XRP: Bulls and bears locked in struggle – What of prices?

- XRP bearish volumes have been cancelling out any bullish attempts in the last two days.

- XRP’s performance reflects the currently neutral sentiment in the market.

Ripple [XRP] has been struggling to find a directional footing after its bearish performance last week. Could this be an indication of low interest in the currency, or is it a case of price suppression?

There has been a lot of optimism around XRP lately, but the price does not seem to match those sentiments.

The cryptocurrency kicked off October on a bearish tone, which saw it tank by almost 20% in the first week of the month.

A sharp drop in such a brief amount of time usually attracts accumulation at discounted prices, but that was not the case with XRP.

While most of the top cryptocurrencies experienced some bullish momentum during the weekend, XRP only made slight progress on the 4th of October. It has since been moving sideways, within its $0.53 press time price level.

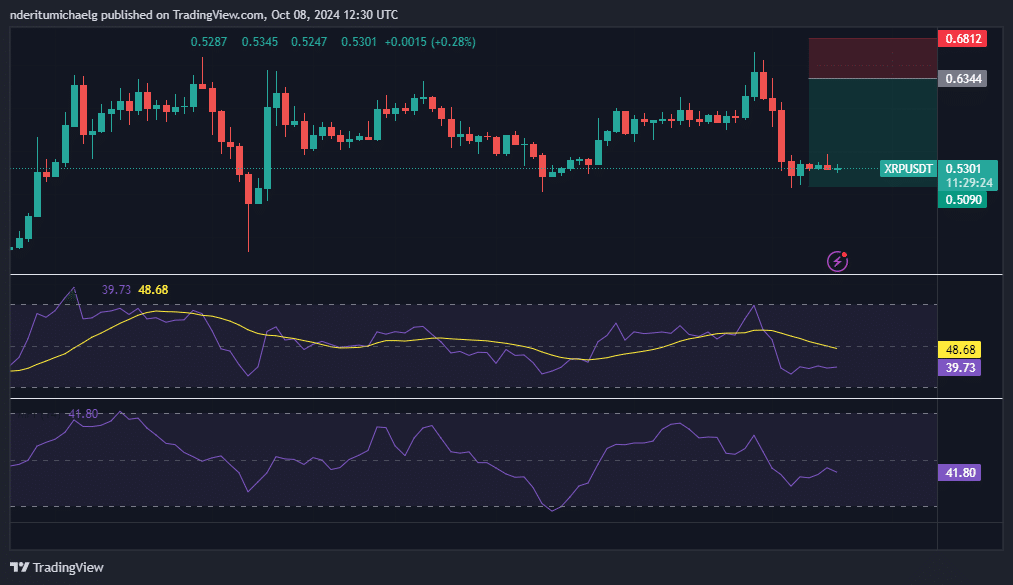

The sideways price movement reflected on the RSI, but XRP’s MFI indicated that there was some potential accumulation taking place.

While the Ripple-native coin did not yield much to suggest that a recovery could be in place, it may also not be an isolated incident.

Top cryptocurrencies including Bitcoin [BTC] and Ethereum [ETH] have been struggling to maintain the bullish momentum that manifested during the weekend.

It is thus not a reflection of XRP demand but rather the market at large.

XRP bulls and bears fight for dominance

As noted earlier, XRP’s money flow indicator demonstrated signs of some liquidity flowing back into the coin. This is consistent with buy and sell data in the last two days.

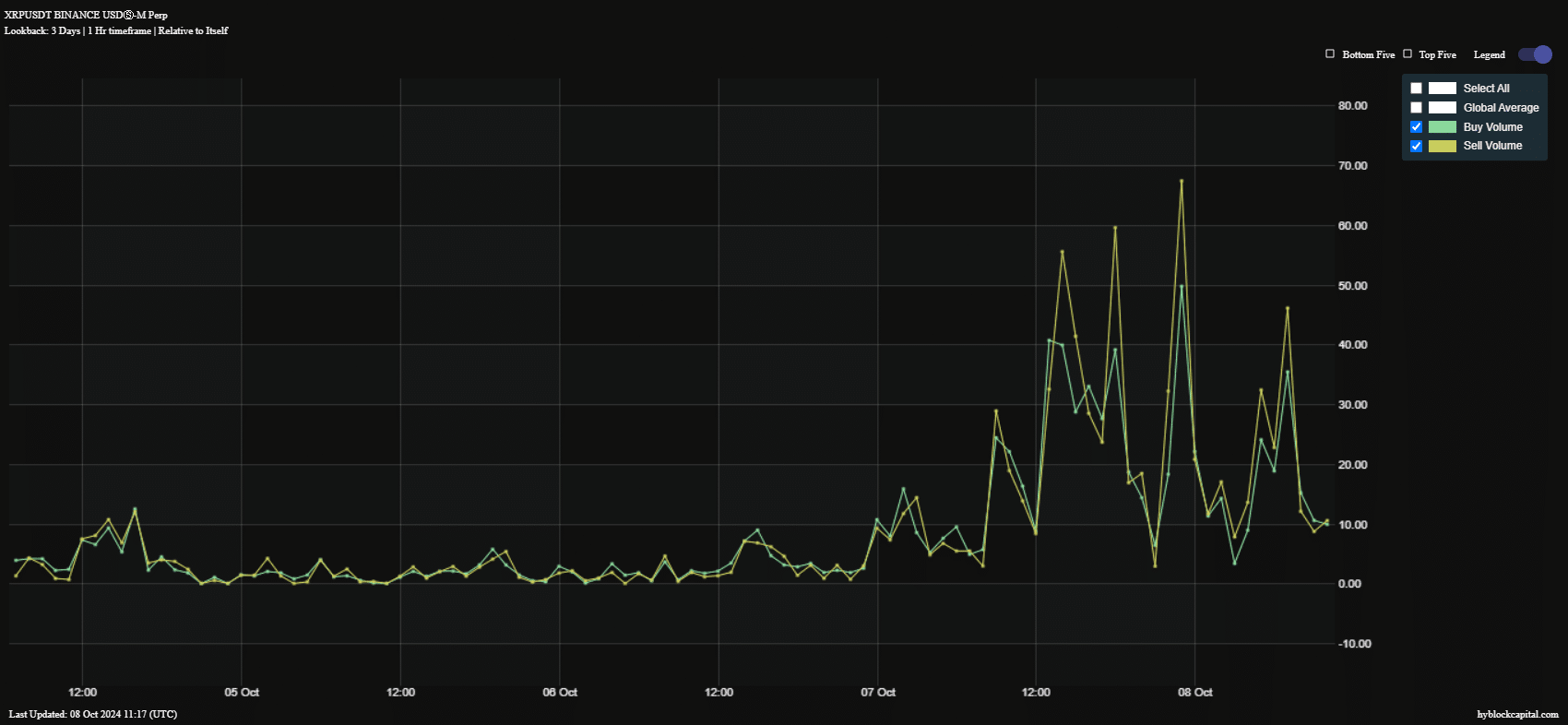

On-chain data revealed that there was a surge in buy volume in the last two days. However, those bullish volumes were watered down by sell pressure.

The above observation suggested that XRP was not moving sideways due to low volume or low demand. It appears that any bullish attempts have been suppressed.

This may indicate that price is currently in a zone of inducement where manipulation is likely to take place.

The signs of price manipulation may not necessarily reveal the next directional move.

Read Ripple’s [XRP] Price Prediction 2024–2025

However, some potential outcomes could include extended downside, to induce selling, followed by a sharp uptick leading to liquidations.

Alternatively, the market may wait out the current phase and gradually build up bullish momentum. The overall market sentiment has been neutral since last week, which may also explain the current liquidity state.