XRP ETF is ‘inevitable’: Ripple CEO confident despite SEC hurdles

- XRP CEO demonstrates confidence in a possible ETF.

- Garlinghouse’s statement triggers a price uptick.

Bitcoin [BTC] exchange-traded funds [ETFs] have been a massive hit since their launch. This has encouraged institutions to replicate this success with other altcoins.

After the launch of Ethereum [ETH] ETFs in July, all eyes are now on the XRP ETF, the cryptocurrency tied to Ripple.

However, given Ripple’s regulatory troubles, is an XRP ETF approval even possible?

XRP ETF dreams may come true

In a recent interview with Bloomberg TV, Ripple CEO Brad Garlinghouse shed light on the matter, expressing confidence in the future of such an ETF. He said,

“It’s just inevitable. You’re going to see not just Bitcoin and ETH, you’re going to see an XRP ETF.”

Garlinghouse emphasized the growing demand from both retail and institutional investors for access to digital assets, noting the rapid success of the Bitcoin ETF as a clear sign of this trend.

He suggested that the introduction of an XRP ETF would be a natural step in this evolving market.

BTC ETFs are an exception, not the rule

The allure of altcoin ETFs may be strong, but their success is far from guaranteed. AMBCrypto has previously reported on ETF ETFs’ underwhelming inflows compacted to BTC ETFs.

While many argue that the former has fallen short of expectations, Garlinghouse begs to differ.

The exec remarked,

“I actually think the ETH ETF has done very well.”

He elaborated that the market participation levels have been proportional to its market dominance.

Furthermore, Garlinghouse underlined the growing community interest surrounding XRP, both in the U.S. and globally, expressing optimism that an XRP ETF would also perform well.

XRP ETF filings and SEC troubles

Meanwhile, to date, AMBCrypto noted that only two firms have filed for an XRP ETF— Bitwise and Canary Capital.

In addition, Grayscale has submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to convert its multi-crypto fund into an ETF, which includes XRP.

Nonetheless, the path to an XRP ETF is far less straightforward than that of Bitcoin or Ethereum.

The SEC remains a major obstacle, primarily due to Ripple’s ongoing legal battle with the agency over whether XRP should be classified as a security.

While a federal judge ruled that XRP is not a security when sold to retail investors, the SEC’s appeal and its broader reluctance to approve crypto ETFs continue to complicate the situation.

Impact on price

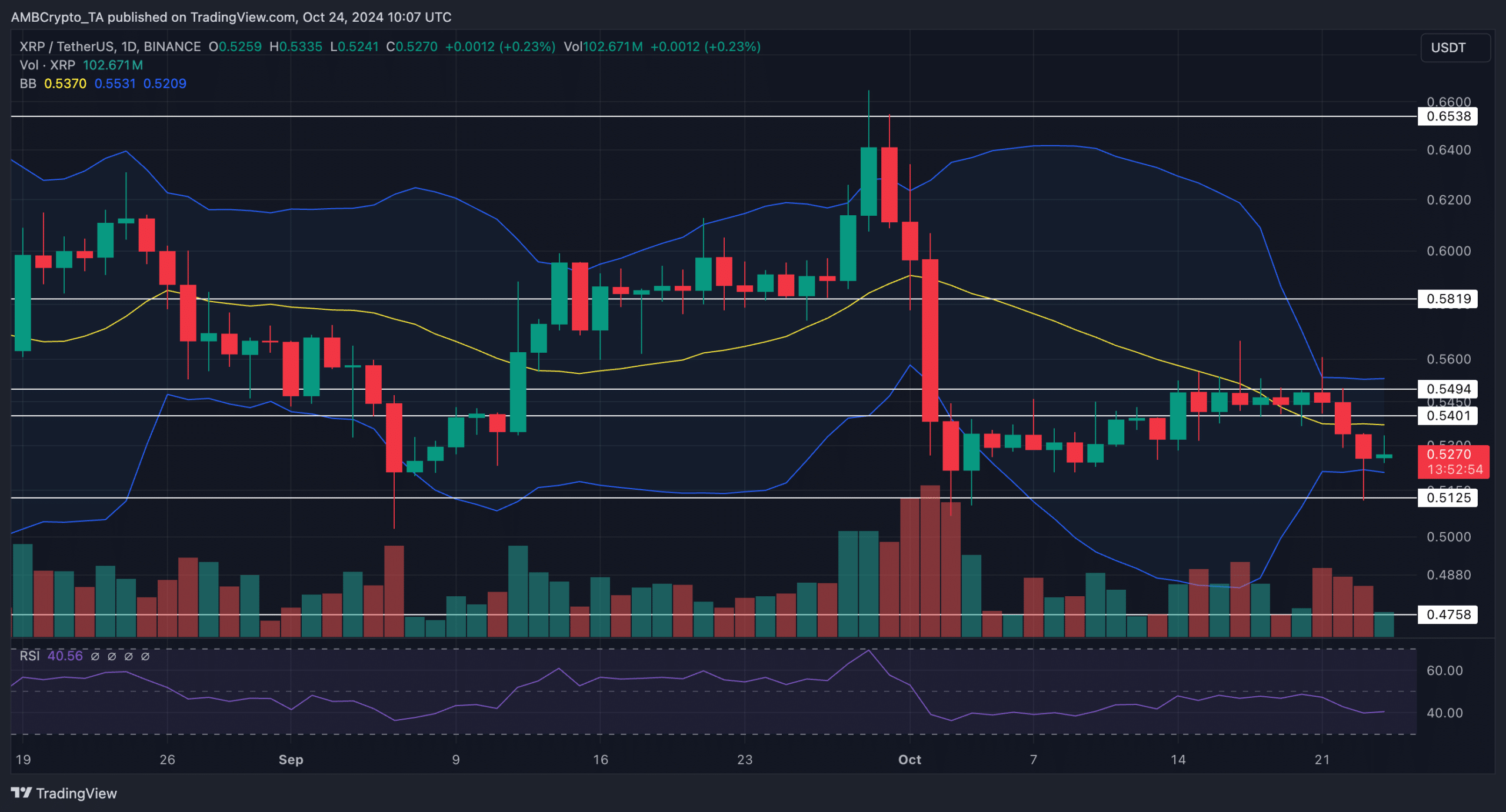

Following Garlinghouse’s statement, XRP rose over 0.20% over the last 24 hours. Yet, this slight uptick was overshadowed by the double-digit losses in the last month.

Last week, the price consolidated within the $0.59 to $0.54 range. The failure to break above the former triggered a drop to a low of $0.51. At press time, XRP was trading at $0.52.

The RSI stood at 40.56, an improvement over the previous day. Additionally, volatility was lower, as evidenced by the proximity of the Bollinger Bands.