XRP defends $2 – A deeper pullback is still possible IF…

- XRP futures traders de-risk amid market-wide volatility.

- Bullish signals were emerging – Will the bulls seize the opportunity?

Ripple [XRP] defends the critical $2 support, but with “extreme” fear gripping the market, its resilience faces a crucial test.

Unlike most high-caps, XRP’s daily chart shows strong support, with sellers rejected at key levels, reinforcing a bullish structure.

With the RSI bottoming out and futures traders deleveraging to three-month lows, over $1 billion in liquidations last week, Ripple eyes a potential rebound once spot selling pressure eases.

However, a 40.97% drop in volume signals weak conviction at the $2 level, suggesting it hasn’t been fully established as a “dip.”

For a sustained recovery, larger players must absorb the ongoing de-risking pressure.

XRP at crossroads: Fight or flight?

Despite a sharp rise in outflows from Binance, volumes remain well below the 1.6 billion recorded in early February, when Ripple dropped to $2.30 – sparking a 17% rebound the following week.

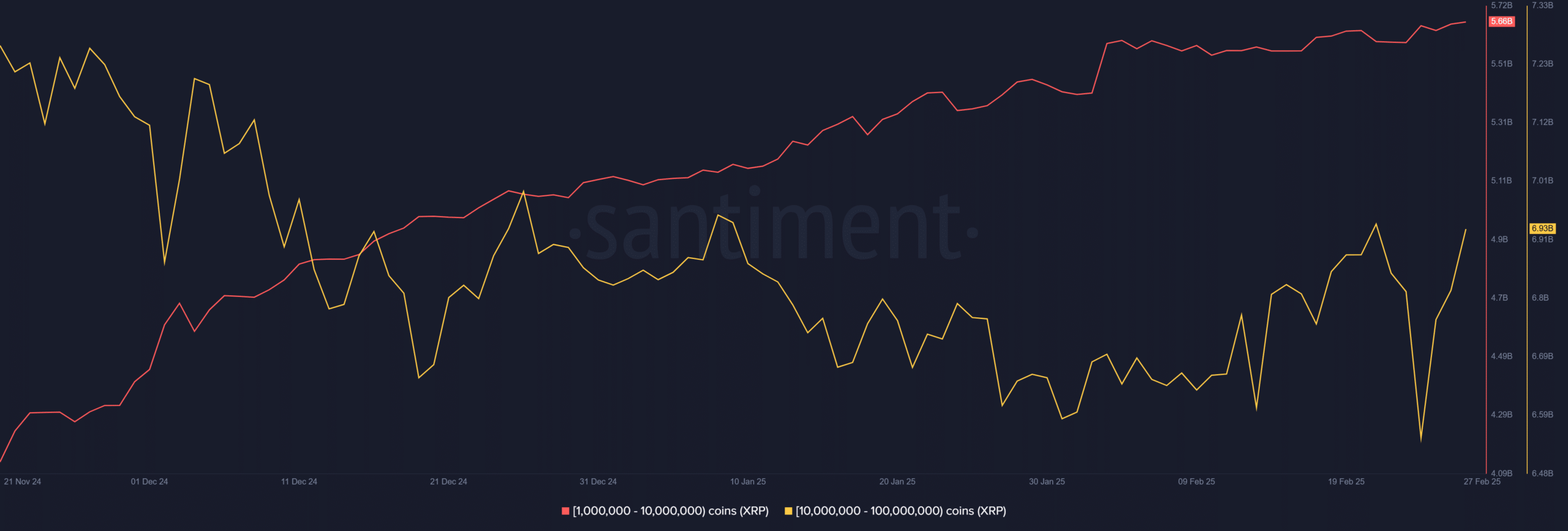

Retail participation remains muted, with FOMO yet to kick in. However, whale wallets holding 1M – 10M XRP have climbed to a three-month high of 5.66 billion XRP.

Additionally, wallets holding 10M – 100M XRP have accumulated 390 million XRP in the past three days, reinforcing buy-side liquidity.

This strategic accumulation has kept Ripple above the $2 support, with the altcoin trading at $2.22, at press time.

Futures traders are unwinding positions, and big players are absorbing the sell-side pressure. However, a definitive bottom remains elusive until retail capital re-enters the market.

Speculative positioning remains a key factor. If futures traders ramp up leverage while spot demand lags, the risk of long squeezes could stall accumulation.

Monitoring liquidity dynamics is crucial, so caution remains warranted.