Worldcoin’s bullish momentum surges: Is THIS why?

- Worldcoin’s European expansion boosted WLD adoption, driving a 13.6% price surge this week.

- Technical indicators hinted at a bullish breakout, with potential targets near $2.00.

Worldcoin [WLD] has seen a strong price performance over the past week, driven by increased adoption and key market movements.

WLD traded at $1.60 at the time of writing, with a 24-hour trading volume of $280,038,161.98.

This marked a 9.30% increase in the last 24 hours and a 13.60% rise over the past seven days. With a circulating supply of 450 million WLD, the market cap stood at $723,470,515.

European expansion fuels adoption of world ID

Worldcoin recently announced a significant expansion of its World ID verification in Europe, launching the service in Poland on the 18th of September. According to the official statement,

“World ID verification has launched in Poland,” allowing individuals to verify their World ID in Warsaw using a custom biometric imaging device known as the ‘Orb’.”

This expansion is part of Worldcoin’s effort to increase access to its proof of humanness technology across Europe.

The project had previously launched similar World ID verification services in Austria and has partnered with Malaysia’s government R&D team to enhance digital proof of humanness in the country.

These initiatives are part of Worldcoin’s broader goal to establish a global, decentralized identity verification network, boosting adoption and engagement across various regions.

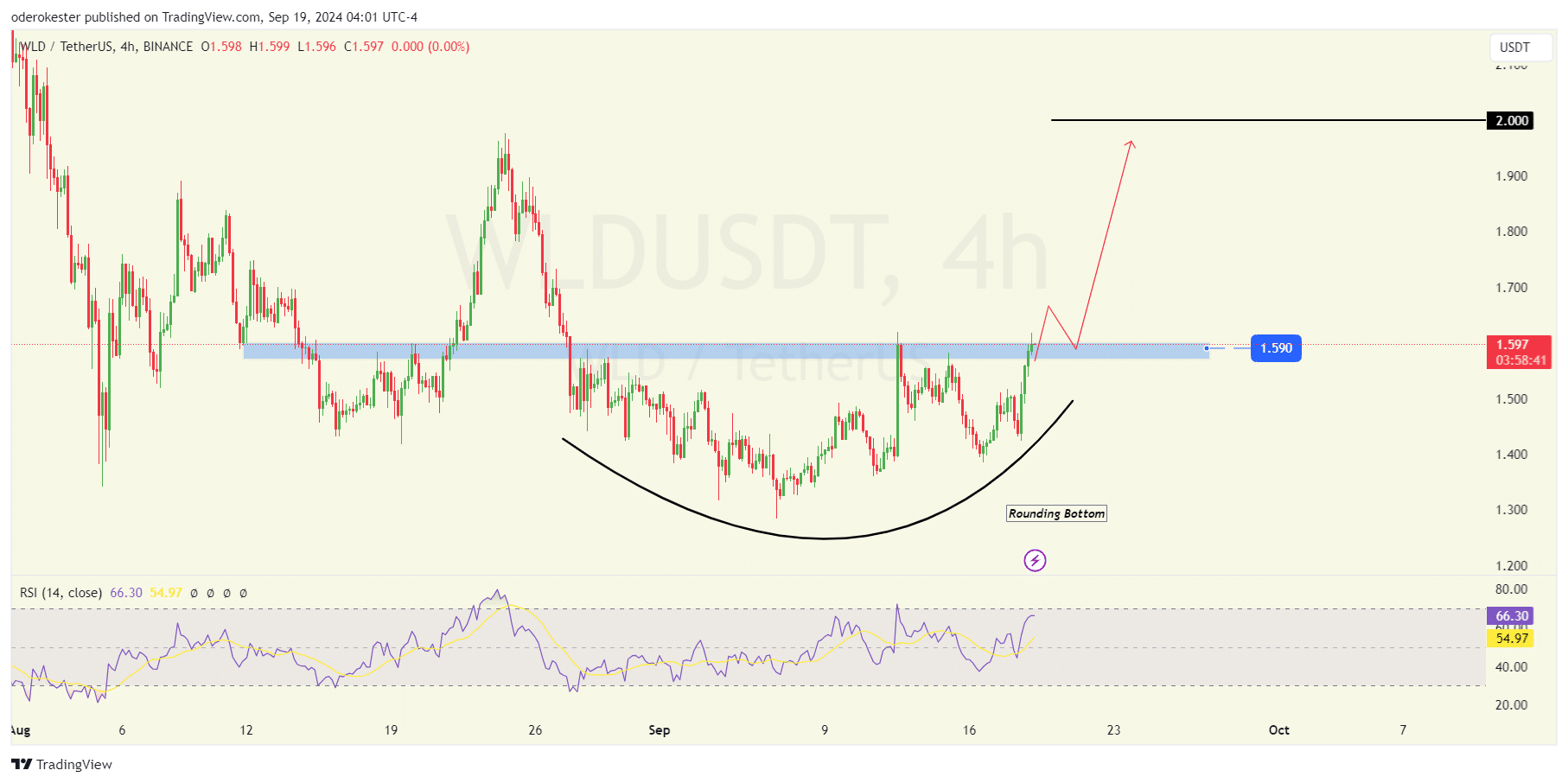

Technical indicators suggest potential upside

WLD’s technical indicators also point toward a potential bullish breakout. The price is approaching a key resistance level at $1.590, which serves as the neckline of a rounding bottom pattern.

A breakout above this level would confirm the bullish reversal, suggesting that momentum is shifting in favor of the bulls, with the next target set at $2.000.

At press time, the Relative Strength Index (RSI) was at 66.30, indicating strong buying momentum but approaching overbought levels. This suggests the possibility of a brief consolidation before any sustained breakout.

Should the price fail to clear $1.590, a minor pullback could occur, though the overall bullish structure remains intact above the rounding bottom curve.

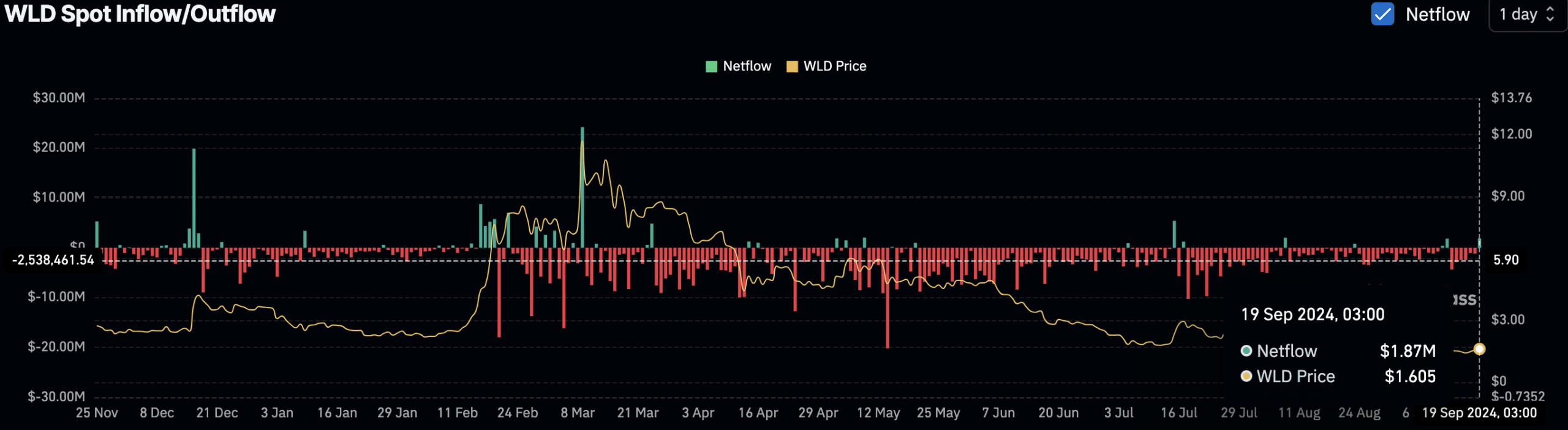

Net inflows and transaction volume

Market data showed positive net inflows into WLD, with $1.87 million flowing into the asset as of the 19th of September. This increased inflow suggests buying pressure, supporting price stability and potential upward movement.

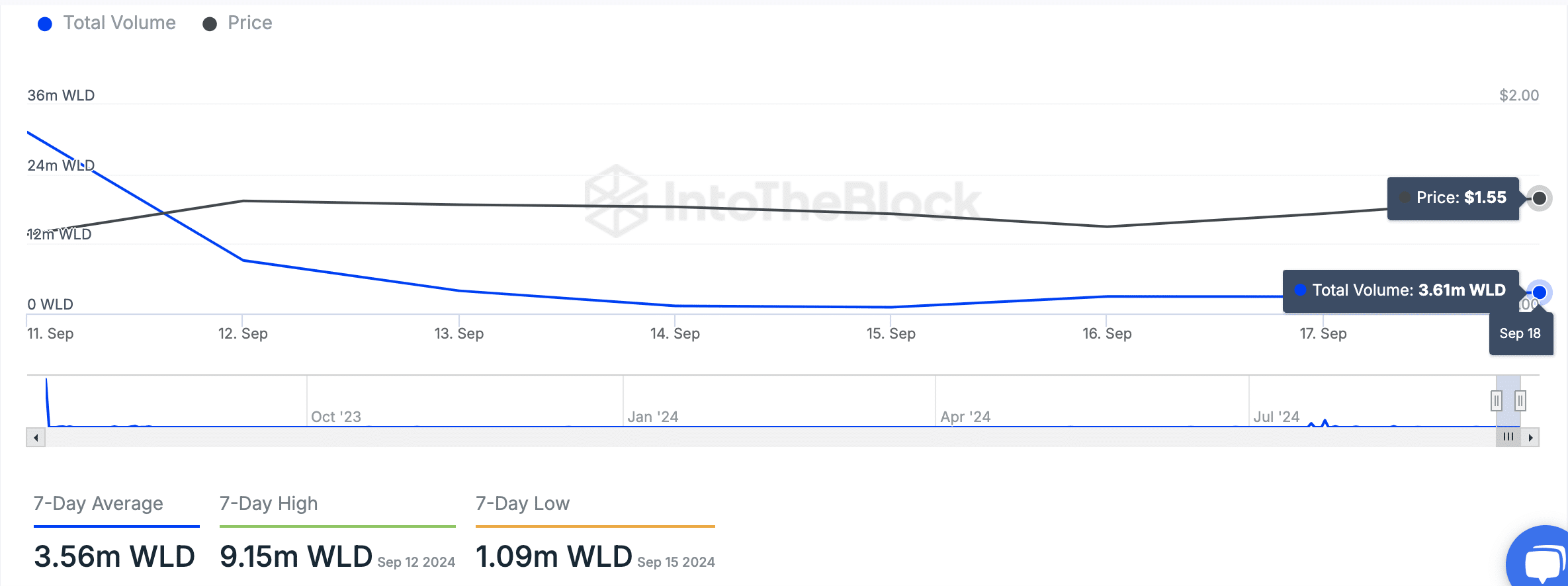

However, total transaction volume has shown a declining trend in recent days. As of the 18th of September, the volume stood at 3.61 million WLD, down from a peak of 9.15 million WLD on the 12th of September.

Read Worldcoin’s [WLD] Price Prediction 2024–2025

This decline reflected reduced trading activity, which may indicate market caution or a period of consolidation as traders await clearer price direction.

Overall, Worldcoin’s European expansion, technical indicators, and market data reflected growing interest and engagement, supporting its recent price surge.