces challenges stemming from ongoing sell-offs by Alameda Research.

Alameda Research fuels selling pressure

Blockchain data revealed that Alameda Research, a significant market player, is actively liquidating its WLD holdings. In fact, it contributed to a nearly 5% drop in the token’s price within a single day.

According to CoinMarketCap, Worldcoin fell by 5.20% over the last 24 hours and was trading at $1.72 on the charts. This raised concerns among investors about the token’s long-term viability.

All this happened because a crypto wallet associated with the defunct FTX exchange and its sibling company, Alameda Research, has been actively transferring substantial quantities of WLD.

What’s more?

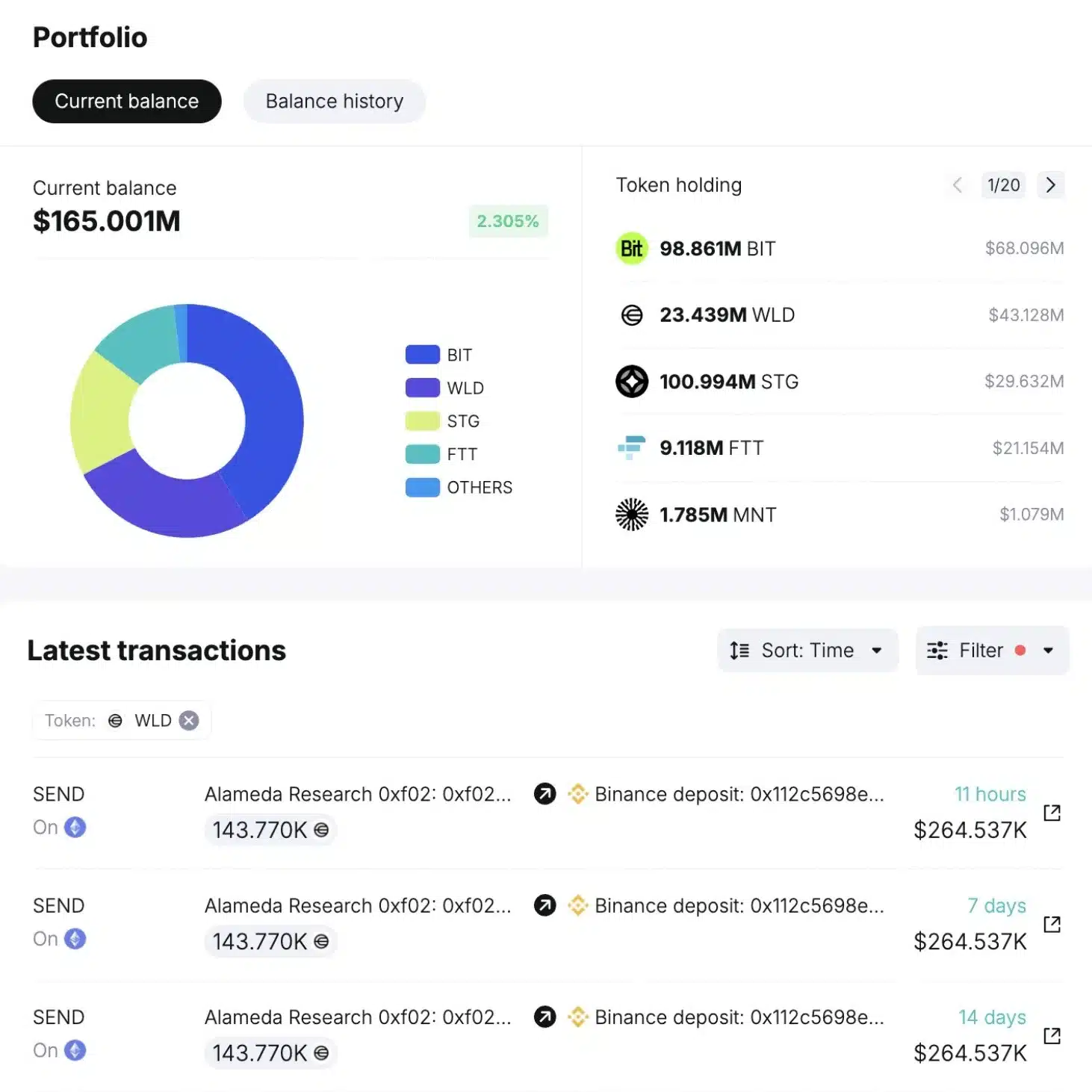

For context, over the past two months, Alameda Research’s on-chain wallet has moved an impressive 1.56 million WLD tokens to Binance, executing ten separate transactions at an average price of approximately $1.605.

This sell-off has generated around $2.51 million, likely in preparation for the upcoming reimbursement of FTX clients and creditors. Especially as the bankruptcy estate gears up for payments.

With the repayment plan recently approved by a judge overseeing the FTX bankruptcy case, Alameda Research’s wallet is currently depositing 143,770 Worldcoin coins every two weeks.

Confirming the same, John J. Ray III, the current CEO of FTX noted,

“Looking ahead, we are poised to return 100% of bankruptcy claim amounts plus interest for non-governmental creditors through what will be the largest and most complex bankruptcy estate asset distribution in history.”

That being said, if FTX and Alameda continue with this reimbursement strategy, it could lead to further significant altcoin transfers to major exchanges like Binance and OKX.

Following the latest round of Worldcoin sales to Binance, Alameda’s wallet now retains 23.44 million WLD tokens. This could take approximately three years to liquidate at its current pace, according to SpotOnChain data.

What do on-chain metrics say?

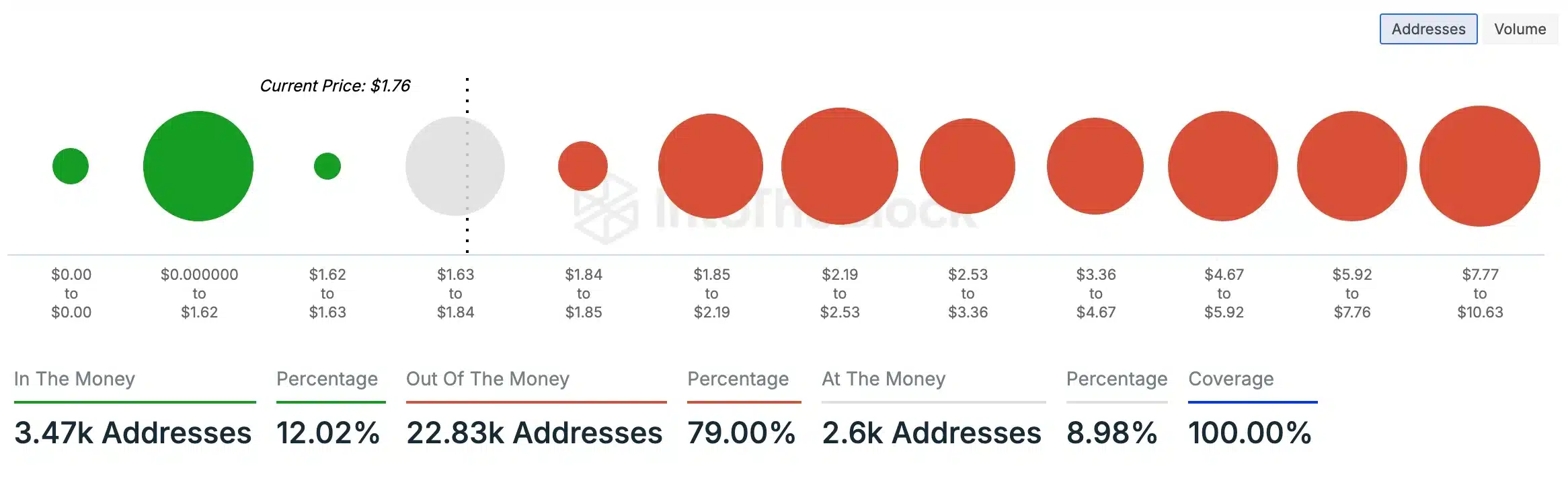

To further confirm the selling pressure speculations, AMBCrypto analyzed IntoTheBlock data and found that a significant majority (79%) of WLD holders held tokens valued lower than their purchase price at press time, indicating that they were “out of the money.”

In contrast, a smaller segment (12.02%) held WLD tokens that were worth higher than their purchase price, placing them “in the money.”

This pointed to bearish sentiment or an ongoing price drop for Worldcoin, thanks to Alameda Research.