XRP aims for a patterned breakout- Is a 7% hike likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Ripple [XRP] formed a symmetrical triangle pattern on the three-hour chart.

- A patterned breakout on the upside could offer more gains.

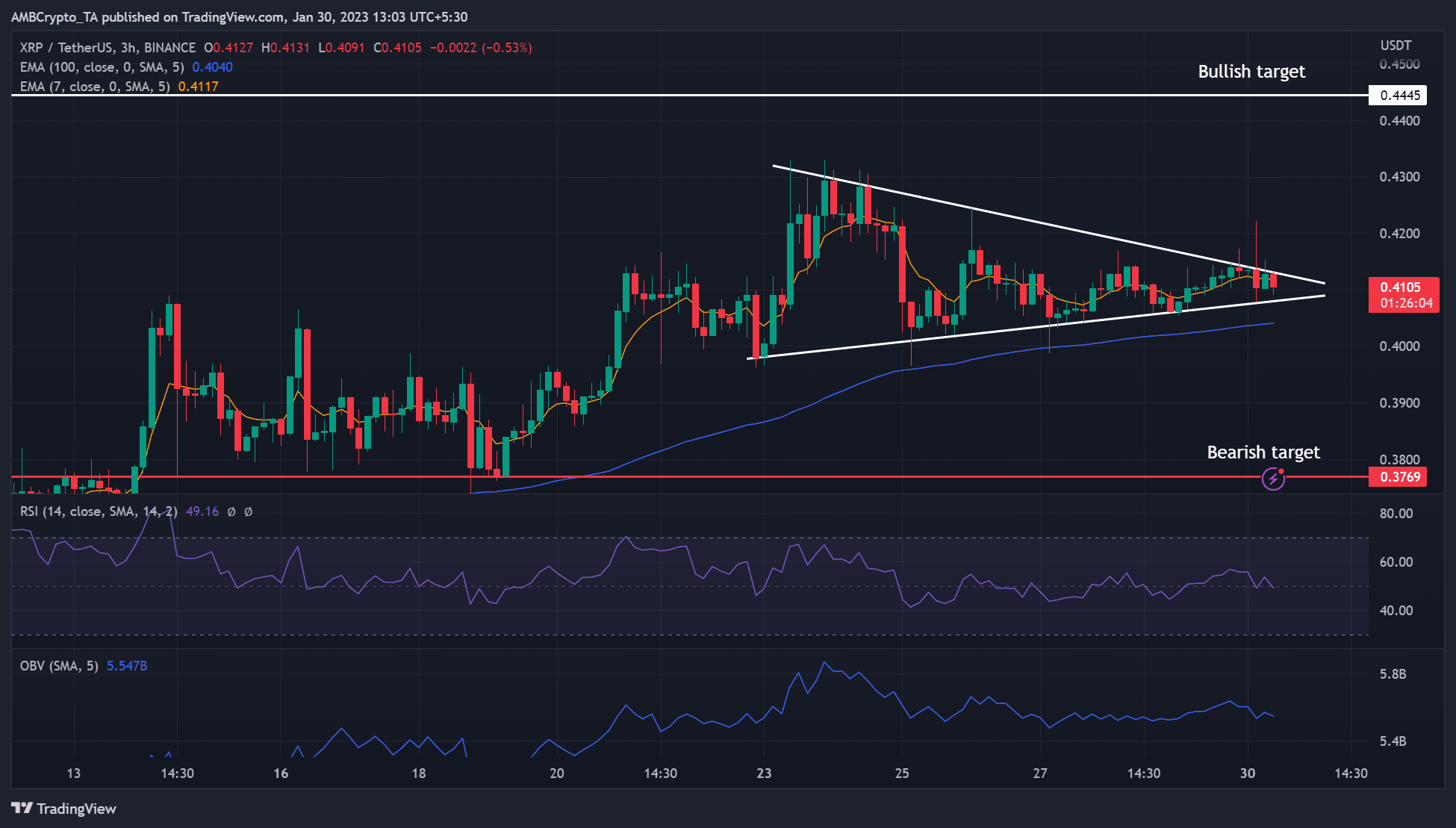

Ripple’s [XRP] recent rally slowed, ushering in short-term price consolidation. Since January 23, XRP’s price action has formed a symmetrical triangle pattern. At press time, XRP’s value was $0.4105 and was close to inflicting a patterned breakout.

Read Ripple [XRP] Price Prediction 2023-24

A symmetrical triangle pattern -Is a bullish breakout likely?

XRP’s structure was almost neutral, as indicated by the Relative Strength Index (RSI) value of 49. XRP bulls could be tipped to break above the symmetrical triangle if Bitcoin [BTC] secures the $23.5K zone and surges upwards.

Such a bullish breakout could aim at the $0.4445 target level, offering a potential 7% hike.

Is your portfolio green? Check out the XRP Profit Calculator

However, bears could inflict a bearish breakout targeting the $0.3769 level and invalidate the above bullish inclination. However, the drop could be checked by the 100-EMA (exponential moving average) line.

So far, two false bearish breakouts have retested the 100-EMA (blue line). A similar trend could see another false breakout retest the line before dropping down to the bearish target.

Therefore, investors and traders should track Bitcoin’s price action, especially on key price levels of $23.5K and $22K.

XRP’s volumes declined, but short-term holders saw profits

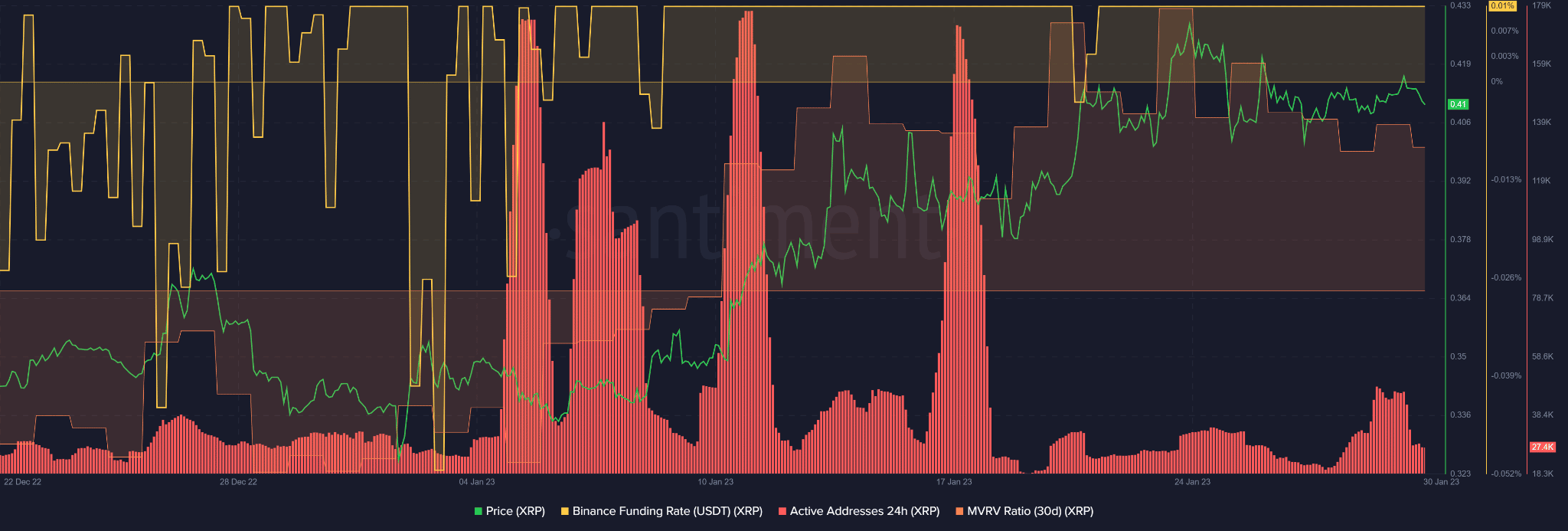

As per Santiment data, XRP daily active addresses spiked recently but recorded a drop by press time. This indicates that the number of addresses exchanging XRP fell sharply, undermining the trading volumes needed to boost the buying pressure and uptrend momentum.

Therefore, a bullish breakout on the symmetrical triangle pattern could be delayed slightly.

Despite the low trading volumes, XRP’s Funding Rate remained positive, indicating that there was a demand for XRP in the derivatives market by press time. It is a bullish sentiment that could bolster XRP’s upward trend if BTC maintains the $23.5K support.

In addition, short-term HODLers saw profits as evidenced by the positive 30-day MVRV (Market Value to Realized Value). Therefore, a bullish breakout could offer short-term holders extra gains.

However, if BTC drops below $23.5K, a bearish breakout could be in play. Therefore, traders should be cautious and consider making long entry positions after a convincing breakout above the triangle and subsequent confirmation of the uptrend above the pattern.