XRP ETF ‘likely next in line’ after Bitcoin and Ethereum, reveals Ripple exec

- Ripple exec stated that an XRP ETF approval was likely this year.

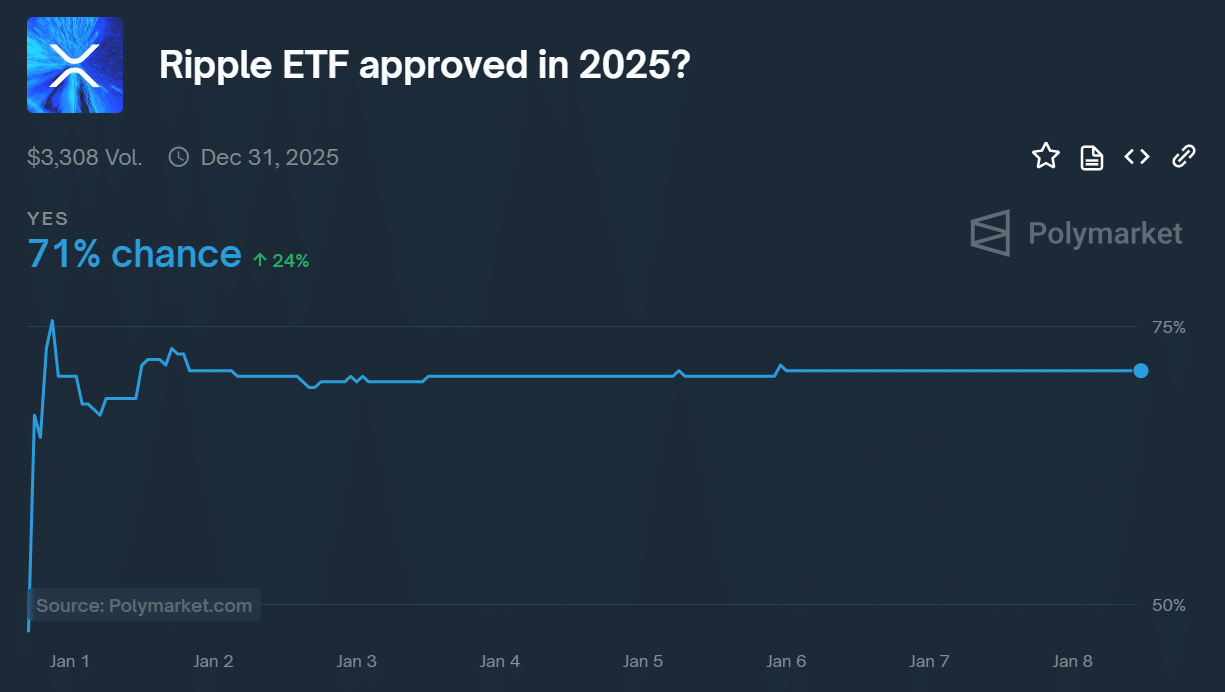

- Polymarket priced a +70% chance of ETF approval in 2025.

The crypto market is strongly optimistic about the potential approval of several altcoin ETFs in 2025.

In a recent Bloomberg interview, Ripple president Monica Long reiterated that XRP ETF would be ‘the next in line’ after US spot BTC and ETH ETFs.

“We’ll see more spot crypto ETFs this year from the US. I think XRP is likely to be the next in line after Bitcoin and ETH.”

Long highlighted that Canary Capital and other potential issuers have filed XRP ETF applications with the SEC, and their approval could be accelerated under the new administration.

She added that the Ripple dollar (RLUSD) will ‘imminently’ be expanded to top platforms like Coinbase.

XRP ETF vs. SEC lawsuit

In 2023, U.S. District Judge Analisa Torres ruled that XRP was not a security when sold on public exchanges, but was within the SEC’s purview if offered directly to institutional investors.

After Coinbase’s recent legal move, regulatory clarity on whether digital asset transactions sold on ‘secondary markets’ constitute ‘security’ could soon be known.

The exchange will proceed to the Second Circuit to establish whether the SEC’s treatment of “sales of digital assets on secondary market” as a security is right or wrong.

Reacting to the update, Jake Chervinsky, chief legal officer (CLO) at Variant Fund, stated,

“The district court granted interlocutory appeal on the key issue of whether digital asset transactions in secondary markets are subject to the securities laws. The Second Circuit will now have the chance to declare the SEC wrong.”

If the court concurs with Toress’s ruling, XRP’s legal standing could improve. On the contrary, it could challenge XRP ETF prospects if the sale of tokens on exchanges is declared ‘security.’

The SEC indicated an intention to appeal Toress’s ruling and has until the 15th of January to do so.

While speculation is rife that the appeal could be dismissed under the new administration, XRP could experience a massive price swing next week based on the regulator’s move.

Source: Polymarket

That said, prediction site Polymarket priced the chance of XRP ETF approval in 2025 at +70%, underscoring the overall market expectation.

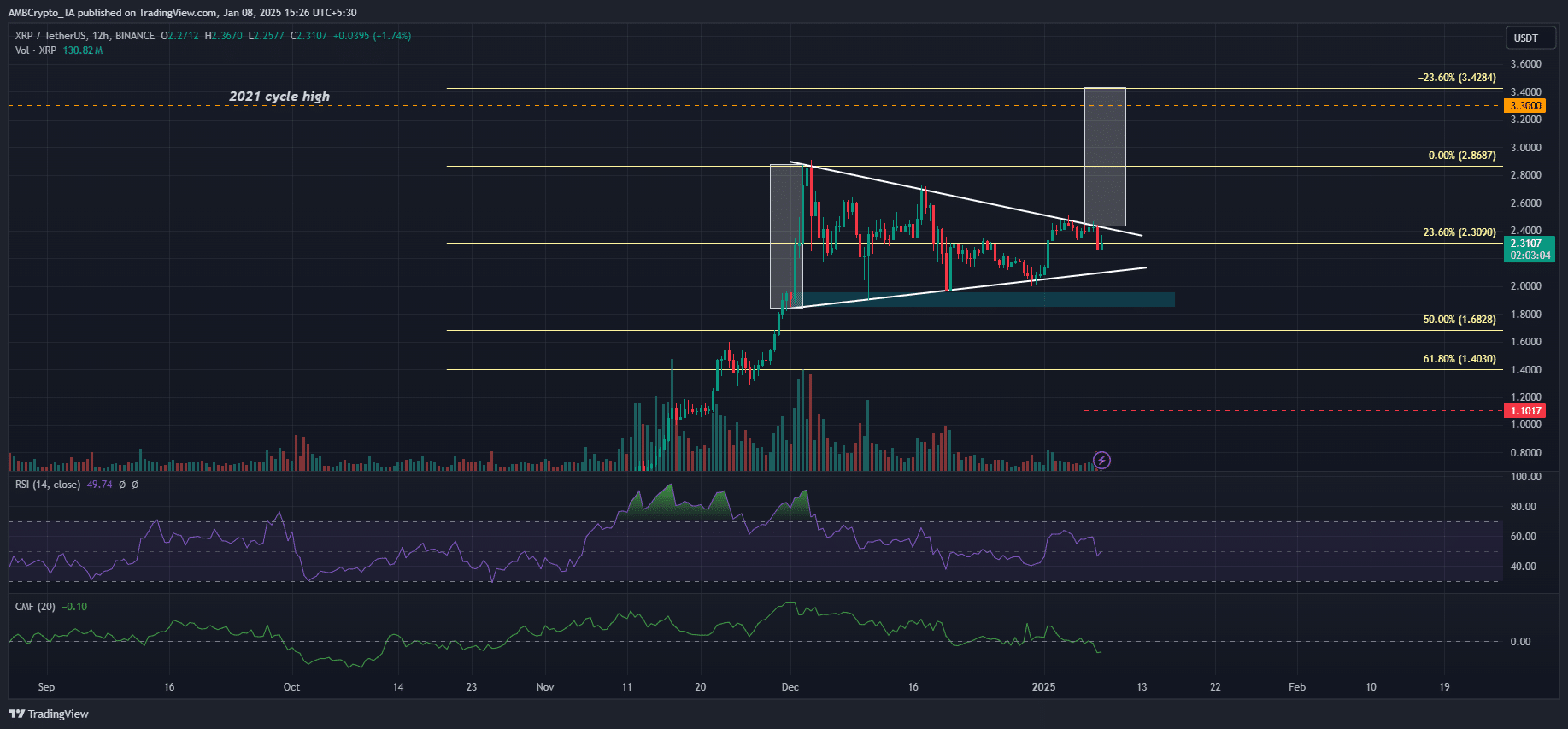

On the price chart, XRP has been consolidating within a triangle pattern. A breakout could either trigger an upswing to $3.4 or drag it lower to $1.