XRP consolidates below range lows- Here are key levels to consider

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

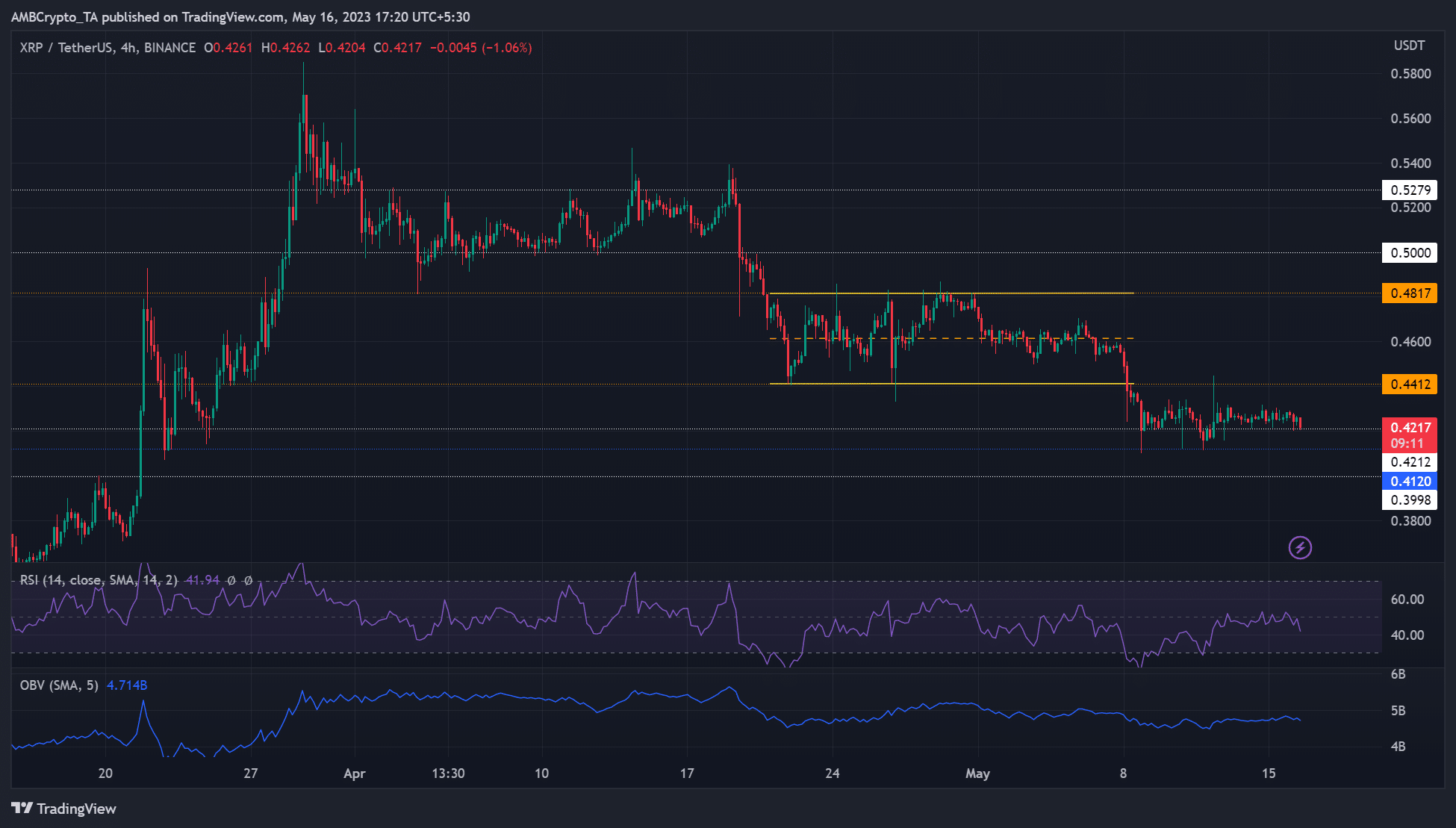

- XRP consolidated narrowly below the previous $0.44 – $0.48 range.

- Liquidation and open interest rate data at press time leaned toward bears.

Ripple’s [XRP] performance on the price charts has been muted for the past three weeks. Nevertheless, a recent report established that those holding 1-10 XRPs increased in mid-April despite the declining network traction.

How much is 1,10,100 XRPs worth today?

In mid-April, XRP dropped from $0.55 before consolidating between $0.44 and $0.48. Bears breached this range on 8 May after Bitcoin [BTC] dropped to $26k.

In the past seven days, XRP has been trading narrowly between $0.41 and $0.44, with the previous range lows becoming a key hurdle for near-term bulls.

Is a breakout likely?

The previous range lows of $0.44 have rejected bulls’ efforts to go beyond this level. This has forced XRP to oscillate narrowly between $0.412 and $0.441 since 8 May.

In the meantime, the 4-hour RSI oscillated between the median level and lower ranges – indicating limited buying pressure. Similarly, the OBV appeared flat – confirming demand wavered in the past few days.

If the trend persists, XRP could continue oscillating between $0.412 and $0.441 in the next few hours/days. Ambitious bears could, however, stretch XRP losses to $0.3998. Traders could target range highs and lows for profit-taking.

On the upside, near-term bulls could clear the $0.44 obstacle if BTC surges beyond $27k. Such an upswing could set XRP to target the former mid-range level of $0.462 or the range high of $0.48.

Sellers had slight leverage in the futures market

Is your portfolio green? Check XRP Profit Calculator

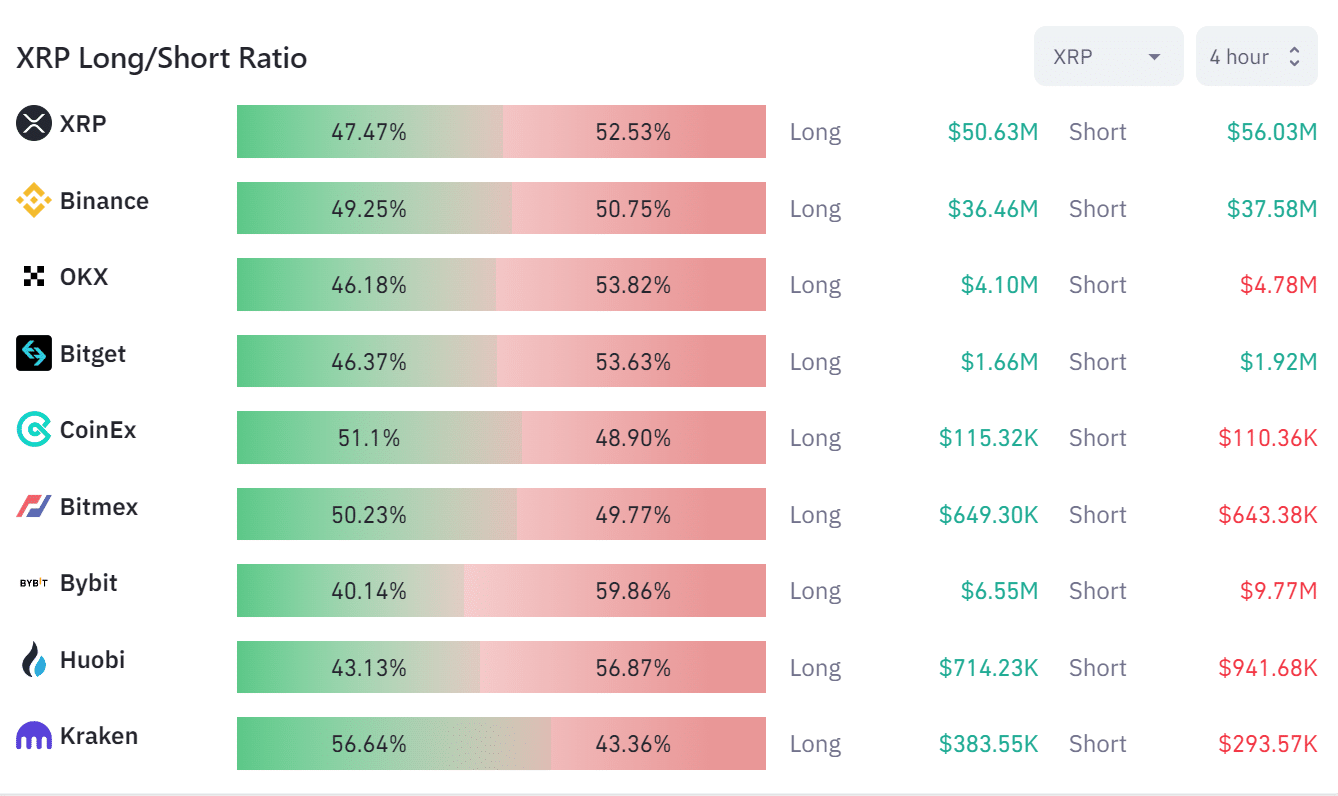

According to Coinglass data, XRP’s exchange long/short ratio showed sellers dominated at 52.53% on the 4-hour timeframe. Long positions stood at 47.47%, reiterating a slightly bearish bias in the futures market.

On the liquidation front, more than $500k worth of long positions were wrecked in the past 24 hours. However, less than $50k of short positions suffered liquidations in the same timeframe, confirming the bearish outlook in the futures market.

Ergo, the $0.44 obstacle could persist for near-term bulls unless the market sentiment takes a U-turn.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)