XRP fails to clear $2.50 resistance – Are bears poised to take over?

- XRP price remains stuck below $2.50 resistance, with support now eyed around $2.35–$2.00.

- Open Interest in XRP Futures has declined from $5.8B to $2.8B, signaling fading speculative demand.

XRP’s recent rally attempt was stopped in its tracks just below the crucial $2.50 resistance zone.

As the price struggles to maintain upward momentum, signs from both the derivatives and spot markets hint that bearish pressure may be mounting.

XRP price consolidates below critical resistance

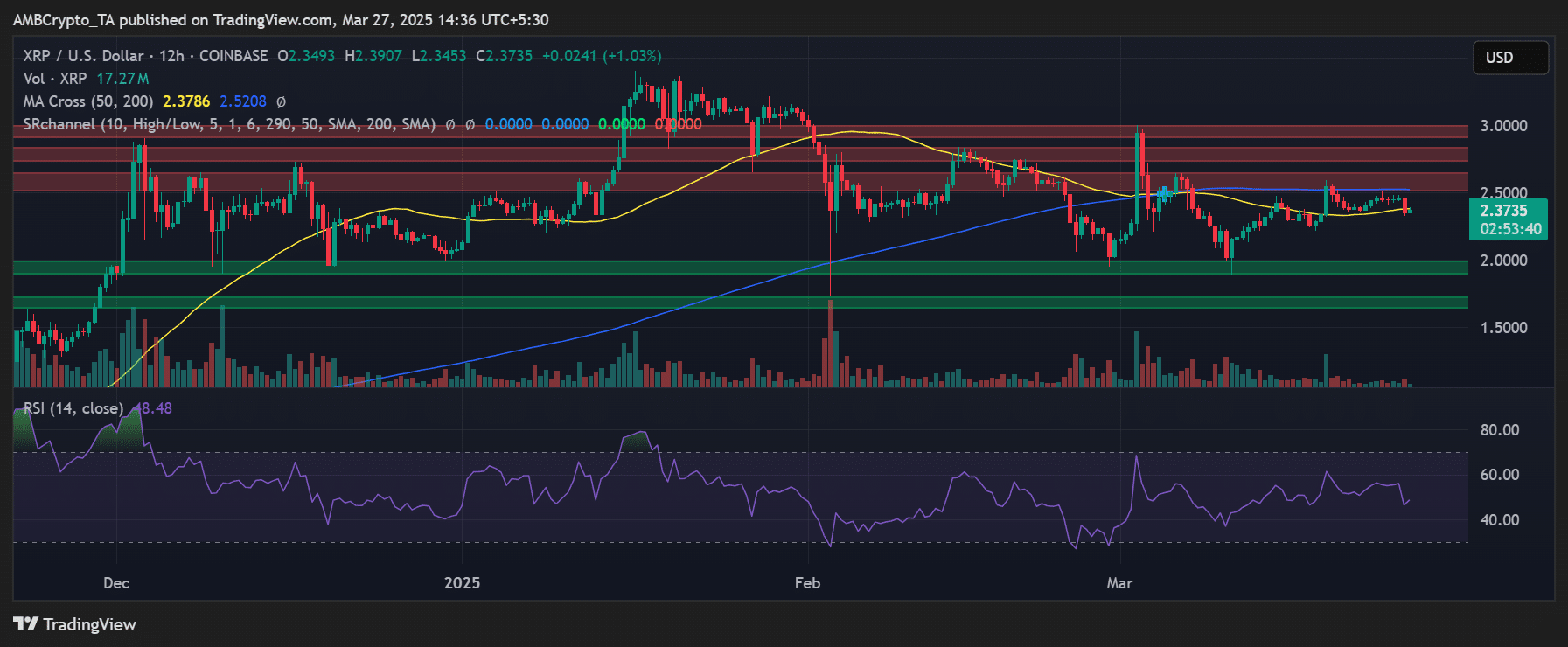

The XRP chart showed the asset hovering around $2.37 after being rejected near the $2.50 mark for the third time in two weeks. This resistance zone aligned with a dense supply area visible on the price chart.

Despite testing higher levels, bulls have been unable to gain a firm foothold above $2.50, a sign that sellers are still in control.

XRP was trading just above its 50-day moving average of $2.37 at press time, but well below the 200-day moving average of $2.52. This mixed technical setup reflects indecision in the market.

The Relative Strength Index [RSI] stands at 48.48, indicating a neutral momentum stance with a slight bearish bias.

A breakdown below the 50-day MA could expose the token to downside risk toward the $2.00 psychological support zone.

Futures market activity lacks conviction

Data from the XRP Futures Open Interest chart painted a similarly cautious picture.

After peaking around mid-January with a value close to $5.8 billion, Open Interest has gradually declined and currently hovers around $2.8 billion.

The drop in speculative positioning implies that traders are not yet confident in a strong bullish breakout.

This is further supported by stagnant volume trends, suggesting that the recent price action is largely driven by spot market traders rather than leveraged speculators.

Without an uptick in open interest or a shift in sentiment, XRP may struggle to overcome its current resistance.

Where XRP might be headed next

If XRP fails to defend the $2.35 zone, a drop toward $2.00 could follow.

On the upside, a strong daily close above $2.50 with volume confirmation would invalidate the bearish setup and pave the way toward the $2.75-$3.00 range.

However, this would require renewed buying strength, something that’s currently lacking.

With both technical resistance and derivatives weakness in play, bears may have a slight edge in the short term. However, any major shift in market sentiment or fundamental catalyst could quickly reverse the trend.