Wormhole [W] breaks out: Is the rally sustainable or a false alarm?

- Wormhole broke free from a descending channel, surging 11.45% with high trading volume.

- Mixed on-chain signals and overbought conditions suggested short-term pullback despite bullish momentum.

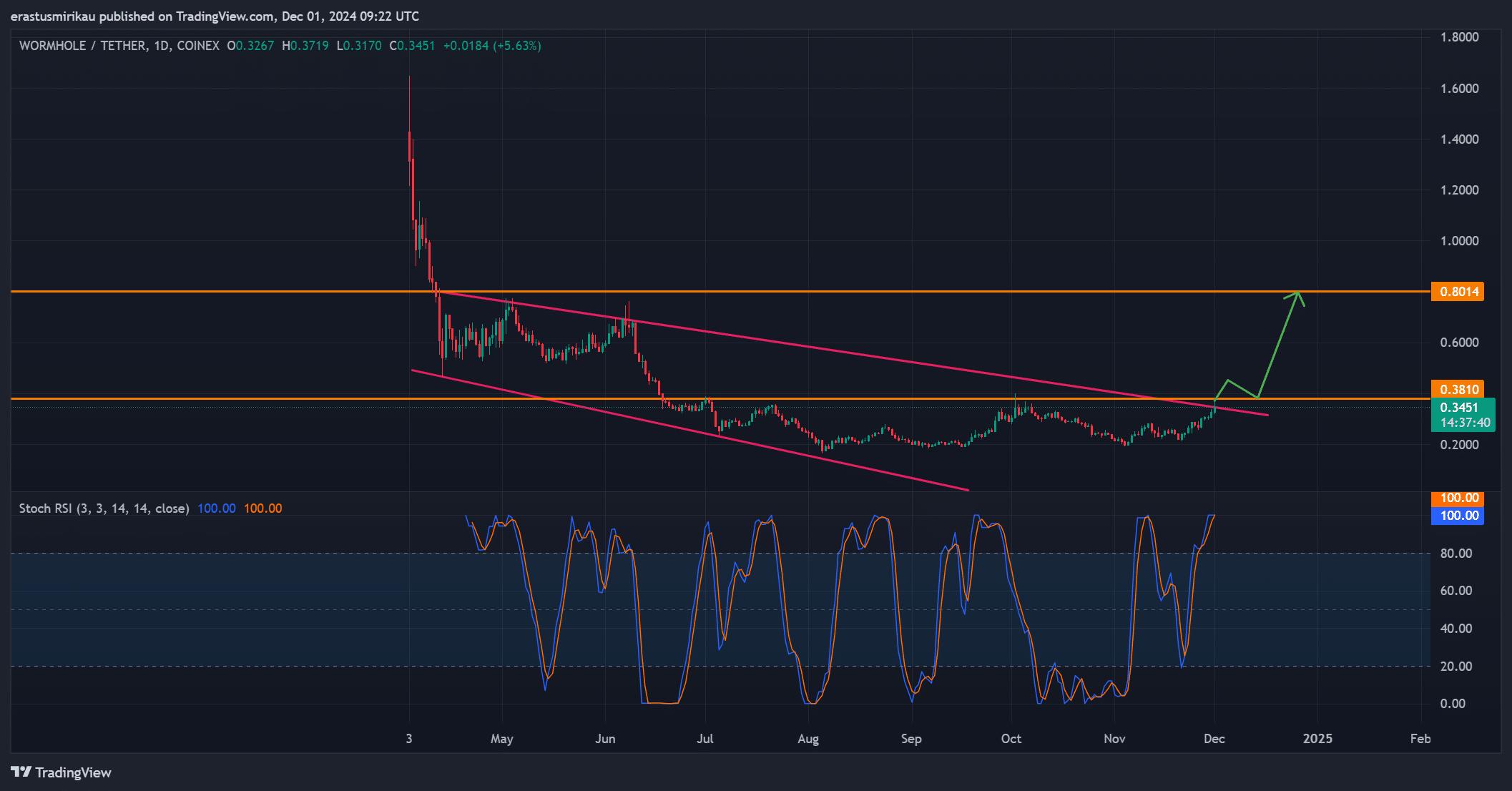

Wormhole [W] has experienced a significant price surge of 11.45% in the past 24 hours, climbing to $0.35 at press time after breaking out of its prolonged downtrend.

This price movement comes after months of consolidation, as the token finally broke free from a long-standing descending channel.

The increase in trading volume—up 112% to $275.74M—indicated a shift in market dynamics, with traders reacting to the breakout.

As Wormhole approaches its key resistance at $0.38, the price action will determine whether this rally can be sustained or if it faces an imminent correction.

Breakout or temporary spike?

Wormhole’s breakout from its prolonged descending channel is a significant development, suggesting a change in market sentiment.

The token was facing crucial resistance at $0.38 at press time, a level that could dictate whether the rally continues.

A successful breakout above $0.38 could push W towards $0.80, but the Stochastic RSI, at 100 at press time, suggested that the token was in overbought territory.

This raises concerns about a potential short-term pullback before any further price action unfolds. Therefore, while the breakout is positive, caution is warranted.

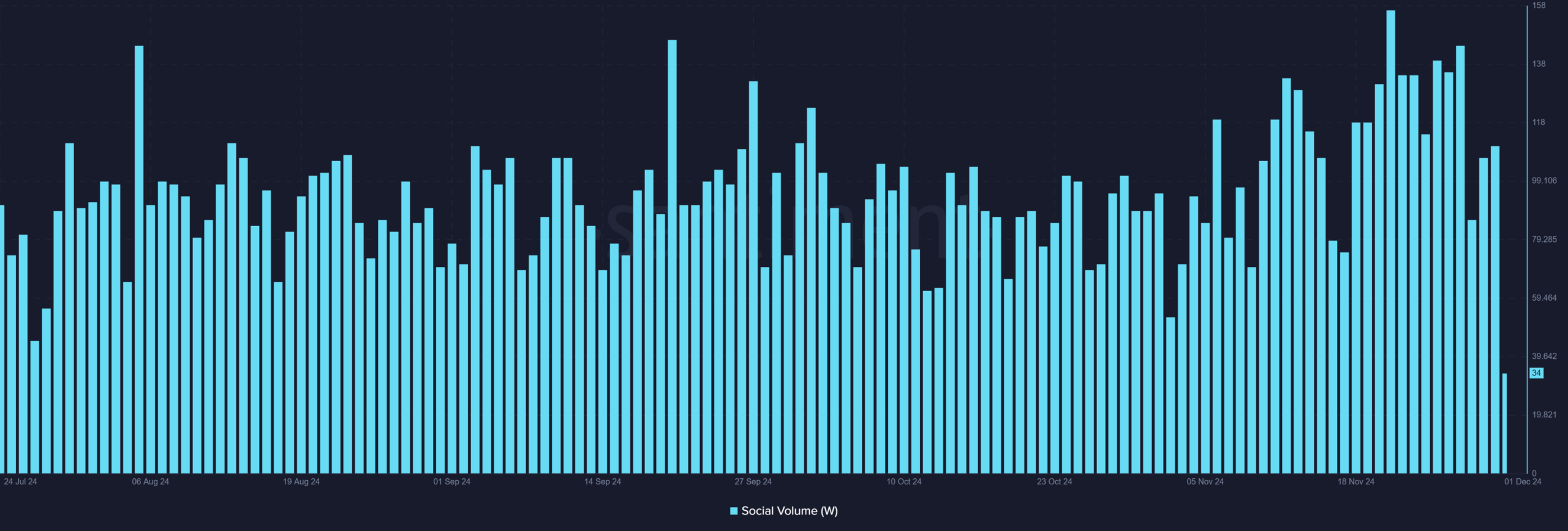

Wormhole social volume: Fading interest or temporary dip?

Wormhole’s social volume dropped sharply, closing at 111 the previous day but falling to 34 at press time. This decline signals weakening public interest, which could limit the upside potential.

However, the day isn’t over, and if the price breaks through the $0.38 resistance, social engagement could pick up again. Consequently, retail interest may return, potentially driving new buying pressure.

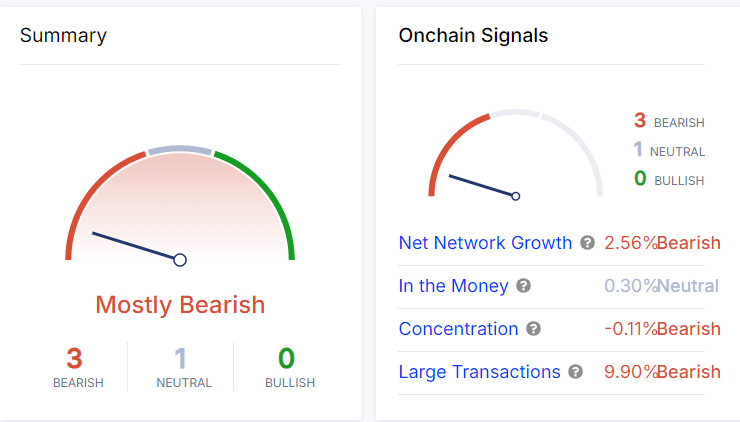

Bearish on-chain signals point to potential selling pressure

On-chain metrics painted a mixed picture. Net network growth has dropped 2.56%, indicating a bearish trend in overall activity.

Additionally, the concentration metric shows a slight decline of -0.11%, suggesting that larger holders might be selling. Large transactions have also fallen by 9.90%, pointing to potential profit-taking.

However, the “Into the Money” metric remains neutral at 0.30%, meaning no strong accumulation or distribution is currently happening.

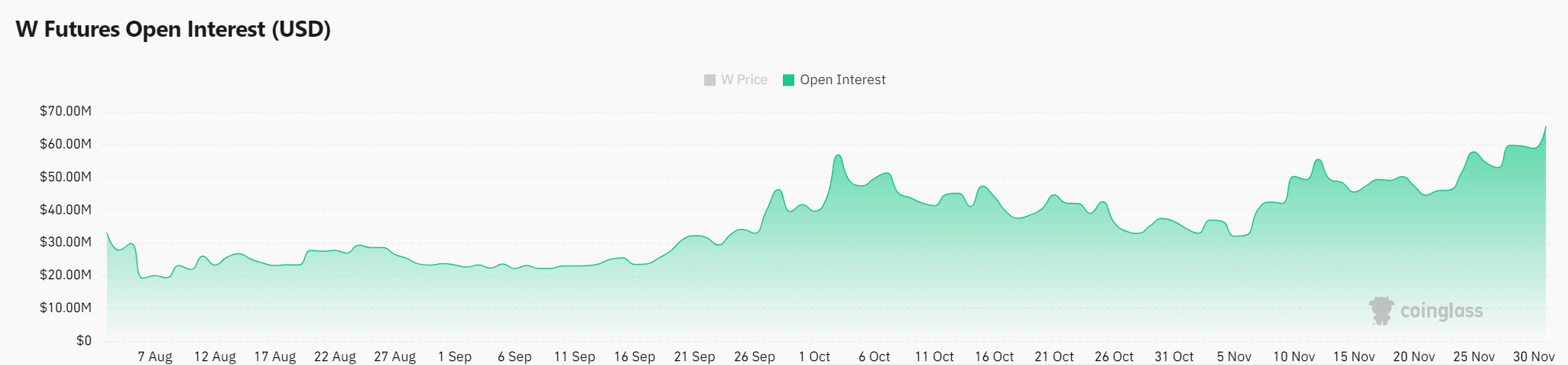

Is market confidence building?

One positive sign is the 29.04% increase in Open Interest, which stood at $80.33M at press time. This indicated growing confidence among traders that the breakout could be sustained.

Open Interest usually reflects market sentiment, and this rise shows that more traders are betting on Wormhole’s continued price movement.

However, overbought conditions and bearish on-chain signals suggest that caution is still necessary.

Is your portfolio green? Check out the W Profit Calculator

Conclusion: Will Wormhole’s breakout lead to a sustained rally?

Wormhole’s breakout to $0.35 is promising, but significant challenges remain. The $0.38 resistance is key, and while Open Interest is rising, the overbought conditions and bearish on-chain signals indicate a potential pullback.

Investors should watch for price action at $0.38 to determine if the rally will continue or stall.