XRP can reach $1 in 2024, but a massive challenge remains

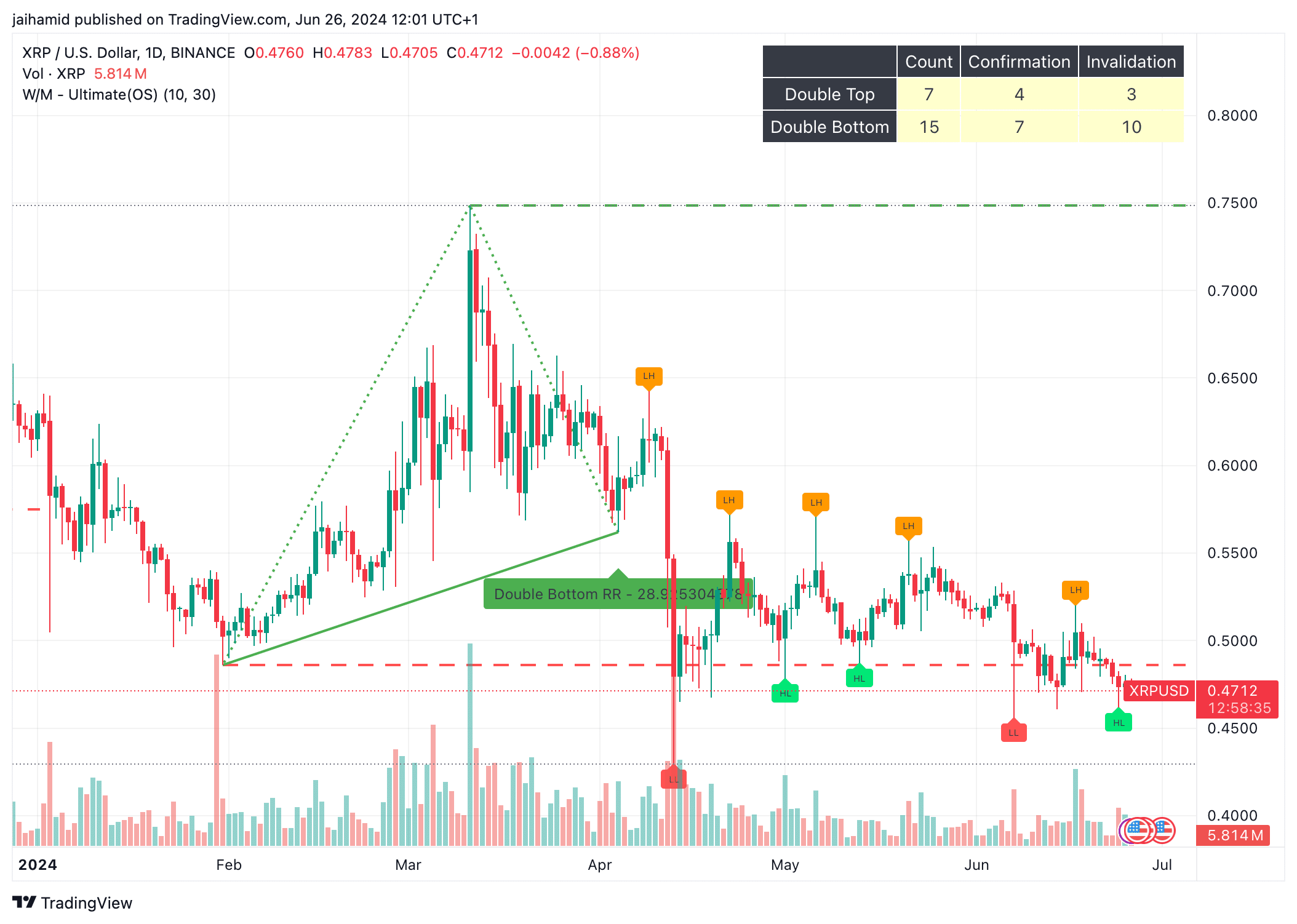

- XRP showed signs of a bullish reversal, with a double-bottom formation at $0.40.

- The Ultimate Oscillator and RSI suggested a balanced state without strong buying or selling pressure.

XRP has recently exhibited a modest bullish reversal, sparking speculation about a potential massive rally.

This upward momentum has raised questions about whether XRP can sustain this trend and finally trigger a larger market surge.

AMBCrypto examined the XRP/USDt chart and saw a double-bottom formation around $0.40, meaning a bullish reversal occurred there.

Post the double bottom formation, the price experienced a rebound but has been facing resistance around the $0.55 level, as highlighted by the recent highs.

The repeated tests of this resistance without a breakthrough will either consolidate for another attempt higher or turn down again if buyers lose momentum.

The current readings of the Ultimate Oscillator around the mid-level indicate neither strong overbought nor oversold conditions, suggesting a lack of decisive momentum in the market.

What challenges XRP’s bullish outlook?

The main challenge for XRP is to break and hold above the $0.55 resistance. Doing so could confirm a continued bullish reversal pattern and potentially lead to a test of higher resistance levels at around $0.65.

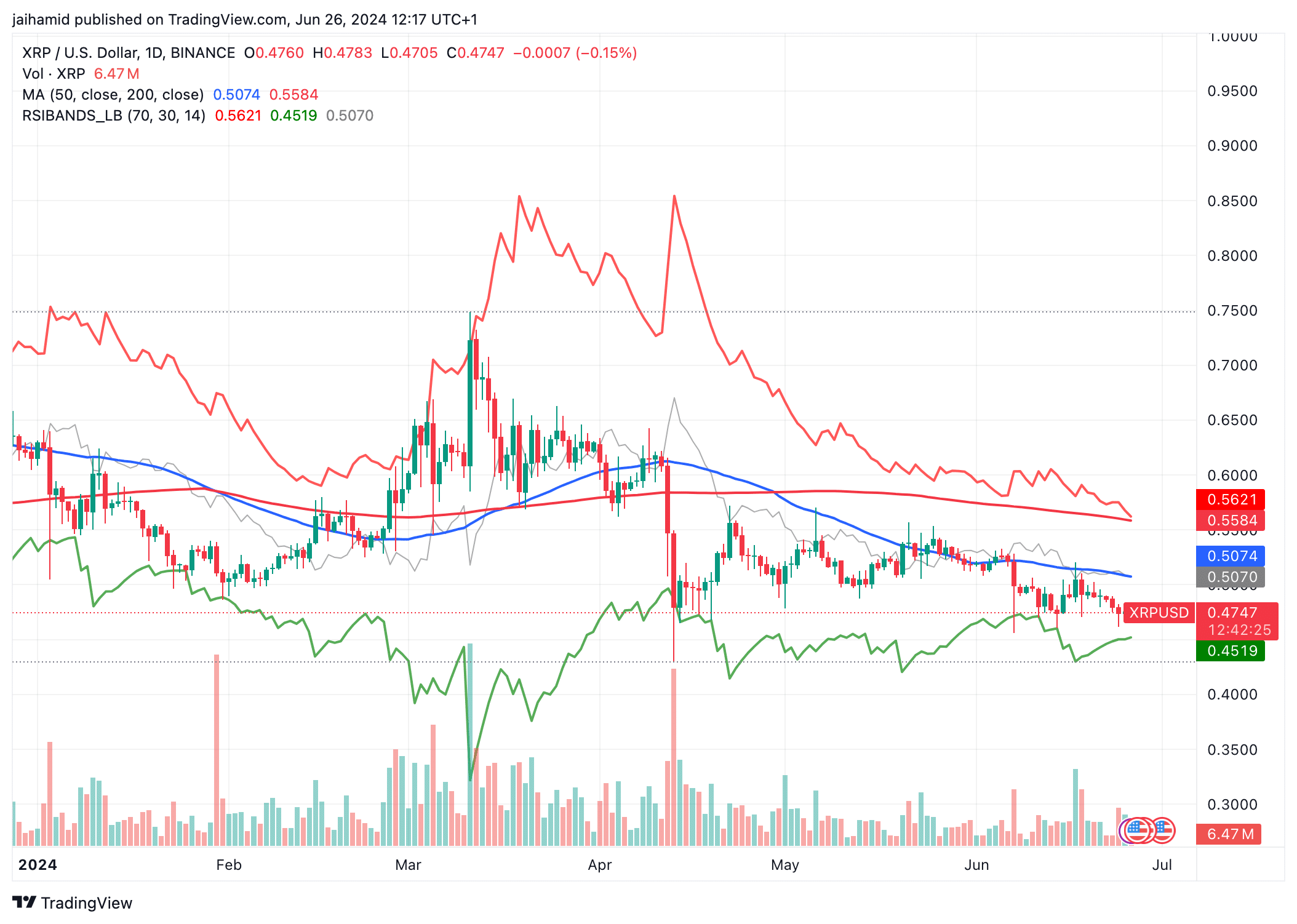

The Relative Strength Index (RSI) adjusted to bands was showing a value just below the midpoint (50) at press time, which suggested that the price was neither in the oversold nor overbought territory.

XRP’s price has been fluctuating within a relatively narrow range between the MA50 and the support line at approximately $0.4519.

This could bring consolidation, with traders potentially waiting for a clearer signal before making larger moves.

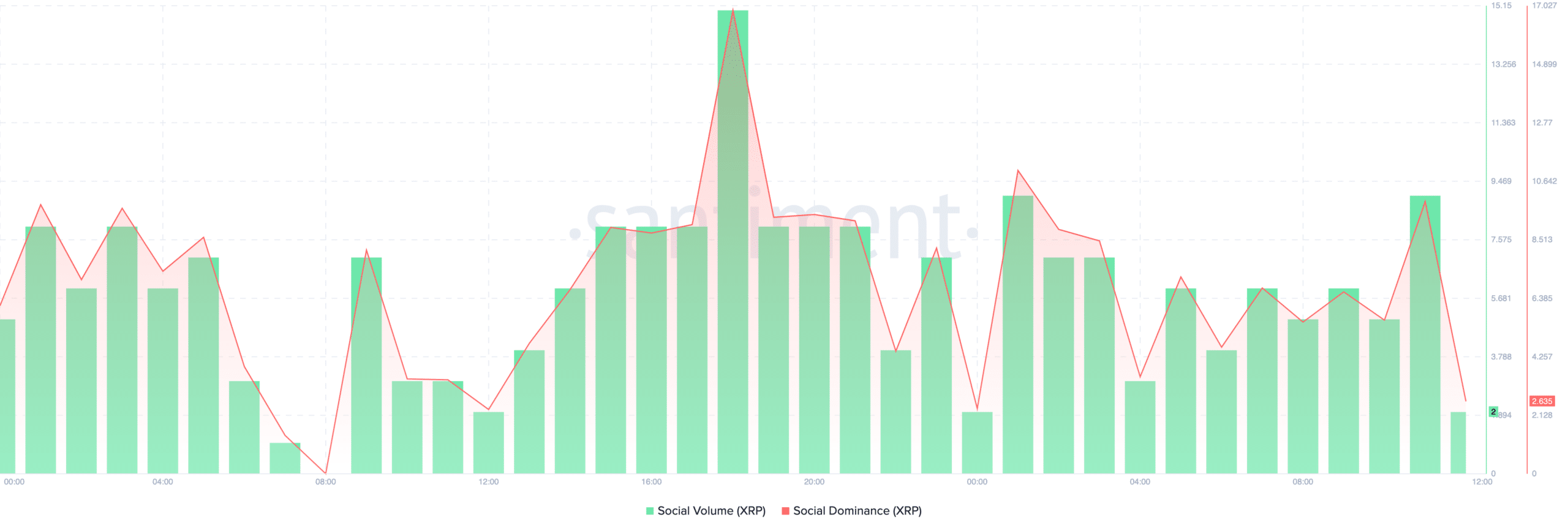

The convergence of the moving averages means there are bearish undertones due to the placement of the MA200. XRP’s Social Dominance and Volume remained strong, correlating with major trading activity.

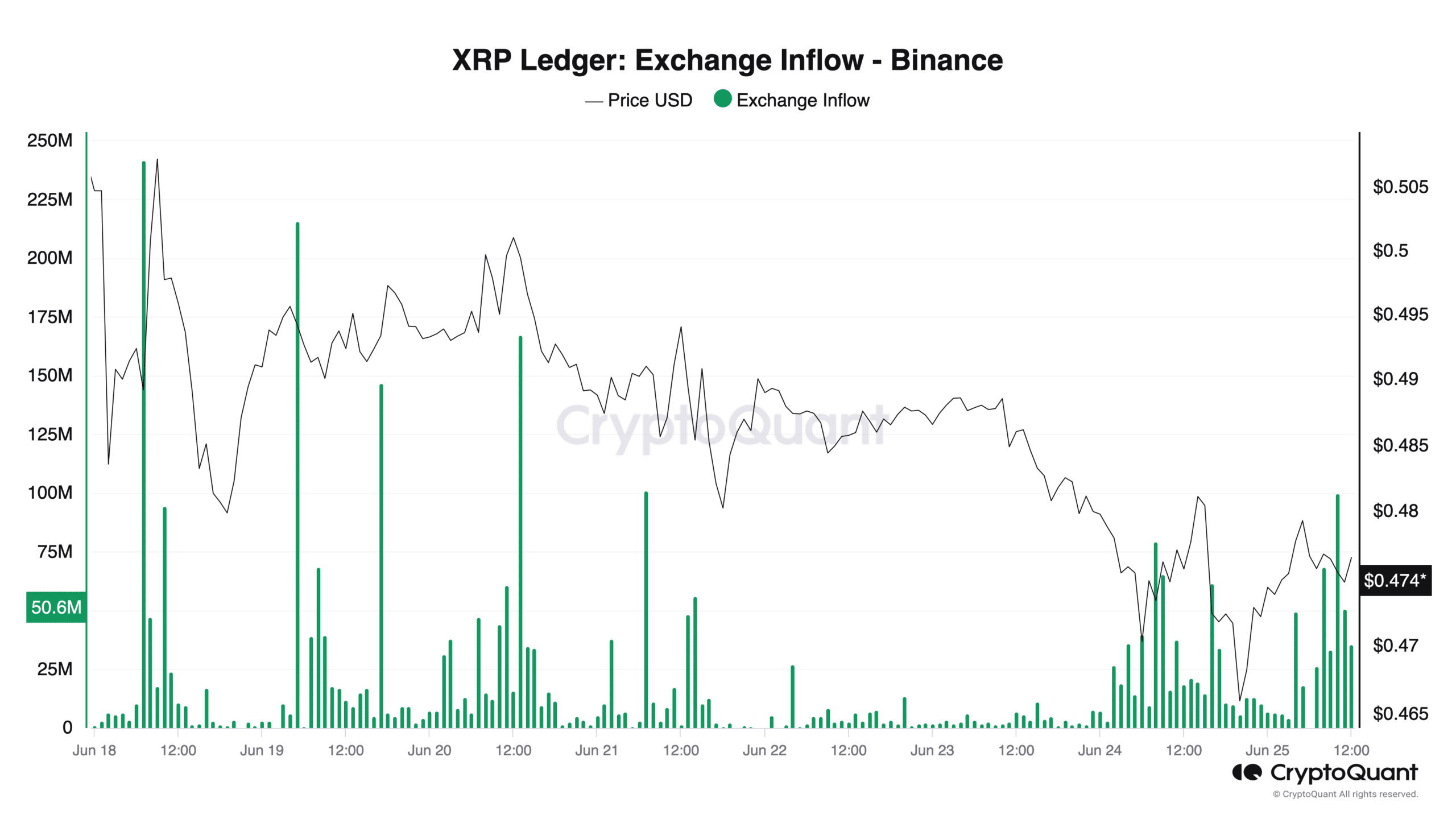

There is some degree of correlation visible between exchange inflows and price dips.

Is your portfolio green? Check out the XRP Profit Calculator

For instance, spikes in inflow on the 19th and the 22nd of June corresponded with noticeable drops in the price, suggesting selling pressure following the inflow.

High inflows might also reflect a bearish sentiment among investors, prompting them to sell off their holdings, possibly in reaction to market news or price expectations.