Ripple

XRP holders dump tokens: Will price drop below $0.50 now?

XRP balances decreased, indicating possible pressure on the token’s price.

- The price of XRP could drop to $0.48 after a ton of holders sold the token.

- Volatility spiked, network activity slumped, indicating that recovery

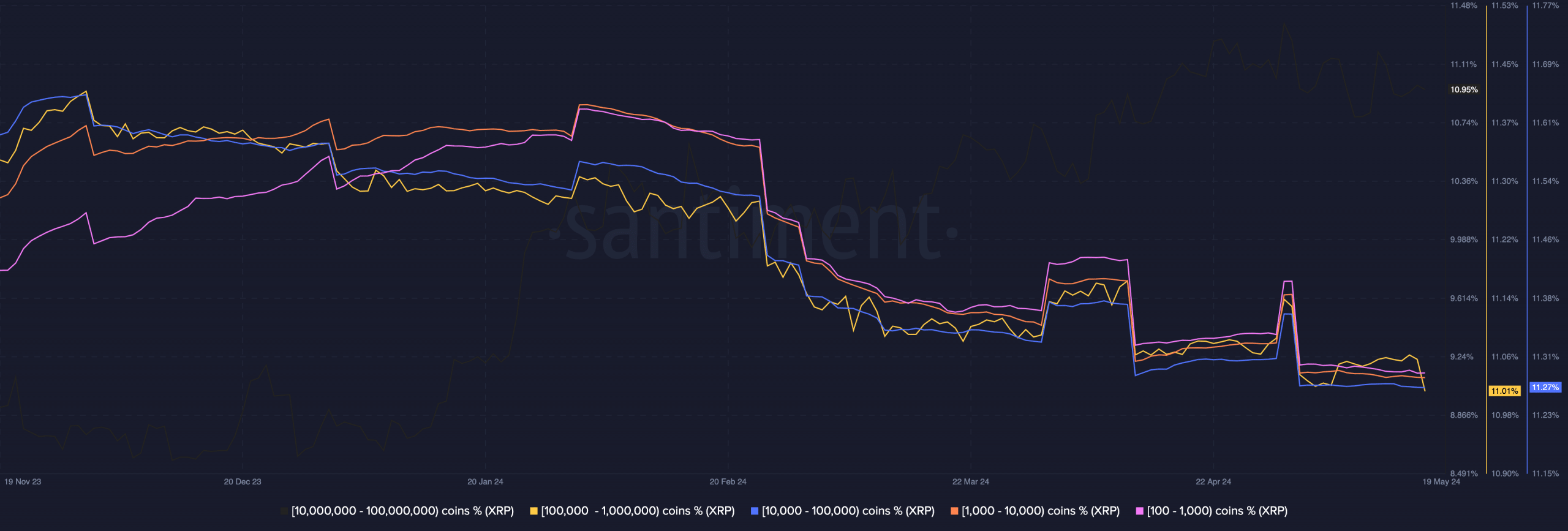

Addresses with 100,000 to 1 million XRP have been shredding the number of tokens held in their wallets, AMBCrypto confirmed after analyzing data from Santiment.

At press time, on-chain data showed that the 100, 000 to 1 million cohort now held 11.01%of the total XRP circulating supply. The decrease in the balance of addresses also revealed that the 10,000 to 100,000 group accounted for 11.27%.

XRP begins the path down

Last week, XRP’s price was able to move from $0.48 to $0.52 within some days. However, the token has been erasing some of those gains.

With the decline in the balances, the price of the token might slip below $0.50. At press time, the value of the token was $0.51, indicating that the effect was already in motion.

But this metric alone cannot determine if XRP would continue to fall. As such, AMBCrypto considered evaluating the Open Interest (OI).

OI refers to the value of all open positions in a contract. An increase in OI implies that more liquidity is coming into the market. When this happens, it implies that buyers are aggressive.

When the OI decreases, it means an increase in the number of net positions closed. If this is the case, it means that sellers are aggressive.

At press time, XRP’s Open Interest was $577.63 million. This was a net decrease in the last 24 hours. If this number continues to fall, the price of the token might evade another pump.

The market is no more volatile

Furthermore, bulls targeting a price increase might need to slow down on their optimism. By the look of things, XRP’s value could drop to the $0.50 support.

However, if selling pressure intensifies, there is a chance that the native token of the XRP Ledger could drop back to $0.48. Besides this, AMBCrypto looked at the one-day volatility.

Volatility shows how rapid and significant price fluctuations occur frequently. Rising volatility, backed by increased buying pressure, could drive a surge in price.

At press time, XRP’s one-day volatility spiked after its recent decrease. However, this spike did not seem to favor an upswing. Instead, the indicator might reinforce a downtrend.

In addition, on-chain data showed that the 24-hour active addresses rose to 35,000 on the 18th of May. But as of this writing, the metric was down to 33,100.

Is your portfolio green? Check the XRP Profit Calculator

Active addresses show the number of unique addresses that participated in a transfer for the given asset on any given day. Historically, a rise in active addresses drives a price increase for XRP.

Therefore, the recent fall suggests that XRP might not make a move that sends its price upwards. In the short term, XRP looks almost destined for a notable decline.