XRP, Bitcoin feel the heat as South Korean crisis shakes crypto markets

- The crypto and financial market in Seoul reacted to the martial law declared.

- BTC and XRP saw major impact, but rebounded.

South Korea’s declaration of martial law and its rapid reversal have rattled the crypto market, creating a sharp spike in volatility. As President Yoon Suk Yeol accused the opposition of threatening democracy, the South Korean crypto market experienced significant turbulence, with Bitcoin and XRP enduring flash crashes.

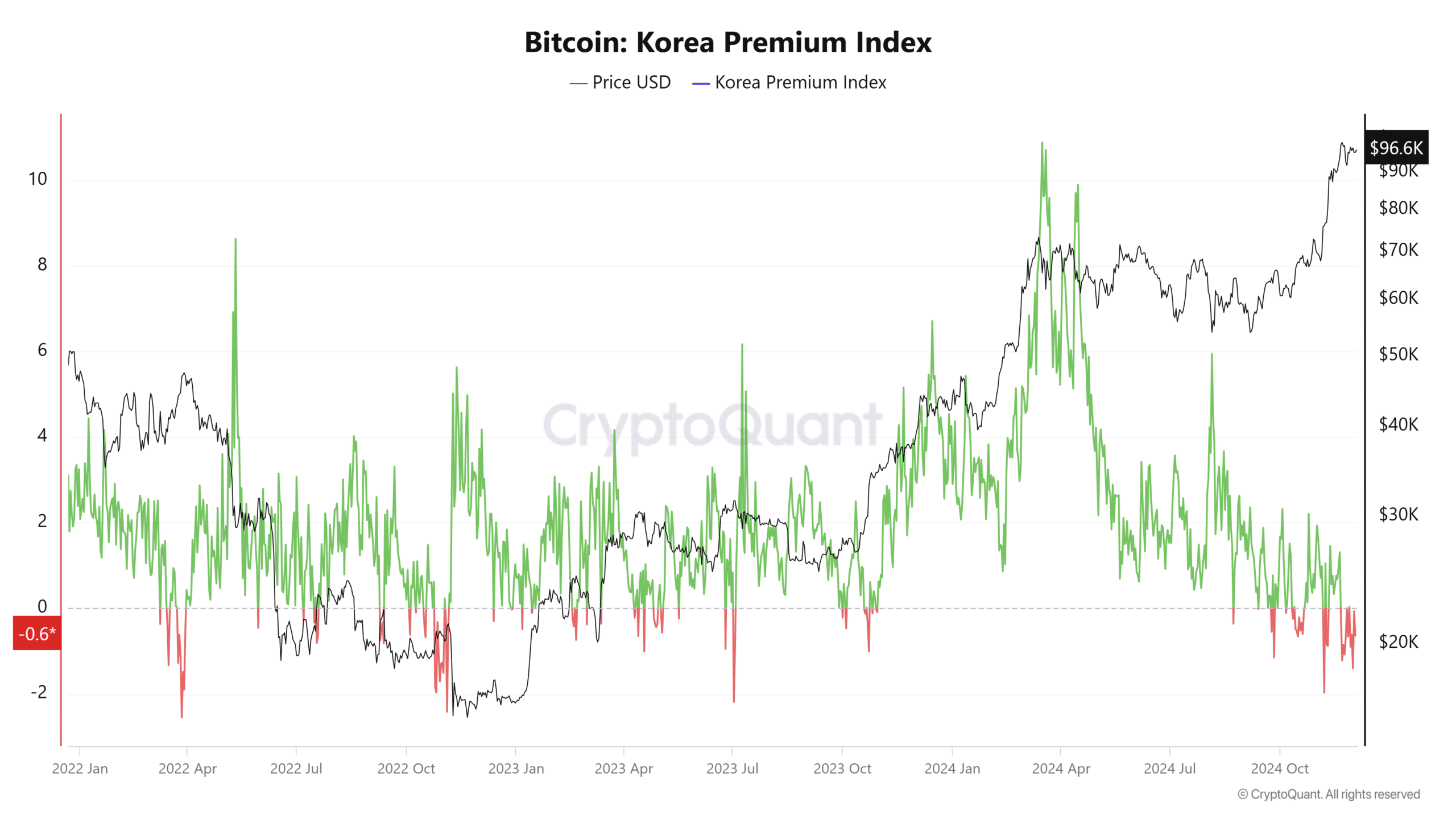

Analysts have pointed to the “Kimchi Premium” – the price gap between Bitcoin on South Korean exchanges and global markets – as a central indicator of the market’s reaction.

Bitcoin’s Korea Premium Index reacts

The Korea Premium Index, which reflects the difference between Bitcoin’s price on South Korean exchanges and the global average, recorded a dramatic decline following the political upheaval.

Historically, a spike in the index often correlates with bullish sentiment in South Korea, fueled by local demand. However, the recent flip into negative territory suggests a sell-off in the domestic market as investor confidence waned amid the crisis.

The chart reveals a steep decline in the premium as Bitcoin fell to a low of approximately $93,000 before recovering to around $96,525.

The sell-off signals an exodus of liquidity from South Korean exchanges, a behavior consistent with heightened political and economic uncertainty.

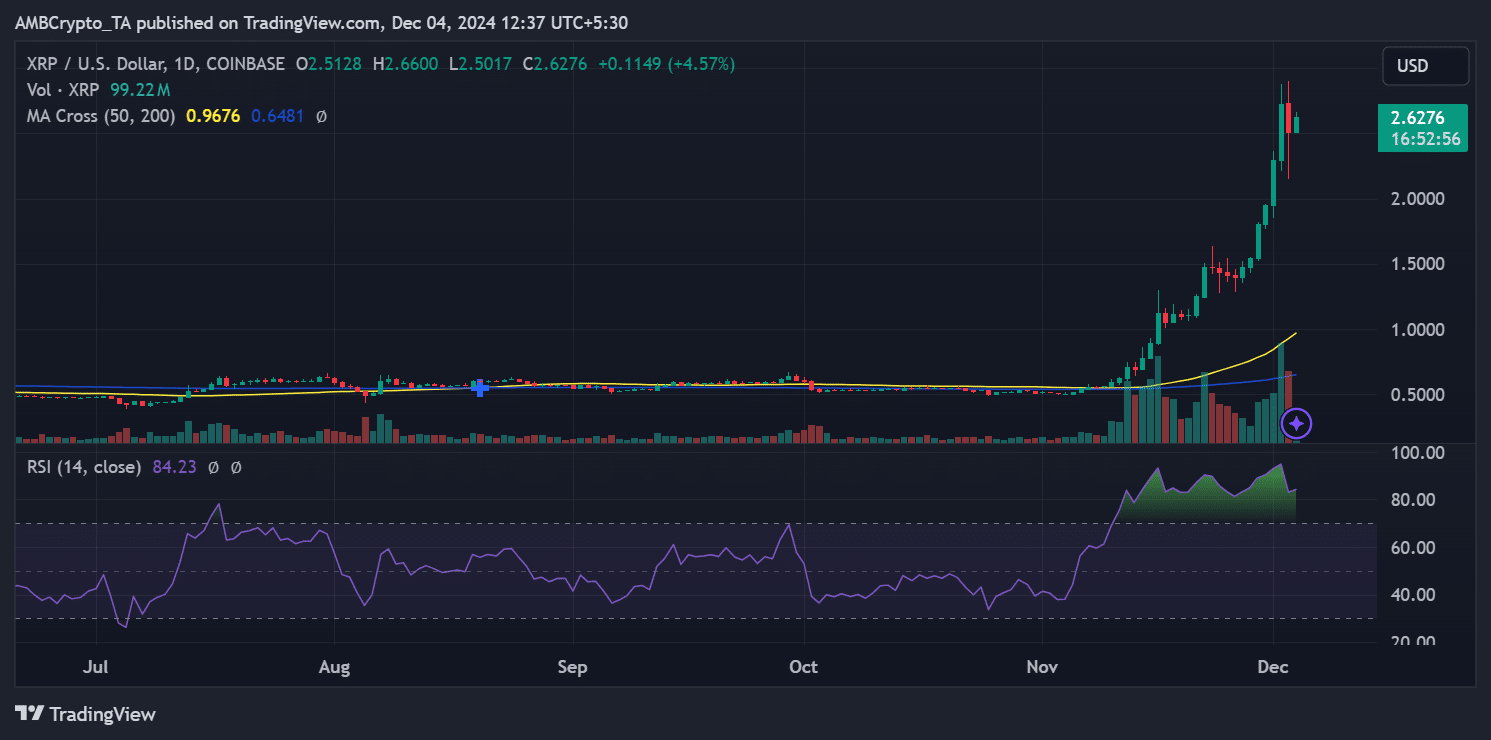

XRP faces parallel volatility

Ripple, another prominent cryptocurrency in South Korea, mirrored Bitcoin’s sharp decline. XRP plunged to $2.15 before rebounding to $2.63, as seen in the price chart.

The Relative Strength Index (RSI) indicates overbought conditions, suggesting that XRP’s recovery may face resistance in the short term.

Additionally, the significant trading volume during the flash crash underscores heightened panic selling and subsequent speculative accumulation. Analysis showed that the volume spiked in the last trading session on 3rd December as the price fluctuated.

South Korea has historically been a major market for XRP, with local exchanges often accounting for a share of global trading volume.

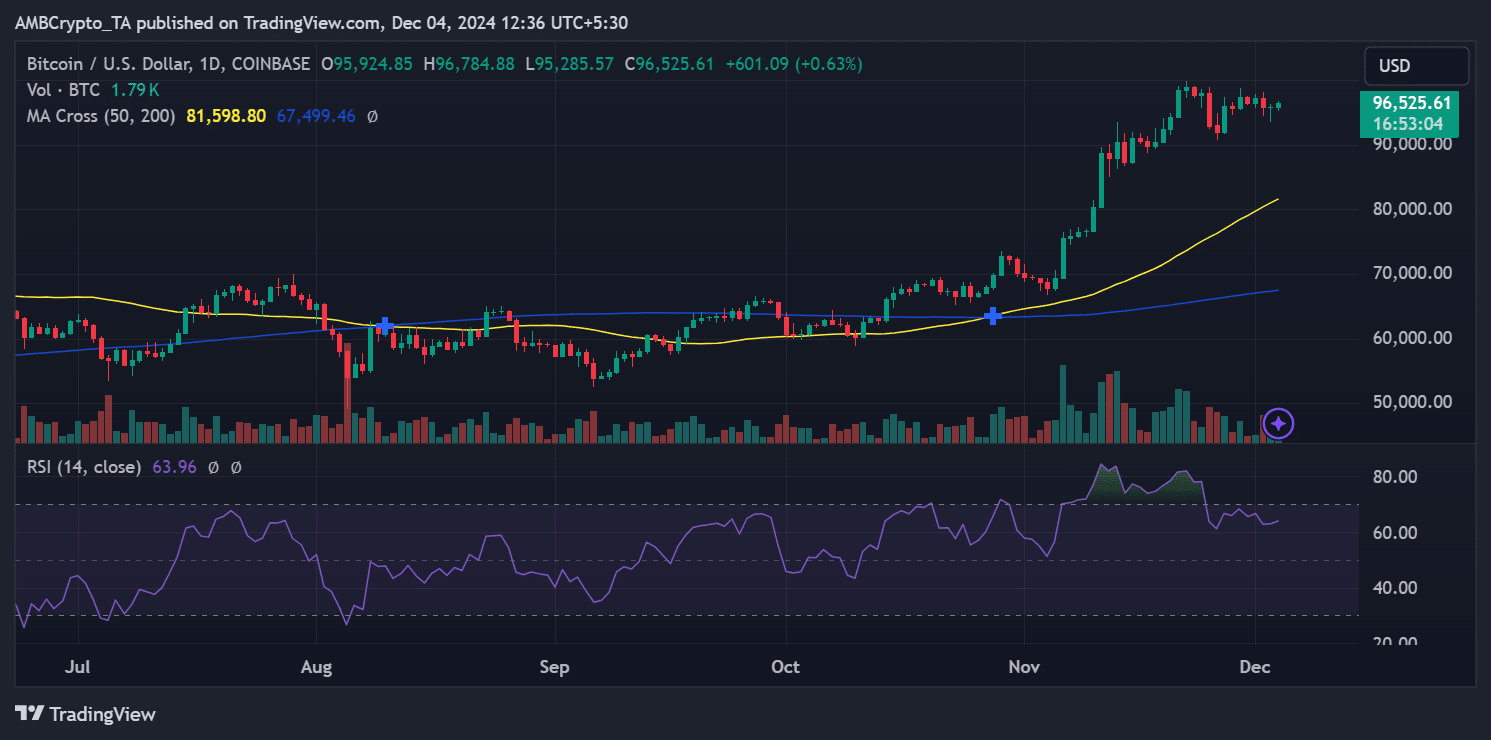

Bitcoin’s trend post-martial law lift

Despite the flash crash and development in South Korea, Bitcoin’s price chart illustrates a broader resilience in the market. The 50-day and 200-day moving averages show a continuation of the upward trend, albeit with signs of cooling momentum.

The RSI for Bitcoin suggests relatively neutral conditions, implying that the flash crash may have been an overreaction rather than a systemic downturn.

The rebound in Bitcoin’s price following the initial dip highlights the broader market’s ability to absorb shocks, even amidst localized turbulence. However, the muted trading volume during the recovery suggests cautious sentiment among global investors.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The unfolding political drama in South Korea has laid bare the vulnerability of crypto markets to external shocks, particularly in regions where digital assets have a strong retail presence.

The sharp fluctuations in Bitcoin and XRP prices reflect both local panic and global opportunism as traders react to evolving conditions.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)