XRP bulls remain dominant as they look to defend the gains following SEC victory

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The 1-day and 4-hour price charts remained bullish as the $0.7 area continued to serve as a demand zone.

- There is the possibility of a deep retracement toward $0.6, especially if Bitcoin faces a drop below $29.7k.

The ruling last week that Ripple [XRP] did not violate federal securities law saw the token pump wildly, gaining 70% in value within a day. Investors must be excited that XRP is “not a security” as it inspires confidence and brings regulatory clarity across the crypto landscape.

Read XRP’s Price Prediction 2023-24

The price action of XRP on the 1-day chart showed it has multiple levels of support to the south that need to be breached before its outlook gets flipped to the bearish side. First among them is the $0.7 level, which has seen demand in the past few days.

The 50% retracement level has been defended as support thus far

After the strong rally last week, the XRP bulls have not relinquished their hold on the market. The OBV showed that even though there was some selling pressure, the buyers have remained the stronger of the two and prices are likely to go higher.

It could take some time, as a sudden rally of this magnitude could face enormous selling pressure from profit takers. In that case, the Fibonacci retracement levels should be places where the bulls make a stand. Hence, positional traders can maintain a bullish outlook till the $0.566 level, which represented the 78.6% retracement level based on the recent surge.

For lower timeframe traders the $0.7 level is critical, and they can look to buy XRP upon a drop to the $0.67-$0.7 region. Their target would be the 23.6% extension level at $1.05, a level that XRP has not traded at since March 2022.

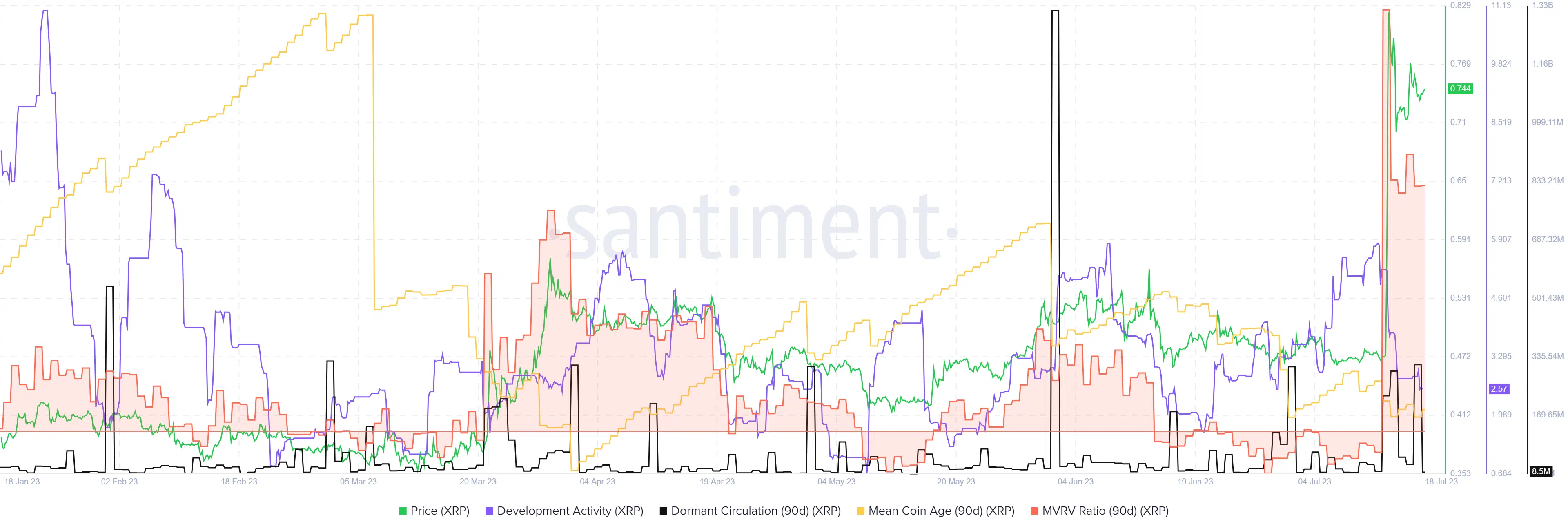

The high MVRV showed XRP could fall in the face of selling pressure

Source: Santiment

The 6-month chart from Santiment showed that the 90-day MVRV ratio climbed well past the 2023 highs. This was a sign that the asset was overvalued.

How much are 1, 10, or 100 XRP worth today?

A retracement might be useful for investors to build a position. The development activity took a tumble in July but this need not bother long-term buyers.

Surprisingly, the 90-day mean coin age has been in a downtrend since June. This showed the token was not in a phase of accumulation. It strengthened the idea that sellers could soon come out on top. Based on the price action, the $0.56 and $0.645 levels need to be breached before bulls would be deeply concerned.