XRP gains 22% as Bitcoin breaks ATH, but here’s what the bears are doing

- XRP posted large gains as Bitcoin broke its all-time high.

- Caution from XRP bulls was warranted based on the liquidity pockets.

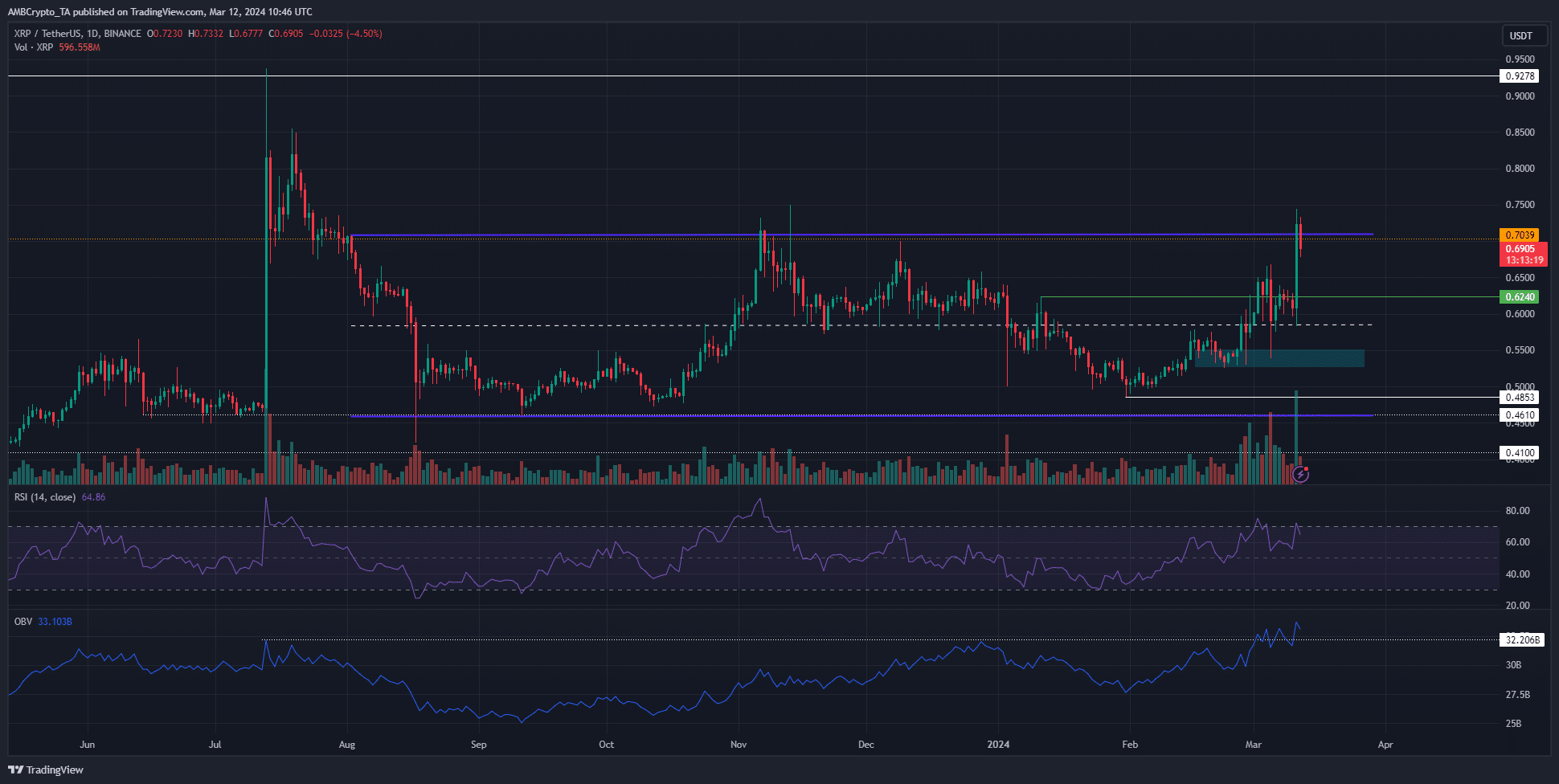

Ripple [XRP] bulls burst into life on the 11th of March. They forced prices to appreciate by 22.37% from the day’s open at $0.608 to reach $0.744 before selling activity pushed prices below $0.7 again.

The token exceeded AMBCrypto’s expectations laid down in a recent report, where a move to $0.7 was anticipated. We got more than that, but it also raised questions about whether the demand would be sustainable.

Is a rejection underway now?

The $0.7 range highs were breached on the 11th, but the bulls were unable to defend this level as support. This was similar to the price action in early November when a swift rally to the $0.7 resistance was followed by a rejection that was just as quick.

The OBV was an encouraging sight as it broke above the highs from July and remained above. A sustained increase in the buying volume could keep the bears at bay, but it was unclear if this optimistic outlook would hold.

Instead, now that the liquidity just above $0.7 was swept, a move southward to $0.64 or $0.52-$0.54 could commence. Prices are attracted to liquidity, and despite the strength in the altcoin market, XRP has lagged.

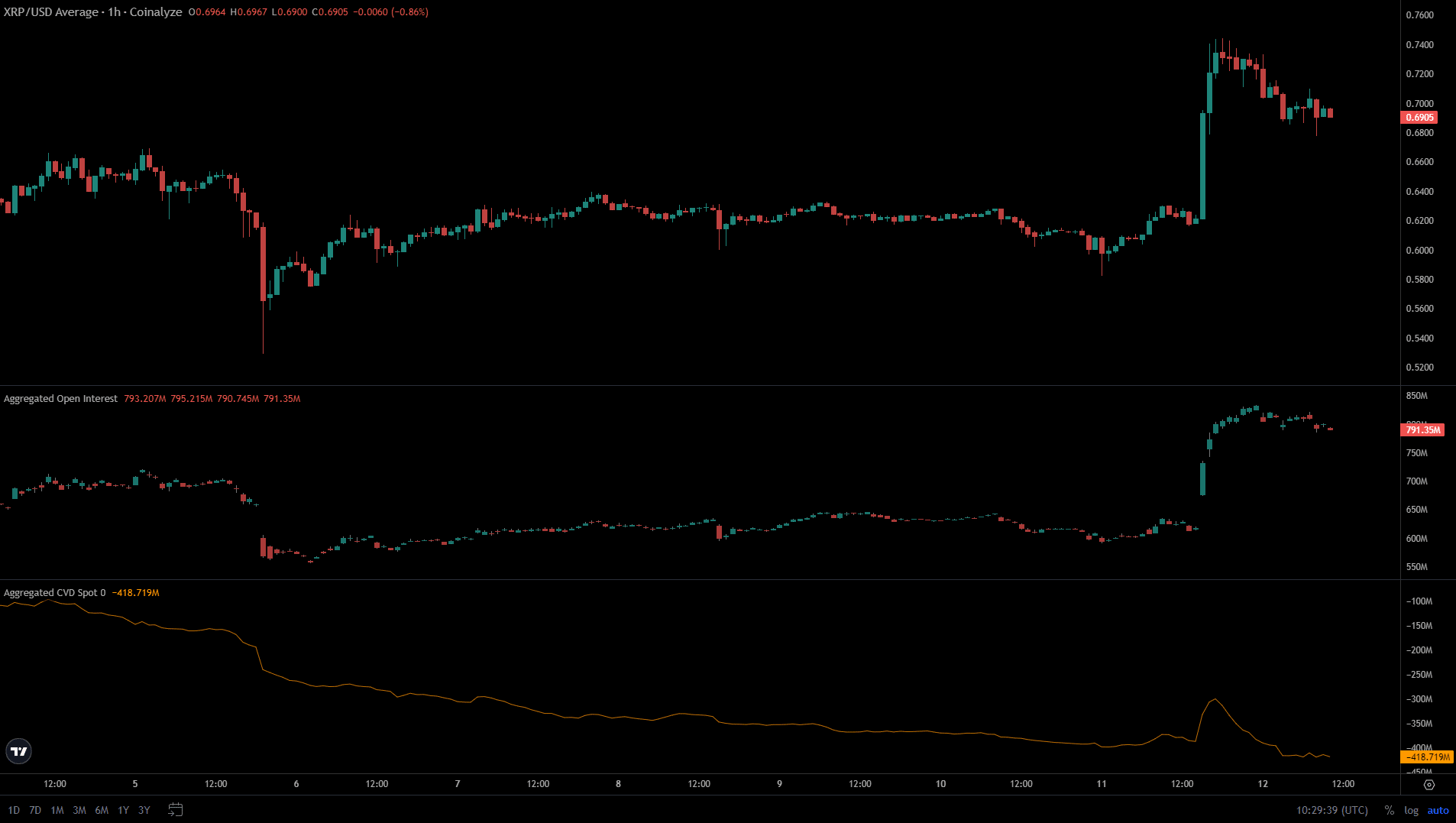

The surge in Open Interest showed intense speculative activity

Source: Coinalyze

As XRP prices bounded higher, the Open Interest followed. It rose from $600 million to $830 million, and the spot CVD also ticked higher. Yet, the latter indicator continued its former downtrend.

Is your portfolio green? Check the XRP Profit Calculator

This was bad news for the bulls. It showed that the run upward was driven by the futures market and was indeed a liquidity grab, not a rally borne by genuine demand.

Hence, a retracement toward the $0.64 and $0.54 support levels could follow.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.