XRP investor sentiment sours ahead of Ripple-SEC verdict – Why?

- Bullish sentiment around the token dropped as the next briefing neared.

- Traders preferred to open long XRP positions despite the uncertainty.

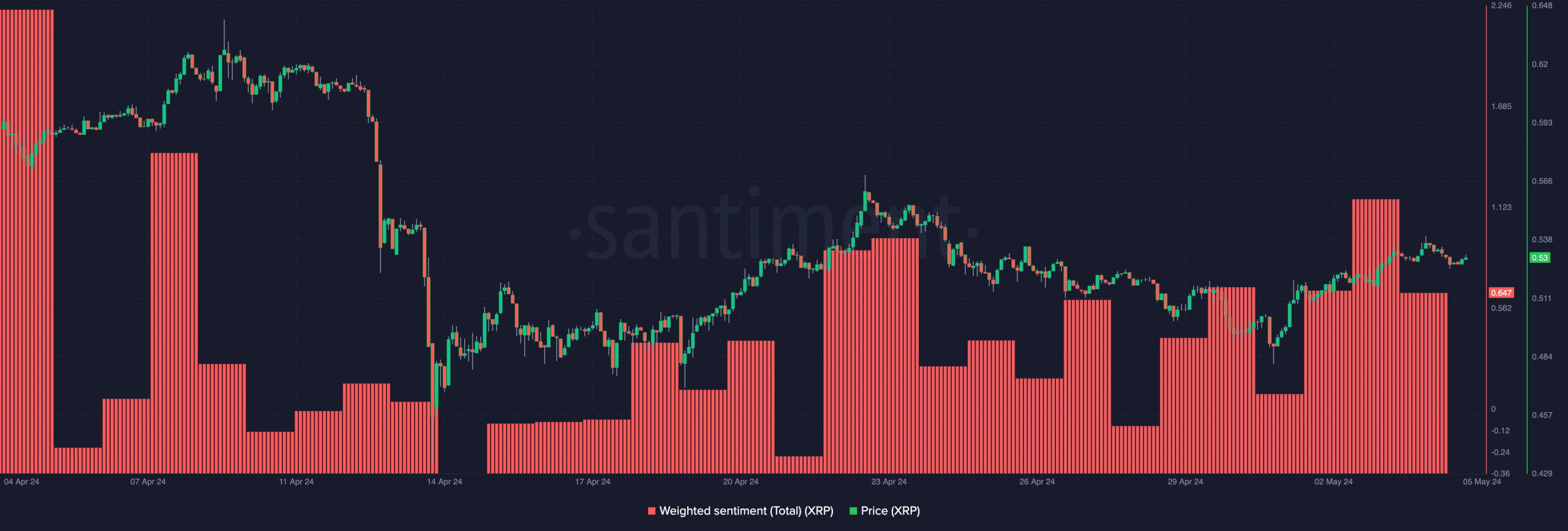

Contrary to the rise on the 3rd of May, Ripple’s [XRP] Weighted Sentiment has dropped. At press time, AMBCrypto noticed that the metric fell from 1.16 to 0.64.

While the reading remained positive, the decline indicated that the broader market does not expect XRP to make a bullish move in the coming days. But why?

Will the hearing make or mar XRP?

Our investigation showed that the perception could be linked to a notable event scheduled for the 6th of May. The U.S. SEC is expected to respond to Ripple’s remedy-related opposing brief on the mentioned date.

Over the weekend, there were no updates about the matter. Hence, XRP was able to bank on the $0.49 support and hit $0.52. However, the price could be affected depending on the outcome of Monday’s hearing.

Previously, the SEC had sought the court’s approval to fine Ripple $2 billion for violating U.S. securities laws in its opening brief. However, the blockchain payment firm opposed the request.

According to Ripple, it would not pay more than $10 million in penalties. While the matter remains unsettled, the judge’s next leaning could leave XRP in a good or bad state.

If the SEC stands its ground on the $10 billion request and the judge favors them, XRP’s price might plummet. But a rejection could help the token’s value rise.

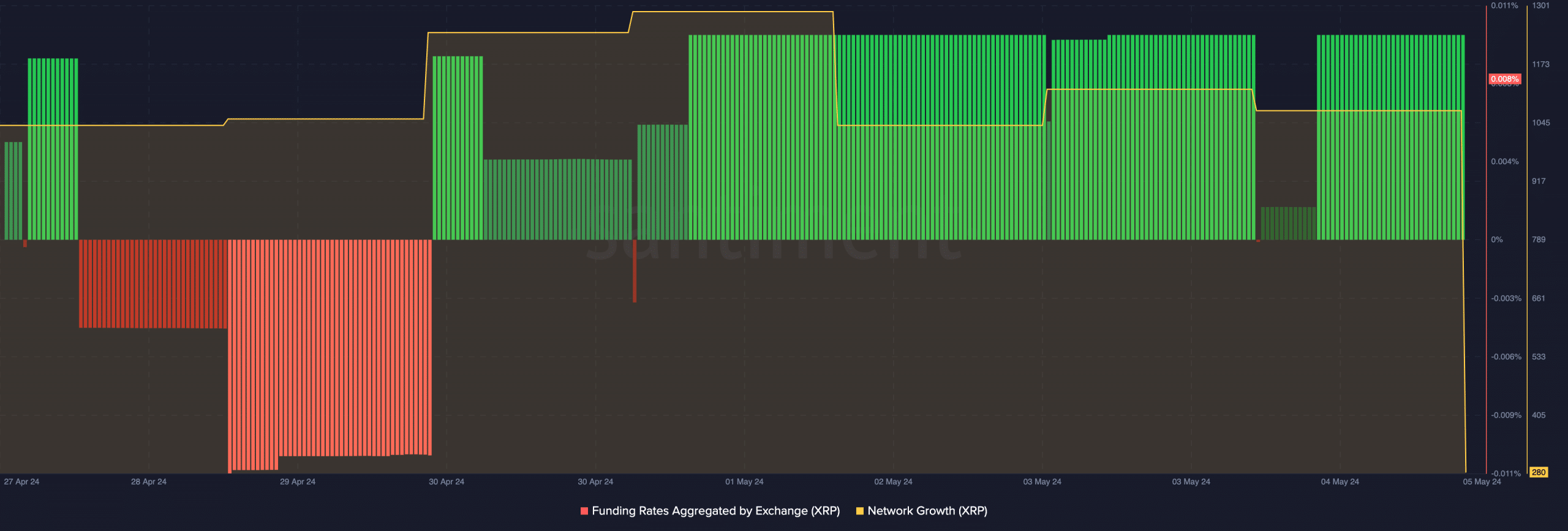

However, it seemed that traders were betting on a positive outcome. This was evident from the Funding Rate data provided by Santiment.

Some participants are confident

As of this writing, XRP’s Funding Rate was 0.008%. If the reading was negative, it would have implied a surge in bearish bets.

However, the positive reading suggests that longs are paying shorts a fee to keep their positions open.

Should XRP’s price increase, these traders would be rewarded for their positions. Alternatively, a plunge in the token’s value could leave longs in the red.

Despite the bullish sentiment of traders, on-chain data showed a decline in network growth. Network growth tracks the number of new addresses making their first transaction.

An increase in the metric suggests improved adoption. Therefore, the decline in XRP’s case implied that the project has not been able to garner enough traction.

If adoption stalls, demand for XRP might be slow. As such, the token might not experience a major upswing. Should the network growth continue to fall, holders of the token might also liquidate some of their holdings.

Realistic or not, here’s XRP’s market cap in BTC terms

In the meantime, Ripple has not commented on their next line of action if the judge aligns with the SEC’s argument.

Whichever way it goes, there is a high chance the lawsuit which has lingered for years might soon come to an end.