XRP loses its momentum as prices plunge below $0.7

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The move beneath the $0.7 support meant bearish sentiment was strengthening.

- The higher timeframe outlook remained bullish but a drop to $0.56 could occur in August.

XRP saw tremendous gains in July after the ruling that Ripple Labs’ token was not a security. It managed to climb past the market cap of Binance Coin [BNB] for a few brief days, but at the time of writing was ranked fifth once again on CoinMarketCap.

Is your portfolio green? Check the XRP Profit Calculator

A recent report highlighted how XRP saw a surge in whale accumulation, but the $0.7 support level has been breached. This was not a good sign for the bulls and hinted at further losses.

The vertical move earlier in July saw a deeper retracement after BTC’s weakness

The Fibonacci retracement levels (yellow) were plotted based on the rally from $0.465 to $0.938 on 12 and 13 July. The 50% retracement level at $0.7 has failed to hold as support, meaning a move to $0.645 and $0.566 was likely to follow.

The RSI was sinking toward the neutral 50 mark but its reading of 55 at press time meant bulls have some hope that they can bounce back. The OBV stood above a significant level from late May after sliding lower over the past week. This highlighted strong selling pressure in the short term. If the OBV sank further, it would be another sign that XRP would see a deep retracement toward the $0.56 area.

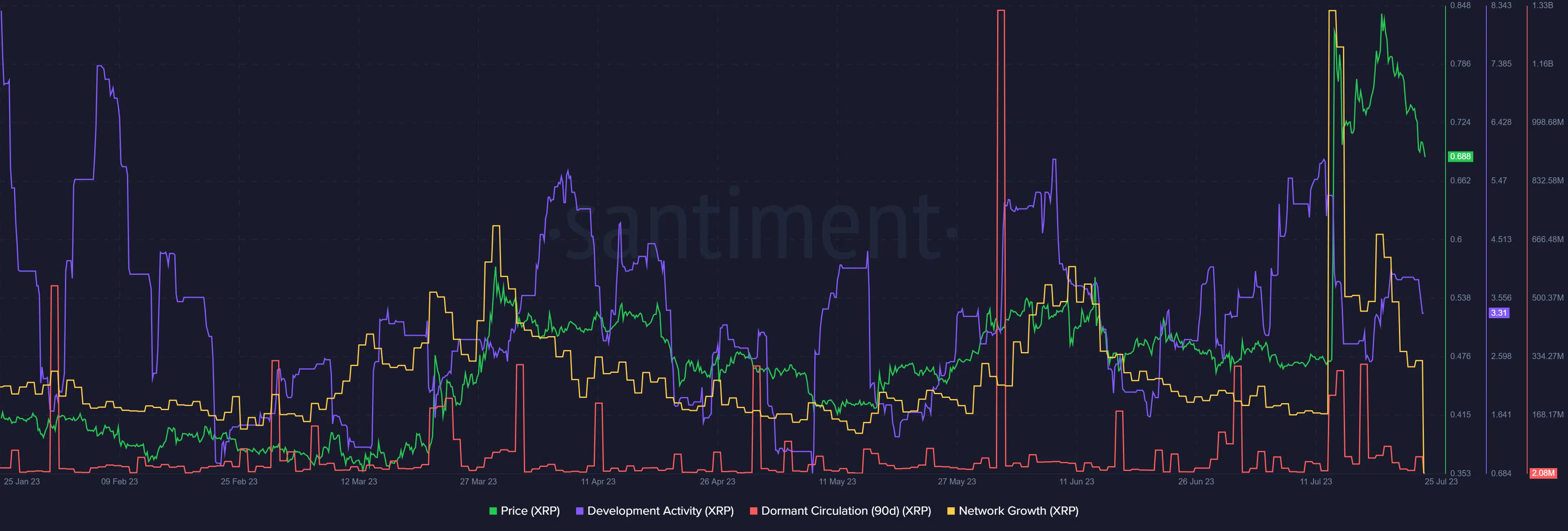

The network growth was unable to keep up with the explosive rally, Open Interest has taken a hit

Source: Santiment

The development activity remained strong and showed long-term investors have no fears on this front. Yet, the network growth has slumped since the rally. The rallies in March and late May also saw network growth wax and wane alongside XRP prices, highlighting user adoption over time.

The dormant circulation metric saw two spikes on 14 and 18 July but remained calm since then. This suggested a chunk of selling pressure accompanied the move past $0.8, marking local highs that would be hard to breach.

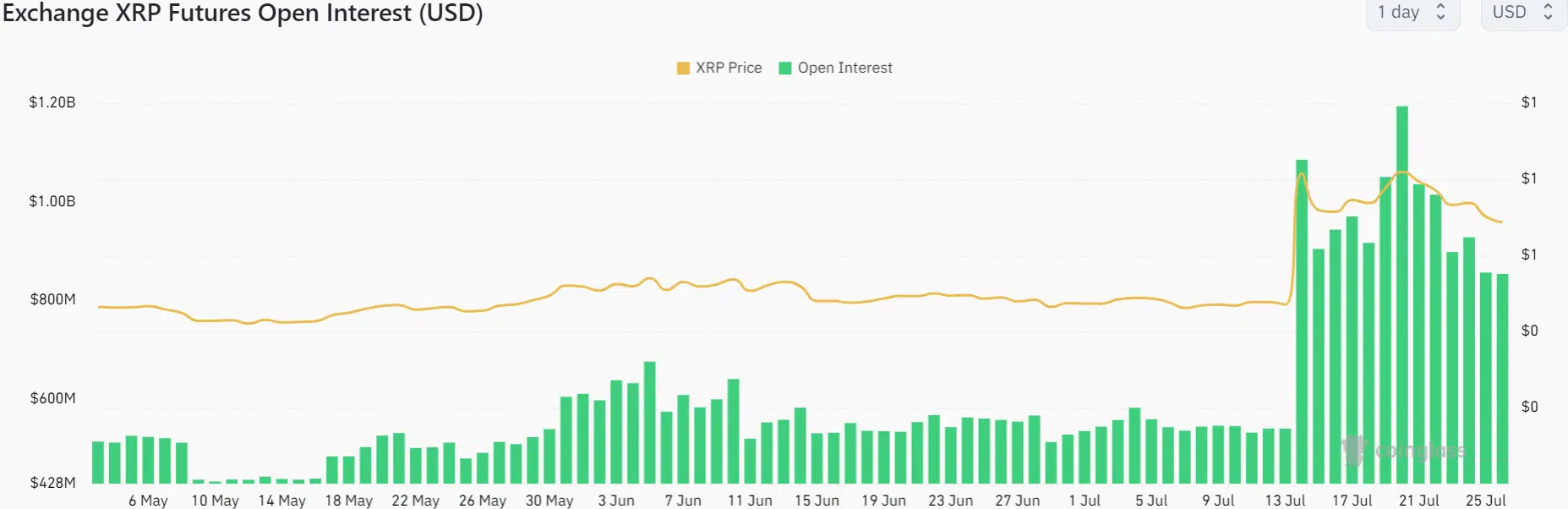

Source: Coinglass

The Open Interest began to creep lower on 21 July. During this time the price has also sunk lower from $0.82 to $0.68, forming a lower timeframe double top in the process. The drop in OI alongside prices showed bearish sentiment.

Realistic or not, here’s XRP’s market cap in BTC’s terms

The evidence at hand pointed toward further losses for XRP, especially if Bitcoin also sank below the $28k mark. One long-term bullish scenario would be a retracement to the $0.56-$0.6 zone, followed by a period of consolidation and another rally.