Worldcoin has new privacy feature which can help WLD prices this way…

- Worldcoin has launched a new privacy feature called “Personal Custody.”

- WLD’s price continues to decline as bearish sentiment increases.

In a blog post published on 22nd March, The Worldcoin Foundation has announced the launch of a new privacy feature called “Personal Custody.”

This privacy feature allows users to self-custody the information they give to Worldcoin. It involves a data package signed with the Orb’s private key, subsequently encrypted with a public key provided by a user, and then transferred to their mobile phone.

According to Worldcoin:

“Since all data is encrypted by your public key, the end result of this process is a collection of encrypted data packages that reside exclusively on your device. Your information is always deleted from the orb once it has been sent to your device, and the use of double encryption within the end-to-end encryption envelope is a safeguard to protect the confidentiality and privacy of your data in the event your device is compromised.”

The bears put pressure on WLD’s price

Not spared from last week’s general market decline, WLD’s price has declined by 11% in the past seven days, according to CoinMarketCap’s data. At press time, the altcoin was trading at $8.24.

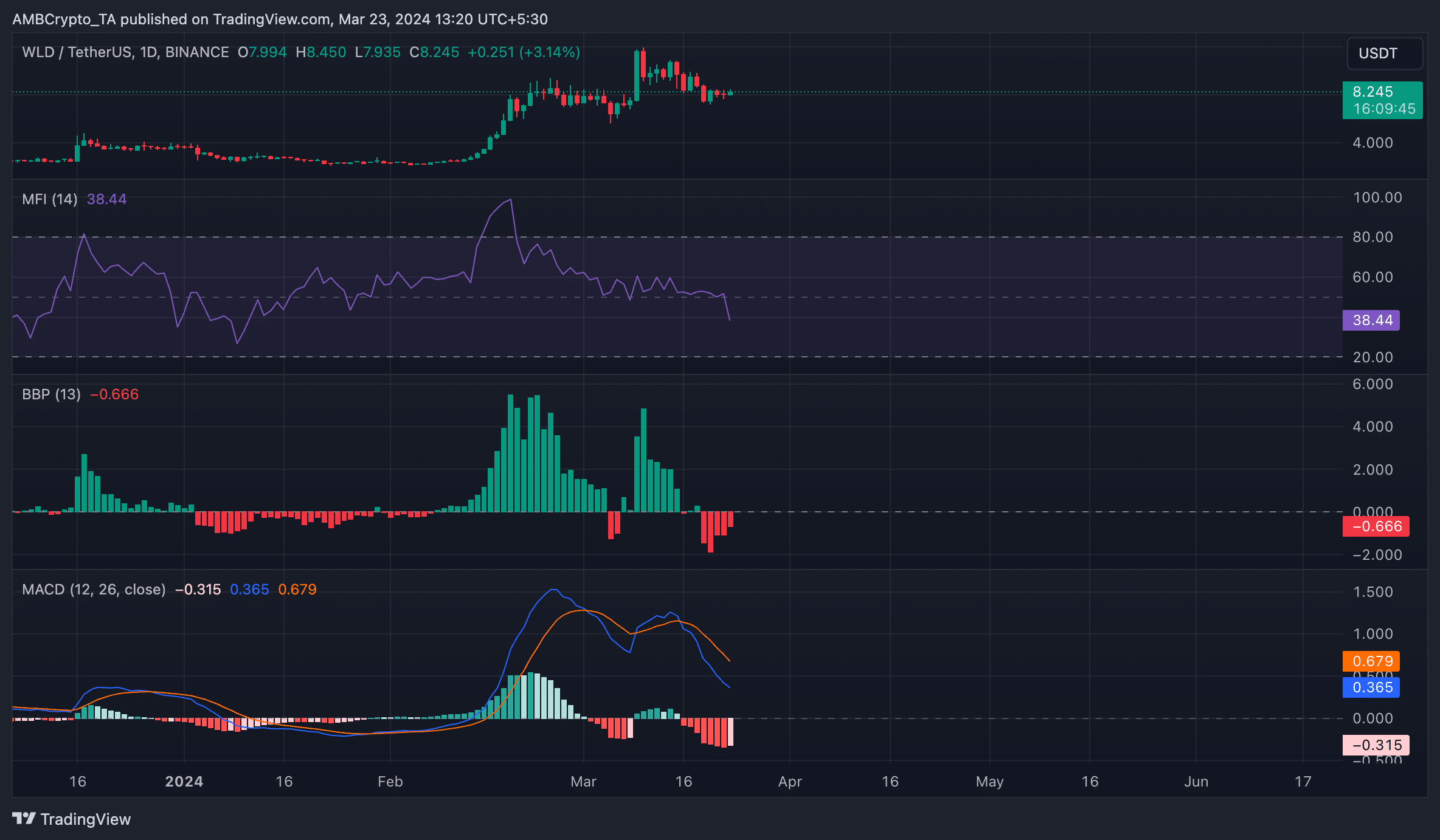

Price movements observed on a 1-day chart revealed high bearish activity. WLD’s Moving Average Convergence Divergence (MACD) indicator showed a downward crossover of the MACD line with the signal line on 16th March. Since then, the token’s price has dropped by double digits.

This intersection is a bearish signal, which suggests a spike in selling pressure. Traders often interpret it as a sign to enter short positions or distribute their holdings.

Confirming the bearish trend, WLD’s Elder-Ray Index, which estimates the relationship between the strength of buyers and sellers on an asset, returned a negative value of -0.6.

Read Worldcoin’s [WLD] Price Prediction 2023-2024

A negative Elder-Ray Index value suggests that the bears dominate the market and are forcing a price decline through their selling activity.

In addition, WLD’s Money Flow Index (MFI) rested below its centre line at 38.43. In a downtrend at press time, the indicator signaled a decline in demand for WLD and an uptick in its sell-offs.