XRP bulls have a chance at driving a rally to $0.52, here’s why

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The formation of a range gave clear levels for traders to set their orders.

- Despite the recent losses, there was a chance that a breakout toward $0.5 could occur.

Bitcoin saw a bounce in prices after a retest of the $27.8k mark as support, but the volatility witnessed in the past 24 hours meant both bulls and bears must be cautious. For XRP, the lower timeframe bias was bearish but this could change soon.

Read XRP’s Price Prediction 2023-24

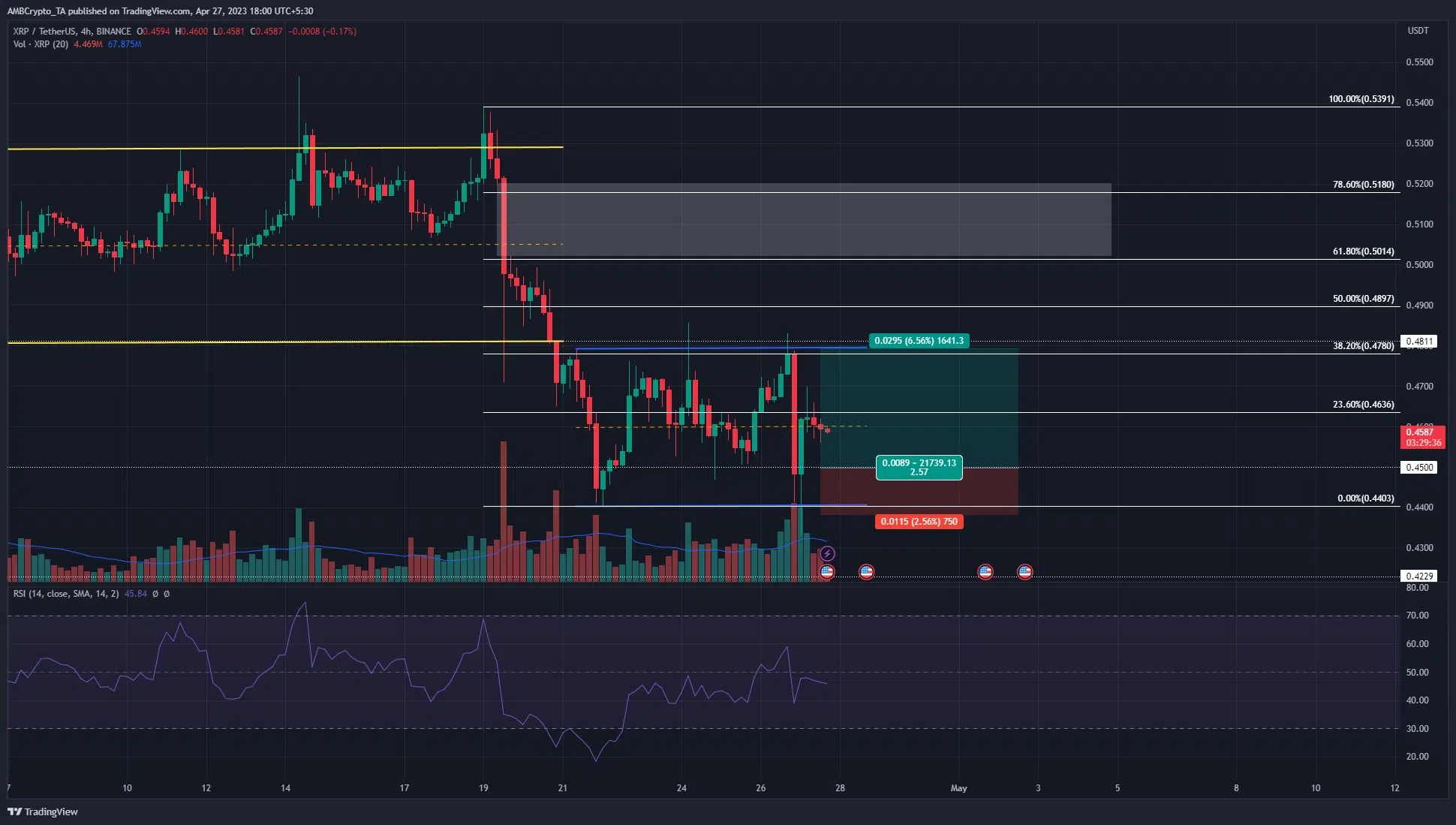

XRP formed a range on the lower timeframes that extended from $0.44 to $0.48. At press time the bulls fought to overcome the $0.46 resistance, but have not succeeded after 12 hours of trying.

A confluence of imbalance and golden pocket presented a reasonable target in the event of a breakout

The 4-hour chart showed that the market structure was bearish after the strong drop in prices on 26 April. Since then XRP has seen buyers effect a bounce from $0.433 to $0.458 at press time, but the RSI remained beneath the neutral 50 mark.

The $0.45 level has served as support over the past week, and a retest would likely offer a buying opportunity. Invalidation would be a move beneath the range lows at $0.44.

Bulls can target the range highs at $0.48 to take profit, but there was the possibility of a bullish breakout as well. The move beneath the former XRP range was used to plot a set of Fibonacci retracement levels (white).

Is your portfolio green? Check the XRP Profit Calculator

These levels showed that the 61.8% and 78.6% retracement levels sat at $0.5 and $0.518. Moreover, the drop from $0.539 on 19 April was accompanied by the development of a fair value gap in the $0.5 area, highlighted by the white box.

Hence, a move above $0.48 would likely climb to this area to fill the imbalance. Thereafter, a rejection could occur to take XRP back toward $0.44 or lower.

Sentiment remained bearish but rising demand showed a short-term rally was possible

Source: Coinalyze

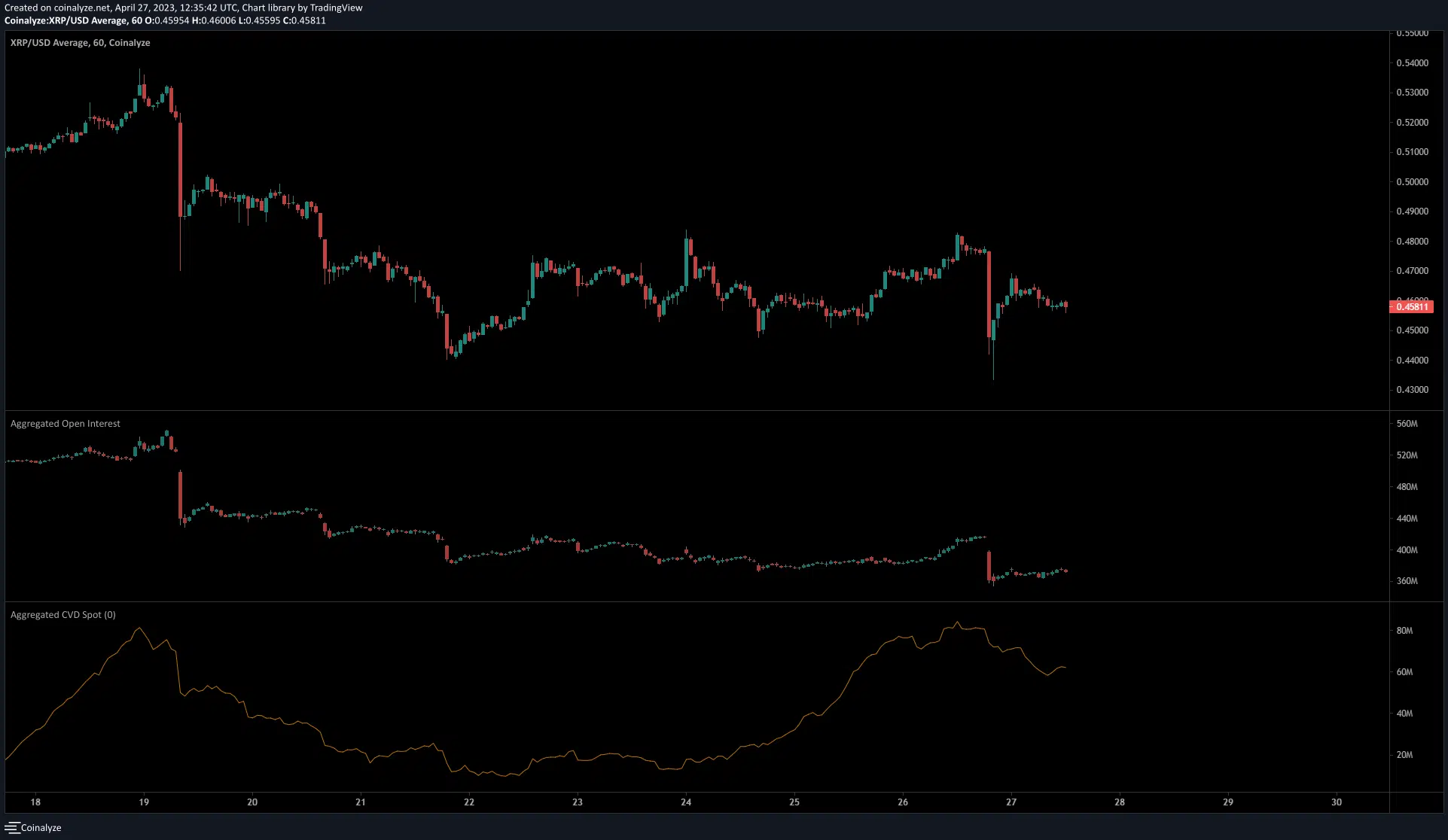

The 1-hour chart from Coinalyze showed that spot CVD has risen massively since 25 April, although it dropped over the past 24 hours to show some bullish exhaustion.

Overall the trend has been upward in the past three days, which showed significant buying pressure could push XRP prices higher once again. A continued descent on the CVD in the coming days could dishearten buyers and embolden sellers.

In contrast, the Open Interest was mostly flat in the past ten days, with sudden drops on the chart when XRP experienced sudden price moves downward.

The falling OI indicated that sentiment was bearish and long positions were discouraged. If this changes, a breakout past $0.48 would become more likely.