Worried about Dogecoin’s 30% drop? Analysts predict…

- DOGE’s current trajectory was similar to its pre-2017 and 2021 bull market phases.

- Several user cohorts were accumulating DOGE, possibly motivated by history.

Much to the community’s relief, Dogecoin [DOGE] started to trade in green, following a 2% gain in the last 24 hours of trading.

The rebound served to ease DOGE holders’ anxieties, since their portfolios had suffered nearly 16% loss over the week, and more than 32% in the last 30 days, according to data sourced from CoinMarketCap.

And going by how the world’s largest memecoin has historically performed, they could have more reasons to cheer.

History suggests incoming bull run

Prominent technical analyst and trader Ali Martinez said that the ongoing price correction was part of DOGE’s “usual behavior” before embarking on massive bull runs.

To substantiate his arguments, Martinez drew attention to two previous occurrences in 2017 and 2018.

Back in 2017, DOGE broke out of a descending triangle, then corrected 40% before exploding 982% towards new highs.

Repeating the trajectory in 2021, DOGE broke out of a descending triangle, retraced 56%, and finally saw a parabolic 12,197% increase towards its all-time high (ATH).

History was repeating itself in 2024 as DOGE came out of the descending triangle, and was in the middle of a corrective phase. Having satisfied the first two criterion, Martinez believed that conditions were ripe for a DOGE bull run.

While analyses and forecasts by reputed analysts do hold weight, it’s always advisable to DYOR before investing, more so for flaky assets like meme coins.

Realistic or not, here’s DOGE’s market cap in BTC terms

DOGE holders dip-buying

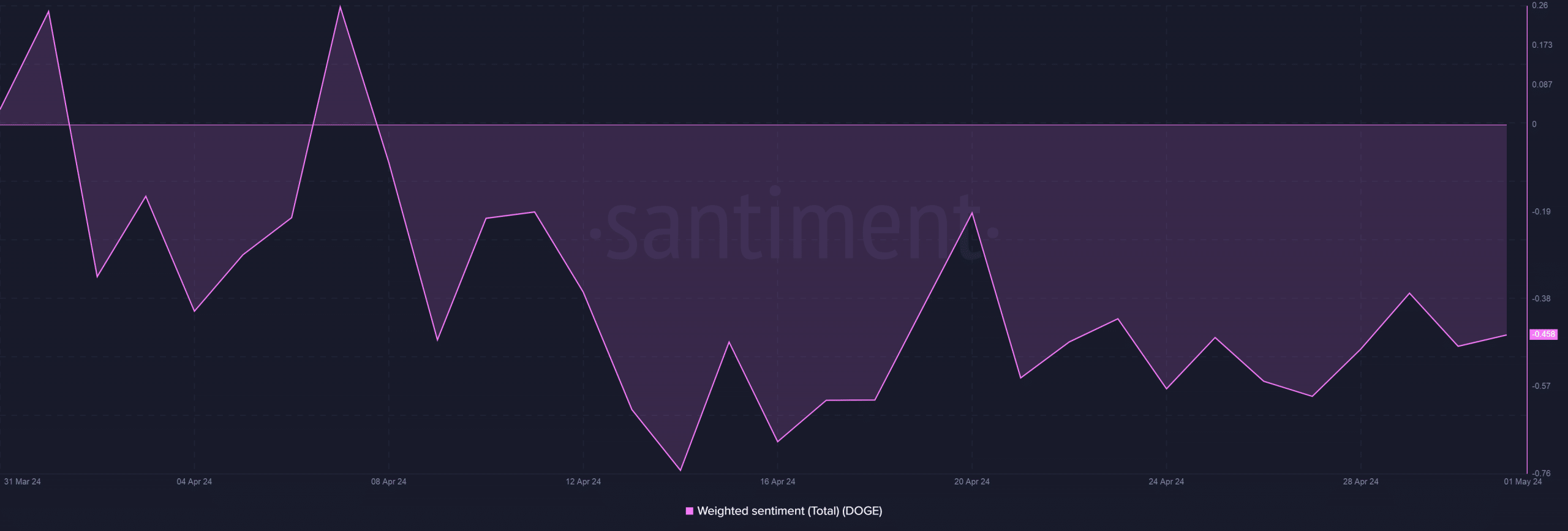

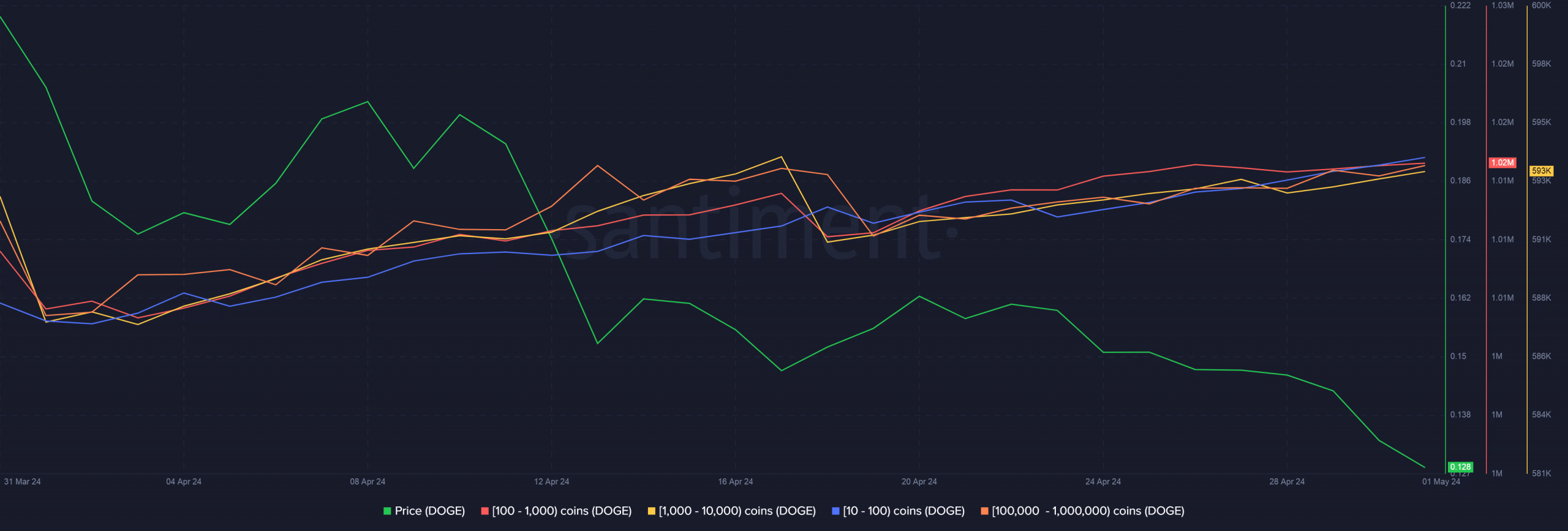

It seemed that certain user cohorts were already aware of the historical equivalence. According to AMBCrypto’s analysis of Santiment’s data, addresses holding between 10 and 1 million DOGE were rose steadily while the price was declining.

The accumulation underlined their belief in DOGE’s bull run and long-term value appreciation.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)