Worldcoin’s struggles continue as Alameda dumps WLD: What’s next?

- WLD’s price dropped further as selling pressure from Alameda Research hampered any attempts to gain.

- The decline in daily active addresses and Open Interest showed a lack of market interest.

As the cryptocurrency market retraced today, Worldcoin [WLD] posted an 11% drop in price to trade at $1.50 at the time of writing.

The recent drop brought WLD’s monthly losses to 37%, making it one of the most underperforming altcoins.

One of the factors that have been weighing on WLD is selling pressure from Alameda Research. Data from SpotOnChain shows that Alameda has been depositing WLD consistently to exchanges since the 9th of August.

In the last two weeks, the bankrupt firm has deposited $1.13M WLD to exchanges. Alameda still holds $36M in WLD, which will likely be sold to repay creditors. These sales are likely hampering Worldcoin’s potential to rally.

Worldcoin remains muted

Worldcoin hit all-time highs in March this year, alongside Bitcoin [BTC]. However, it has since lost 87% of its value.

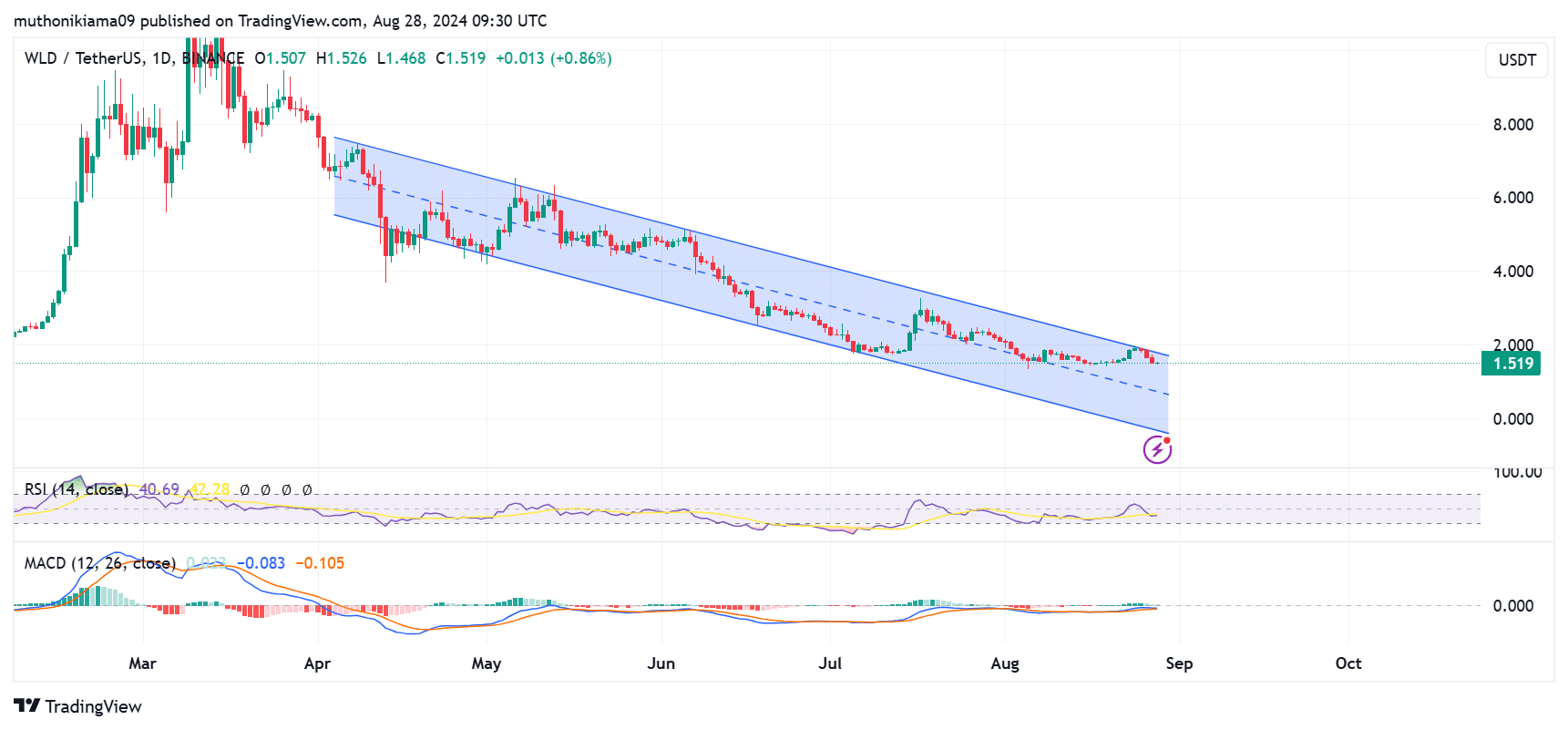

WLD has been moving downward within a parallel channel for months, indicating a steady downtrend, with the price making lower highs and lower lows.

Recently, Worldcoin attempted to break out of this channel, but the upper resistance line held firm. The failure to break out suggests that the price might continue to fluctuate within the channel.

For WLD to confirm an uptrend, it needs to break a key resistance level at $1.95.

The Relative Strength Index (RSI) at 40 showed bearish momentum. This low RSI score suggested an inactivity of buyers, which has muffled Worldcoin’s attempts to recover.

The Moving Average Convergence Divergence (MACD) histogram bars also flashed green when WLD attempted to break out of the parallel channel.

However, with the MACD line being below the signal line, WLD will only rally if buyers re-enter the market.

WLD, on-chain

On-chain data does not support a bullish case for Worldcoin as well.

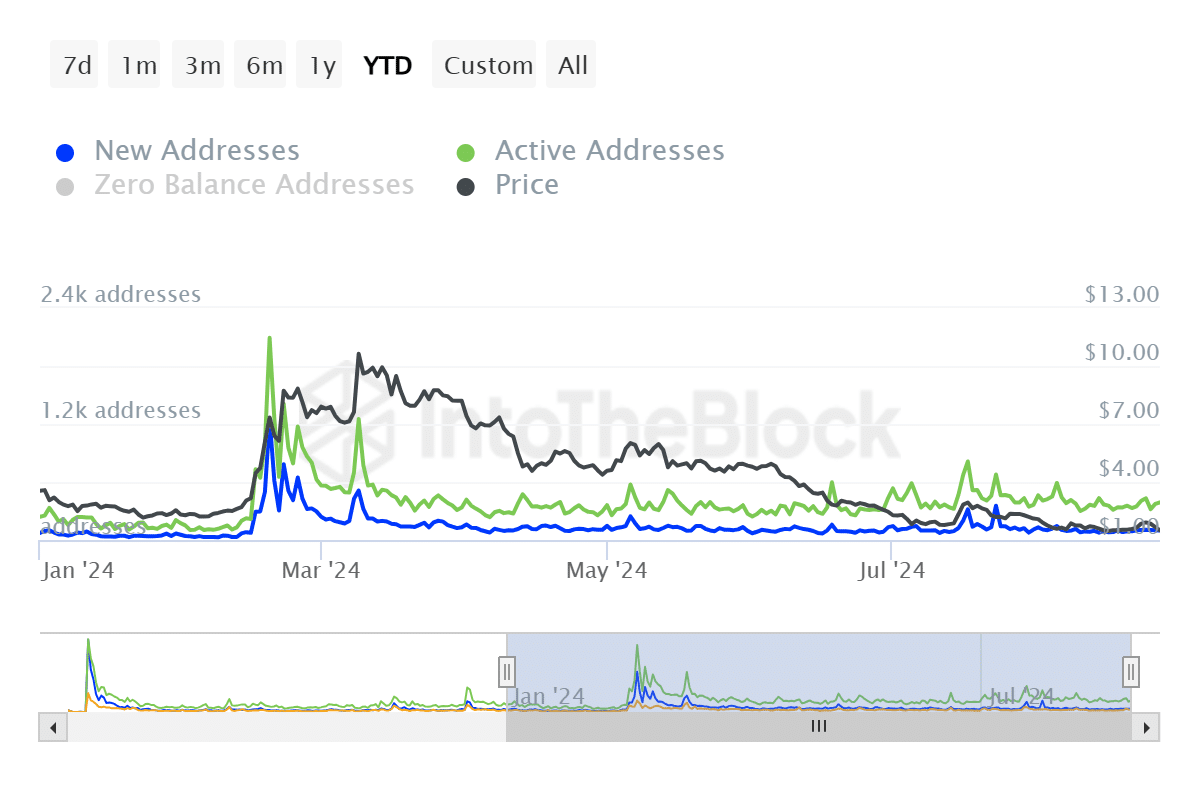

At press time, the number of daily active addresses was at the lowest level since the beginning of the year.

This same drop is seen in the number of new addresses, which have also plummeted, indicating a lack of buying activity to support the uptrend.

93% of WLD holders were also in losses at press time, while only 2% were in profits. This is a bearish scenario, as these investors might choose to mitigate losses by selling whenever the price attempts a rebound.

This trend will muffle any attempts to gain.

Read Worldcoin’s [WLD] Price Prediction 2024–2025

AMBCrypto’s look at Coinglass data showed a significant drop in Worldcoin’s Open Interest. The decrease shows reduced market participation and a possibility of WLD consolidating or market indecisiveness.

WLD’s Open Interest has dropped from over $322M in mid-July to $126M at the time of writing.